Pound Boosted by Hot Services Inflation Reading, Headline CPI Hits Magic 2.0%

- Written by: Gary Howes

Image © Adobe Images

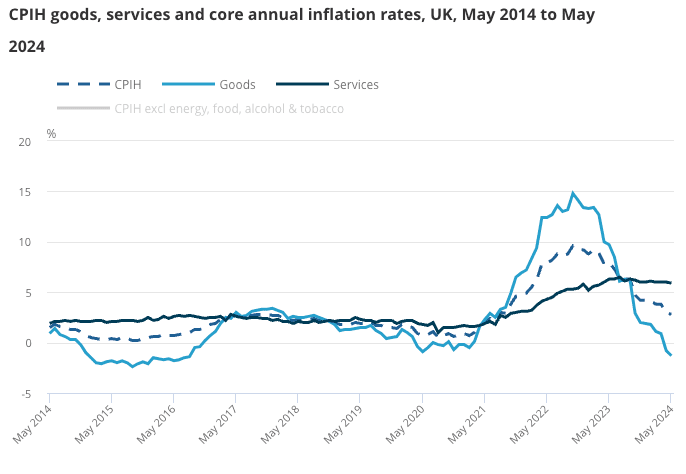

The British Pound rose after the UK reported another strong services inflation print, although the headline CPI inflation rate hit the Bank of England's 2.0% target.

The Pound to Euro exchange rate lifted to 1.1860 after the ONS said the CPI services annual rate eased from 5.9% to 5.7% in May, but this was above the consensus expectation for a fall to 5.5%.

Money markets show investors lowered expectations for an August interest rate cut at the Bank of England as a result. OIS pricing shows expectations have slid to around 36% in the wake of these data, from around 55% the day before.

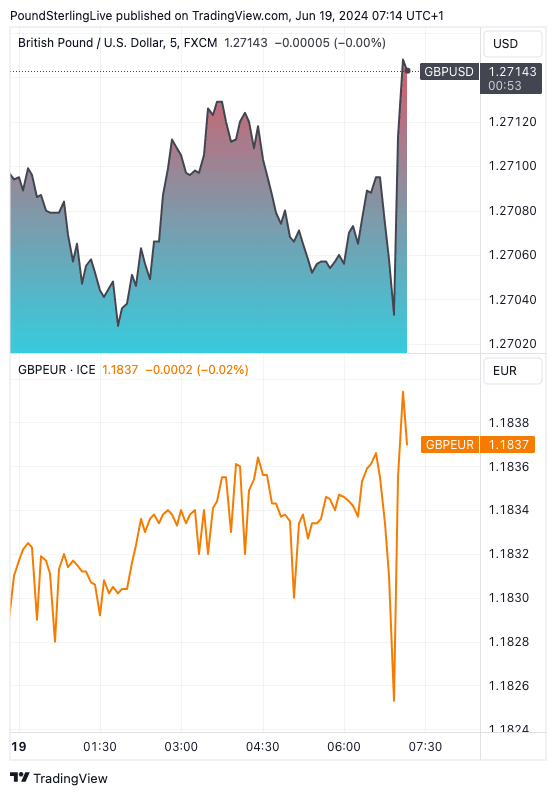

The Pound to Dollar exchange rate has risen to 1.2727 in response to the repricing in expectations. "GBP is slightly stronger, probably due to the hotter services CPI data," says Arno Venter at Capital Edge Advisors.

The good news for UK consumers and businesses, however, was that the UK's annual inflation rate finally fell to the Bank of England's 2.0% target. May's month-on-month figure reading was 0.3%, which is below the 0.4% the market was looking for.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Core CPI inflation was flat at 3.5% year-on-year, which is also what the market was looking for, so it won't be a market mover.

Although the fall in headline inflation to 2.0% will be welcomed, most economists agree inflation will creep up again over the coming months because services inflation is still too high.

As the 'base effect' of previous price rises falls out of the annual comparison, the sticky services print could mean inflation refuses to stay around 2.0%. This is why the Bank of England will not cut interest rates as early as tomorrow's meeting.

Above: GBP/USD (top) and GBP/EUR. Track GBP with your own alerts, find out more here.

The key question for currency markets now is how these inflation figures impact the odds of an August rate cut.

Two members of the MPC voted for a cut already in the last meeting, and we reported on Tuesday that if one member - Dave Ramsden - withdrew his vote, the Pound would rise.

These inflation numbers could mean Ramsden sticks with his vote for a cut, and there is a risk others on the Monetary Policy Committee join him and Swati Dhingra.

If this is the case, the odds of an August cut would rise, likely resulting in a softer Pound heading into the weekend.

"Finally! UK inflation fell to 2.0% in May, hitting the BoE’s target," says Julian Jessop, an economist at the IEA. "This was widely expected but still good news, and should make it much easier for more MPC members to join the two – Swati Dhingra and Dave Ramsden – who are already voting for a cut."

A Reuters poll published last week showed 63 of 65 economists expect the Bank to cut rates by 25 basis points to 5% on Aug. 1. Yet, the market attaches a 32% chance of such an outcome.

Who will be right?

"The markets vs economists gap should narrow, to the detriment of GBP, if any other Monetary Policy Committee members join Dave Ramsden and Swati Dhingra in voting for a rate cut on Thursday," says Robert Howard, a Reuters market analyst.

Nevertheless, caution will be in abundance amongst other members of the MPC, as the Bank will have to address the sticky services inflation print and acknowledge that headline inflation could well creep higher again over the coming months. Such caution would likely limit the scope of any GBP weakness and offer downside protection.

Food prices contributed the largest downward contribution to the change in annual inflation between April and May, while motor fuel prices contributed the largest upward contribution.

"Services inflation was a significant 0.4pp higher than the BoE had expected. This, along with strong wage growth and election-related near-term economic uncertainty, is likely to keep the BoE on hold when it announces its monetary policy decision tomorrow," says Marco Valli, Global Head of Research at UniCredit.