It's a "Policy Disaster" - Soc Gen's Edwards Takes Aim at the Federal Reserve

- Written by: Gary Howes

Image © Adobe Images

a

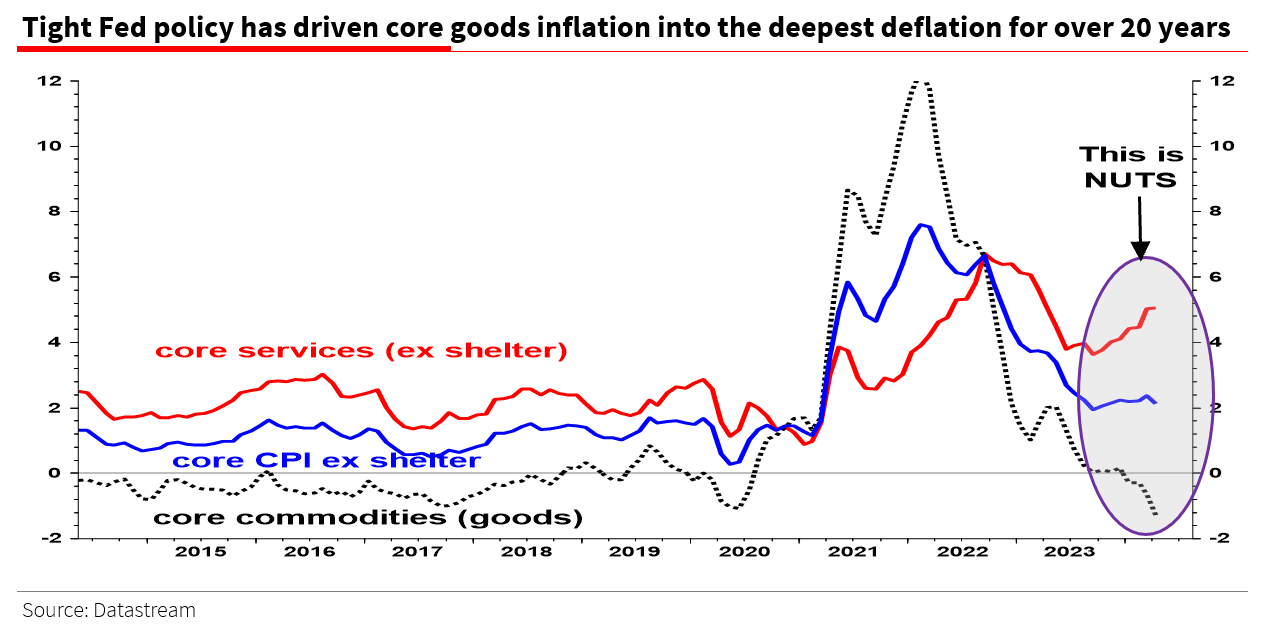

The Federal Reserve is overseeing a "policy disaster" that has triggered a deep deflation in goods prices, according to a prominent strategist.

Albert Edwards, Société Générale's chief global strategist, says the Fed's policy of keeping rates high to kill rising supercore services inflation has resulted in unprecedented falls in core goods inflation.

He says core goods are seeing a record fall since the late 1950s, apart from a few months in 2003.

"I believe the Fed is sowing the seeds of yet another policy disaster. Having let the inflation cat out of the ‘transitory’ bag, it now seems determined to regain its credibility by driving CPI inflation all the way back down to its 2% target," says Edwards.

Edwards is described in some corners as a 'perma bear', but he gets a lot right, which ranks him among the best macro strategists of the past 20 years. He says the Fed's policy stance has led to a huge divergence between goods and services inflation.

"This policy error is the mirror image of the mistake the Fed made after the 2008 Global Financial Crisis, the very mistake it was castigated for by former Fed Chair, Paul Volker, back in 2018," warns Edwards.

Edwards says the Fed’s current error is that in targeting one part of overall inflation (i.e. rising super core services inflation), it has either inadvertently or deliberately driven core goods prices into the deepest deflation for 20 years.

"In fact, aside from a few months in 2003, we are now experiencing the deepest deflation in core goods prices since records began in the late 1950s. Is that sensible?" he asks.

He presents the following chart:

Alberts says the Fed should heed Paul Volckers warning that targetting 2.0% inflation is an imprecise science and there are forces behind inflation/disinflation that simply cannot be fought by the Fed. "False precision can lead to dangerous policies," said Volcker in a recent article.

"The bad news is that the Fed still seems to think it can control things it can’t, and in trying to exert that imaginary control it is driving goods prices into unprecedented deflationary territory. Bonkers!" he adds.

The Fed is expected to cut interest rates for the first time in September, according to money market pricing. U.S. inflation data for April showed a welcome moderation in price increases following a run of upside surprises in the first quarter of the year.

Indeed, the Fed would have already cut interest rates by now were it not for this unexpected rise in inflation; markets entered 2024 thinking there would be up to seven cuts, the first starting in March.

The Fed holds rates at restrictive levels as it waits for inflation to cool, which it thinks will only happen when the jobs market starts to deteriorate (a healthy jobs market generates strong wage growth, which boosts demand, which boosts inflation).

"Serious Downshift"

A firm labour market and persistent core inflation prints meant the Fed adopted a higher-for-longer stance that keeps interest rates restrictive for an extended period.

However, Ian Shepherdson, Chief Economist, Pantheon Macroeconomics says "a more serious downshift" in the labour market is approaching.

"If jobless claims are going to trend higher at the same time, payroll growth will head south rapidly. Remember, at the start of the business cycle downturns of 1990 and 2001 - the two most recent “normal” recessions - job growth dived from fine to zero in about four months. We would be unsurprised by a similar shift over the next few months," he says.

Shepherdson's comments came after U.S. weekly initial claims were reported to have risen 222K last week. He adds that the NFIB survey’s hiring intentions measure is also signalling a significant downshift in labour market health.

The Fed might be too late in Edwards' view, but it might cut fast once it starts in the face of official data that confirms the surveys are right and the labour market is deteriorating.