When Will the Fed Cut Rates? Why September is Now a Firm Favourite

- Written by: Gary Howes

Image © Adobe Stock

When will the Federal Reserve cut interest rates? Analysts and money market pricing show September is the likely start date as crucial elements of America's inflation basket begin to disinflation.

"We believe today’s reading will not change the outlook for rate cuts in the autumn if coming inflation data remains moderate and the labour market continues to ease. The market is pricing in the first rate cut in September, in line with our forecast," says Knut A. Magnussen, Senior Economist at DNB Markets.

Following Wednesday's inflation report, Overnight Index Swaps - a money market that shows how traders are currently positioned for future interest rate levels - shows a September rate cut is now fully priced by the market, whereas two weeks ago, the first cut was only expected in December.

Markets have significantly reduced expectations for Fed rate cuts in 2024 thanks to a strong run of inflation prints in the first quarter of the year and an overbearing sense that some elements of the inflation basket simply won't budge.

This has led to higher U.S. bond yields and 2024's U.S. Dollar outperformance in FX markets. But the tide might be coming in again.

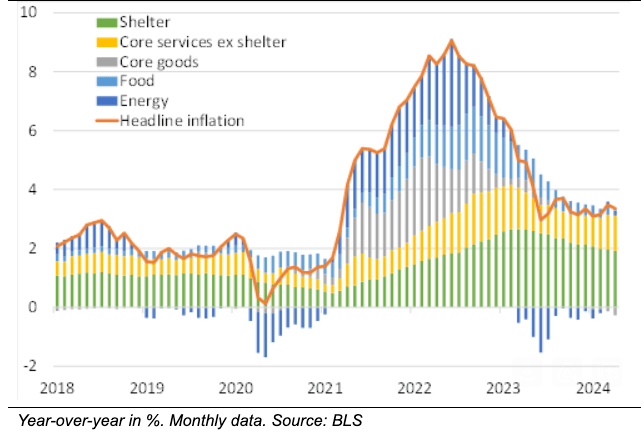

Core services inflation (which excludes shelter costs) and shelter costs (housing) have evaded the disinflation process, and until they fall, headline inflation cannot fall to the Fed's 2.0% target on a sustained basis:

Above: Core services inflation and rent are stubborn enough to halt inflation's decline.

Shelter costs account for about 40% of the overall CPI index and have been pushed higher by the lingering effects of rising home prices & rents over the past few years.

But, Gus Faucher, Chief Economist at PNC Bank, says the April 2024 CPI report should provide some sense of relief among Fed officials as the most stubborn CPI categories of shelter and core services offered the first glimpse of easing in some time.

Core CPI fell to 0.2% m/m and shelter fell to +0.2% m/m, the slowest reading since January 2021 (+0.6%).

"PNC’s expectation of two (2) 25 basis point rate cuts this year, in September and December, now looks like a more robust prediction than it has at any point in 2024 thus far.

Other analysts agree. Felix Schmidt, an economist at Berenberg, sees today's inflation print as slightly increasing the possibility that the Fed will start cutting rates earlier. "We continue to expect one 25bp rate cut in December and three further such moves next year to bring the Fed funds target rate to 4.25-4.50%," Schmidt adds.

Economists at Wells Fargo and Pantheon Macroeconomics share a similar view. Sarah House of Wells Fargo believes that multiple benign inflation readings are necessary before the Fed feels confident to lower rates. "We continue to look for the first rate cut from the FOMC to come at its September meeting," House states.

Ian Shepherdson, Chief Economist at Pantheon Macroeconomics, argues that the case for expecting a further slowdown in core CPI inflation remains strong. "Supply chains have normalised, wage growth is weakening, and corporate margins are flat but still hugely elevated, indicating clear scope to fall ahead," he explains.

Shepherdson also notes no current threat from global food and energy prices, with subdued rent inflation for new tenants and falling vehicle prices suggesting a slowdown in auto insurance inflation.

"The foundations, therefore, are in place for a further deceleration in the core CPI this summer, enabling the Fed to start easing in September," says Shepherdson.

David Page, Head of Macro Research at AXA Investment Managers, concurs. "We see both releases as consistent with our view of a softer pace of economic activity and more marked disinflation over the coming quarters," he says. "This is consistent with our outlook for the Fed to start easing policy in September and December this year."

As the market consensus leans increasingly towards a September rate cut, all eyes will be on upcoming economic data to solidify these expectations.