The Outlook is Improving and Bank of England Rate Cuts are Coming: Reactions to UK GDP Growth Figures

- Written by: Sam Coventry

Image © Adobe Images

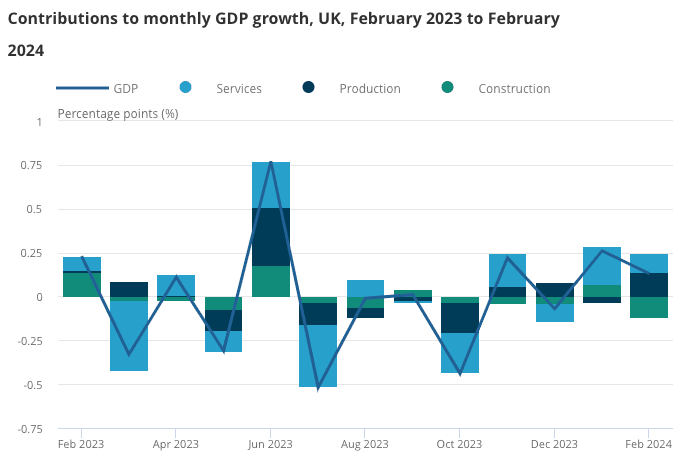

The UK economic revival can continue, say economists and business owners, after the ONS reported 0.1% month-on-month growth in February and revising higher January's number to 0.3% m/m.

In fact, it would take an unlikely 1.0% slump in March to trigger a quarterly contraction, meaning the UK economy has almost certainly exited the shallow recession of the second half of 2023.

"With the damp and dismal weather hitting retail and other sectors, it's not surprising to see activity was broadly flat in February. But lower inflation is easing pressure on household incomes and spending, and the economy still seems to be on course to exit its mild recession in the first quarter," says Ben Jones, CBI Lead Economist.

"While growth was probably fairly modest over the first quarter, the outlook is improving with our business surveys showing growth expectations for the second quarter at their strongest for almost two years," he adds.

The UK experienced one of the wettest Februarys on record, making it little wonder the services sector only grew 0.1%.

But production came to the rescue, rising by an impressive 1.1% in February 2024 and was the largest contributor to the growth in GDP in the month.

According to some small businesses, consumers are looking increasingly confident. "We continue to see a recovery in client activity as the economic outlook improves," according to Jenny Landsdowne, site editor of UK no deposit casino and bonus site NoDepositTracker.com.

Falling inflation and hopes for Bank of England interest rate cuts have been behind recent business and consumer confidence improvements, which should feed into broader growth dynamics.

"We are optimistic about the near-term outlook for GDP. Both services and manufacturing have returned to growth this year and the construction sector will likely join them once the rain disruption passes," says Robert Wood, Chief UK Economist at Pantheon Macroeconomics.

Richard Carter, head of fixed interest research at Quilter Cheviot, says although "the UK appears to be entering a slightly more positive period, the economy is still sluggish."

"Given inflation recently fell to 3.4%, the Bank of England will be facing ever-mounting pressure to begin cutting rates. However, the Bank has maintained a data-dependent resolve and it will continue to do so until it is satisfied that inflation has come down far enough and will not see a further spike," he says.

Hopes for a Bank of England rate cut by mid-year will nevertheless underscore business and consumer confidence in the coming months.

"Growth for the first quarter is now set to come in stronger than the Bank of England’s anaemic forecast, but it is still only a modest recovery that does not threaten the ongoing disinflation in the economy. Hence the stage is set for rate cuts, given base rates are comfortably above the rate of nominal GDP growth," says Stephen Payne, Portfolio Manager on the Global Equity Income team at Janus Henderson.