"Firms Plotting Hiring Spree" Says Lloyds Bank

- Written by: Gary Howes

Image © Adobe Images

Concerning news for the Bank of England's plans to cut interest rates later this year after it is reported UK businesses are "plotting a hiring spree".

The Lloyds Bank Business Barometer for February says expected staffing levels will increase to a near 2-year high amid signs that labour shortages are easing.

Expected staffing levels for the year ahead increased to the highest level since May 2022, with the net balance up 3 points to 36%. The increase reflected only 13% planning to reduce their headcount.

Above: Job prospects near 2-year high: % net balance reporting higher staffing levels, next 12m.

"Businesses reported the highest expected staffing levels for the year ahead since the spring of 2022, reflecting strong hiring intentions and a desire to retain existing employees," says the report.

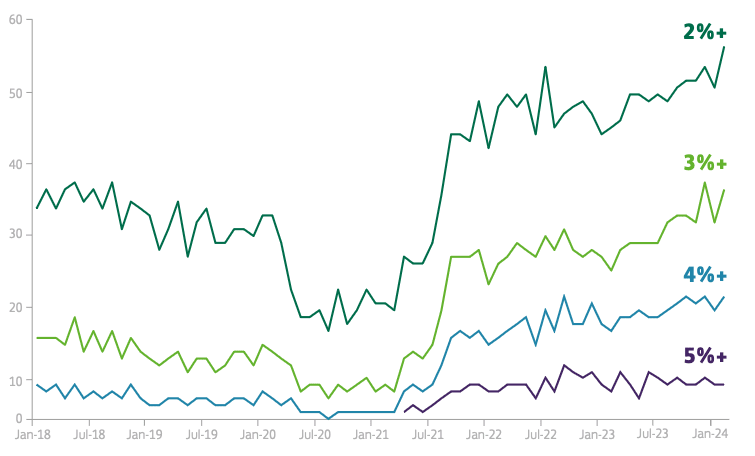

The forward-looking indicators of pay growth in the survey have remained elevated since the end of the furlough scheme in 2021 but there are signs of stabilisation at the higher thresholds.

"Policymakers remain very attentive to pay growth, but the pace of moderation could be gradual rather than swift," says the report.

"Businesses are looking forward to 2024, but a lot of this optimism rests on the Bank of England cutting interest rates. I wonder how this might change if the BoE delays that cut for an extended period," says Matt Lewis at TopMoneyCompare.

Above: "Less upward pressure for higher pay growth rates" - Pay growth expectations, next 12m % firms.

It also finds businesses intend to pay for these hires by hiking their own prices, as "own price expectations edge up even as inflation concerns ease back."

This hints at ongoing inflationary pressures in an economy with an already tight labour market.

The Bank of England has said it will maintain interest rates at 5.25% until it sees clear evidence that inflation will fall back to 2.0%. Although inflation is expected to fall to target in April, the Bank then expects it to rise again amidst ongoing pressures in service sector inflation.

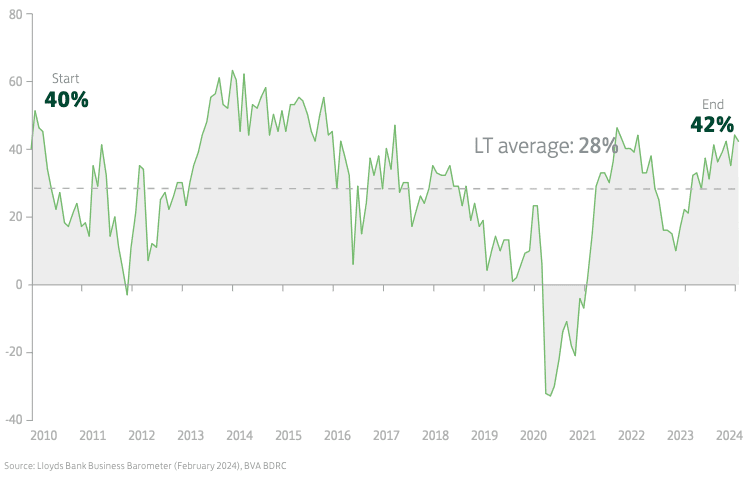

Above: % net balance. "Confidence stays above long-term average"

Meanwhile, the Lloyds Bank survey shows that overall business confidence remained elevated despite dipping to 42% in February from last month's 44%.

"Disquiet about supply-chain disruptions" were reported after attacks on commercial ships in the Red Sea.

Trading prospects remain at the second-highest level since 2017. Confidence in the dominant service sector was unchanged, but it fell in manufacturing and construction.

"This month's data still reflects a positive mood among businesses despite a marginal fall in overall confidence. Firms appear to be upbeat about their prospects and the economy, supporting their positive staffing expectations," says Hann-Ju Ho, an economist at Lloyds Bank.

Ho also notes the overall level of confidence suggests that last year's mild recession could be fleeting and that the seeds of recovery have been planted.

The net balance for trading prospects slipped 2 points to 49% from 51% in January. That outcome was still the second-highest level since April 2017.

More than half expressed greater optimism regarding the wider economy, although the 54% outturn was down slightly from 57% in January. The share of firms more pessimistic about the economy remained at 20%.