"Wake Up Call for Investors" as Bank of England Rate Cut Bets Recede

- Written by: Gary Howes

Image © Adobe Images

A strong UK inflation print leaves global investors resigned to the realisation that it might not be until mid-year that the Bank of England, U.S. Federal Reserve and European Central Bank cut interest rates.

Central bank policymakers in Europe and the U.S. have spent recent days pushing back against expectations for rate cuts to commence as early as the first quarter, but it was only after Wednesday's UK inflation data that this message hit home.

"The rise in inflation delivers something of a wake-up call for investors who have been considering the BoE 'home and dry' on getting inflation sustainably back to target," says Victoria Clarke, UK chief economist at Santander CIB.

Above: Traders pare rate cut bets for three major central banks.

Money markets are now pricing four quarter-point reductions from the Bank of England and about a 65% chance of a fifth in 2024, according to swaps tied to the central bank meetings.

Yesterday, five cuts were fully priced and a month ago, six was seen as a certainty.

UK bond yields and Pound Sterling rose on Wednesday in response to this shift in expectations; the Dollar has meanwhile been an outperformer in 2024 as U.S. Fed rate cut bets recede.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

All main UK inflation metrics surprised to the upside of economist expectations in the December prints, with headline CPI rising to 4.0% year-on-year from 3.9% previously.

Some economists dismissed the rise as simply being down to the sharp rise in alcohol and tobacco prices, but recreation & culture, and transport services also surprised to the upside.

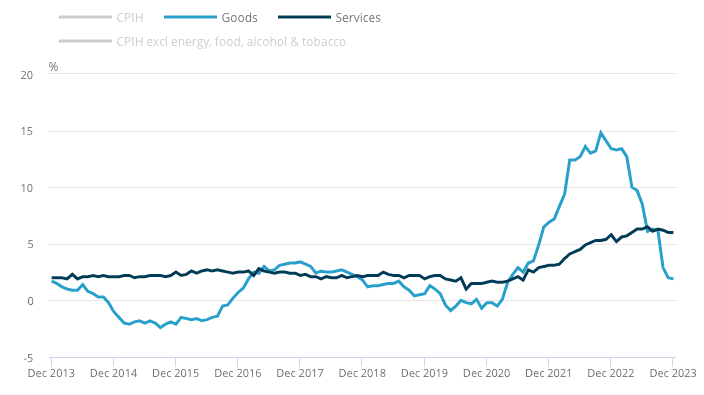

Recreation and culture's strong showing helped push UK services CPI inflation, which is closely monitored by the Bank, to 6.4% in December from 6.3% in November.

Above: Goods inflation is falling, but services inflation remains 'sticky'. Chart: ONS.

"The rise in services CPI provides a reminder that the underlying, more domestically driven elements of inflation could be slow to return to BoE policy-consistent rates," says Clarke.

Economists are, however, almost united in the belief inflation is still headed back to the 2.0% target over the coming months and the Bank of England will cut interest rates.

But these data, as well as the consistent messaging to not expect imminent rate hikes from all the major central banks, suggest a rate cut as early as March is highly unlikely.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes