Best Mortgage Rates Could Be Withdrawn: Hargreaves Lansdown

- Written by: Gary Howes

Image © Adobe Images

There's a chance mortgage rates could stay put for a while, and the best rates could even be withdrawn, according to a new analysis from Hargreaves Lansdown.

The UK investment provider says the recent fall in mortgage rates relies on investors' expectations for the Bank of England to begin cutting interest rates as early as May.

This suggests current market valuations rely heavily on assumptions that are prone to disappointment on any delays. Indeed, the Bank of England has consistently warned it is too soon to start cutting rates.

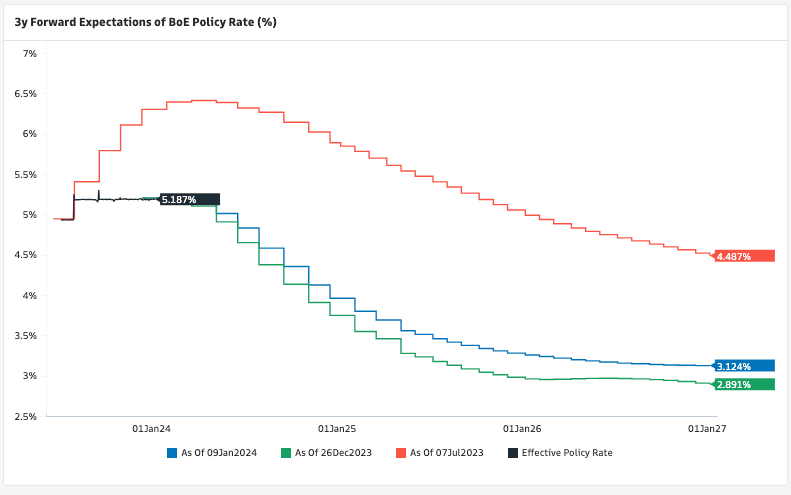

Above: The market has ramped up bets for rate cuts since July 2023 (red line), however, these bets have been pared as of late (the curve has lifted since December). Image courtesy of Goldman Sachs.

For now, the market is calling the Bank's bluff, anticipating as many as five 25 basis point rate cuts in 2024 as inflation falls back to the 2.0% target.

The risk for mortgage holders is that the Bank is not bluffing.

"If inflation comes in higher than expected, wage inflation stays elevated, or supply issues or oil price rises push prices back up, the Bank of England may be reluctant to cut rates in the immediate future, and this would upset the mortgage market," says Sarah Coles, head of personal finance, Hargreaves Lansdown.

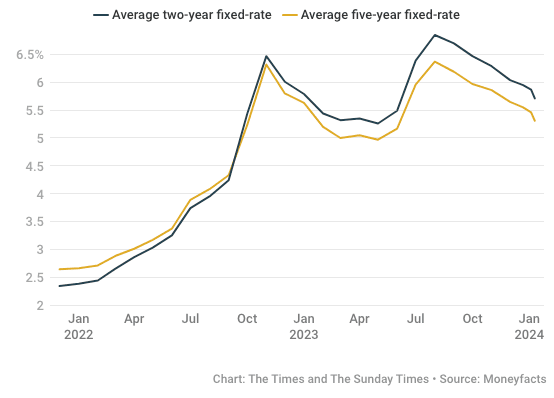

Image courtesy of The Times.

Britain's largest mortgage lenders have cut mortgage rates this year to below 4% as competition between banks delivers further good news for homeowners.

Barclays and Santander became the latest banks to make big rate reductions, cutting the cost of fixed-rate deals on Wednesday by up to 0.82 percentage points.

"We’ve seen some chunky cuts across the mortgage market – including the high street giants. The best rates on five-year and two-year fixes are looking more attractive than they have since early June last year," says Coles.

Hargreaves Lansdown says the average 2-year rate dropped from 5.92% to 5.71% in the week to 10 January – and the average five-year fix fell from 5.53% to 5.31% in the same week

But, 2024 has seen market bets for the scale of Bank of England interest rate cuts retreat somewhat, with investors reacting to stronger-than-expected economic data that eases the pressure on the Bank to cut rates.

Coles says the market is already showing signs of doubt, and swap rates (which impact mortgage rates) have crept up a little.

"So there’s the chance mortgage rates could stay put for a while, and the best rates could be withdrawn," says Coles.

Nevertheless, she says the long-term direction for mortgage rates is south, but in the short term, we could see more uncertainty.

"If this happens, you’ll be grateful for having locked in a rate while they were looking relatively attractive" says Coles.