When Will Interest Rates Change In The UK? A Bank of England Cut is Getting Closer

- Written by: Gary Howes

Image © Adobe Images

When will the next interest rate change in the UK fall? Market pricing now suggests the next move by the Bank of England will be in May 2024.

And this change could be the cut in interest rates mortgage holders hope for.

Following a slew of softer-than-forecast economic data over the past three months, investors are now pricing a May interest rate cut at 50/50 odds. But as we note in the below paragraphs, there are significant risks for disappointment.

This is divined from the Overnight Index Swap (OIS) market, used by investors to hedge against future changes in the cost of money. The Sterling OIS shows up to 80 basis points of rate cuts are now expected by market participants in 2024, which amounts to more than three 25 basis point cuts.

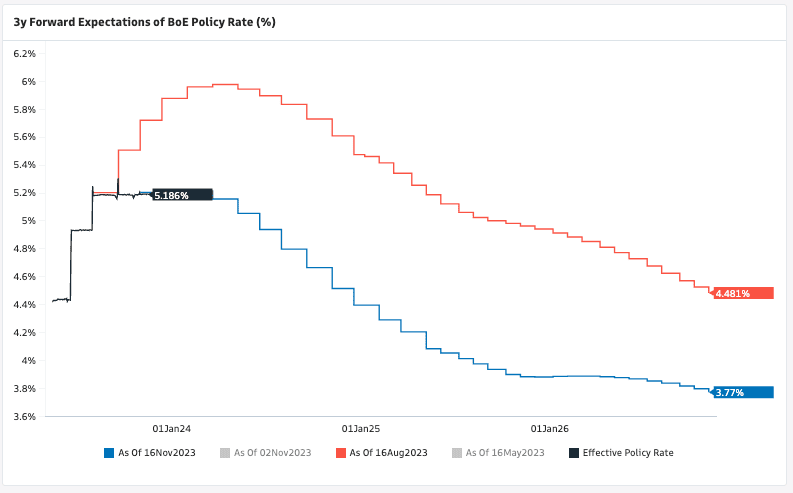

Above: Money market pricing based on the GBP OIS shows a rapid deflating in interest rate expectations, signalling a first cut at the Bank of England occurring as early as May. Image courtesy of Goldman Sachs.

Expectations have fallen dramatically since August, when investors were pricing in a peak in Bank Rate near 6.5%. Because these expectations feed into current lending rates, mortgages surged to multi-decade highs.

But UK data has cooled since then, and expectations have been pared back, bringing the cost of lending down.

This week saw inflation and retail sales figures for October undershoot market expectations, pointing to a slowing economy and a belief the Bank of England has raised rates by enough to bring down inflation.

Economists at Goldman Sachs say they attach a 10% probability to additional rate hikes and see the Bank of England most likely on hold until the first cut in the third quarter of 2024.

But Pantheon Macroeconomics says the Bank of England will cut Bank Rate in May, and 75bp of cuts can be expected next year, with a further 100bp over the course of 2025, bringing down mortgage rates.

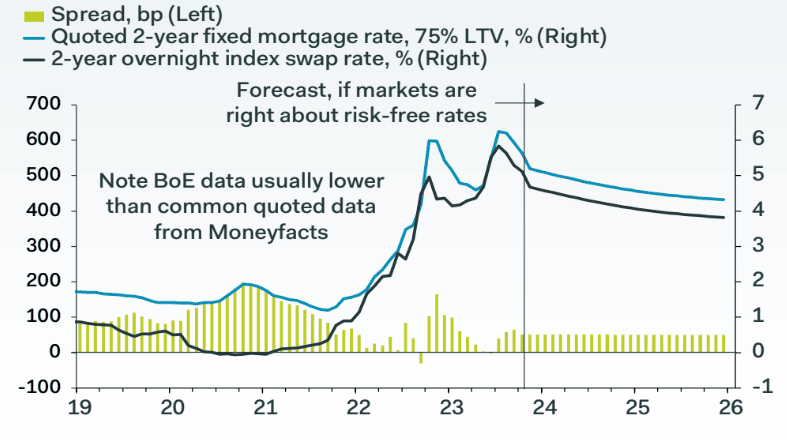

"Mortgage rates look set to fall more quickly over the coming months than we had previously expected," says Gabriella Dickens, an economist at Pantheon Macroeconomics.

Above: "Drop in risk-free rates points to faster falls in mortgage rates" - Pantheon Macroeconomics.

But mortgage holders beware a rude surprise: if the markets got it so wrong in midyear when they saw Bank Rate peaking at 6.5%, they could get it wrong again.

Bank of England Monetary Policy Committee (MPC) member Megan Greene said Thursday the market was not getting the message that interest rates would stay higher for longer in an apparent pushback against market bets for a May rate cut.

"The notion that the long-run neutral rate might be a bit higher and the natural rate of unemployment might be a bit higher isn't something everyone's grappling with," said Greene in an interview.

Greene joins other economists in warning elevated wage increases in the UK will keep core inflation and services inflation well above levels consistent with the Bank of England's aim of bringing inflation back down to 2.0%.

Core inflation rose 5.7% y/y in October, while services rose 6.6% y/y, suggesting that inflation is set to remain high and could be reluctant to fall back to the Bank of England's 2.0% target until at least 2025.

It was reported this week that the UK earnings index (with bonuses included) increased 7.9% in September, according to the ONS, outstripping the 7.4% increase the market was expecting, while August's increase was revised higher to 8.4%.

"Policymakers have continued to push back against expectations of near-term rate cuts. We continue to think that the MPC will hold fire until the summer of 2024," says Andrew Goodwin, Chief UK Economist at Oxford Economics.

Given the strength of wages, economists at HSBC say the Bank of England won't be able to consider rate cuts at all in 2024, and the first cut will only fall in 2025.

"With wage growth high and an absence of rapid productivity growth, services companies in particular may need to continue to pass on increased costs to consumers," says Simon Wells, Chief European Economist at HSBC in London.

So, while the market is pointing to imminent relief for borrowers, tail risks that rates are not cut at all in 2024 cannot yet be discounted.