UK Inflation Preview: "Revenge Travel" Sunset Will Prove a Drag, says TD Securities

- Written by: Sam Coventry

Image © Adobe Stock

Another important inflation print is due from the UK midweek, and analysts at TD Securities are looking for an undershoot in some key areas.

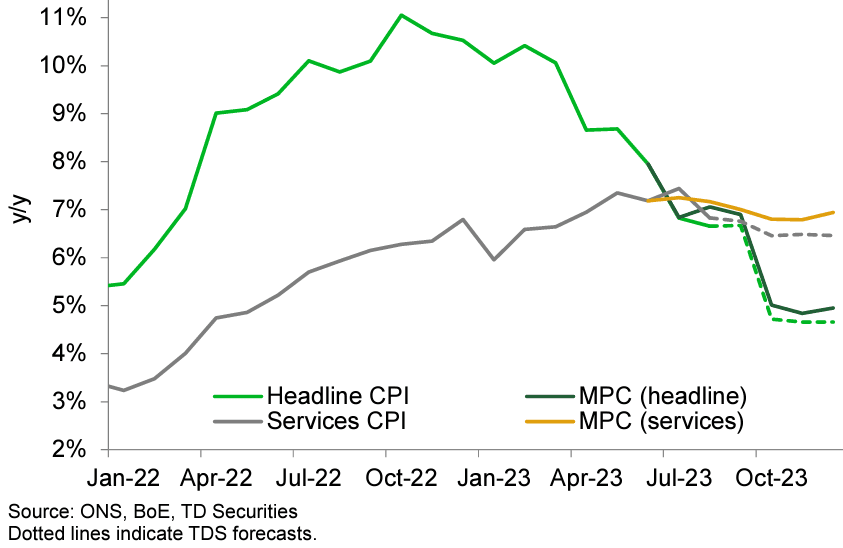

"Another weak airfares print coupled with further softness in food and core goods likely left headline and services inflation 0.2ppts below the MPC's projections," says Lucas Krishan, Analyst at TD Securities.

Economists at the international lender and investment bank predict "the end of revenge travel" will bring the UK's inflation rates down as the release of pent-up demand following the Covid years looks to have finally runs its course.

"The surprisingly soft inflation data in August was essentially all due to record-breaking declines in hotels and airfares," explains Krishan, "while we do see hotel prices rebounding 3% m/m, airfares likely posted another unusually large decline—we estimate a seasonally adjusted 2.8% m/m fall."

Image courtesy of TD Securities.

The market consensus shows investors are positioned for headline CPI inflation to read at 6.5% year-on-year in September, down from 6.7%, with core booked at 6.0%, down from 6.2%.

Should the figures undershoot, as was the case last month, then the Pound could be in for a soft period of trade as markets effectively erase expectations for another Bank of England interest rate rise.

A particular focus for the Bank of England will be the services component, where TD Securities sees the year-on-year rate remaining 20bps below the MPC's forecast at 6.8% y/y (BoE: 7.0%).

"Further signs of improvements in inflation, and most importantly, a lack of a rebound after August's significant downside miss, would continue to suggest that the MPC will keep Bank Rate on hold at its November meeting," says Krishan.