UK to Avoid Mortgage-induced Recession Shows New Research

- Written by: Gary Howes

- Berenberg says UK to avoid a recession

- Pantheon Macroeconomics says mortgage hit to be contained

- But Capital Economics still reckons recession is likely

Image © Adobe Stock

Fears that rising mortgage rates will tip the UK economy into recession are overblown say some economists who argue the majority of households have the means to withstand rising borrowing costs and the proportion of households that will need to refinance at higher rates is still relatively low.

The findings come as financial news pages focus heavily on those economists warning the UK economy is about to be tipped into recession as households succumb to higher mortgage refinancing rates amidst expectations for the Bank of England to continue raising interest rates.

However, those inclined to forecast a recession could be overestimating the extent of any mortgage-induced hit to the economy and underestimating the robust position households and businesses are in.

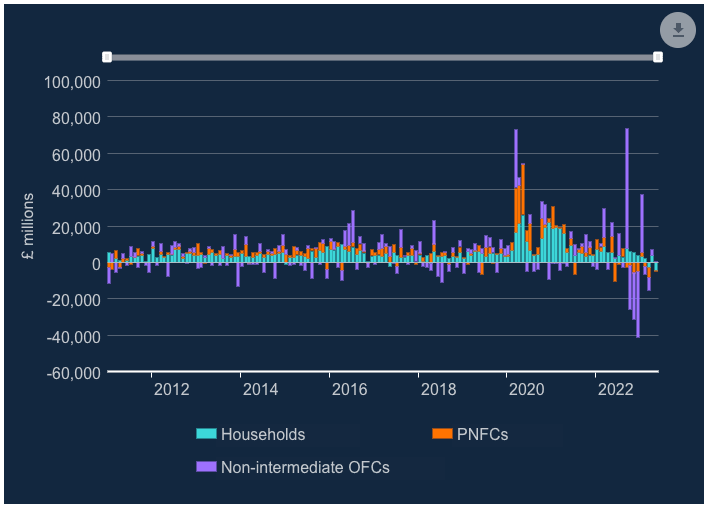

The Bank of England's latest statistical release on the health of households and businesses reveals a still adequate savings pool, although a net withdrawal of household savings took place in May. But the big picture tells a story of an economy in which excess savings will likely continue to provide an ample cushion to the interest rate shock, according to one bank analyst.

"Well-capitalised banks, no excess debt at the lower income end of the housing market (unlike pre-Lehman) manageable levels of corporate debt and high cash balances among businesses and households allow the private sector to absorb a lot of interest-rate pain without triggering a recession or major crisis," says Kallum Pickering, an Economist at Berenberg.

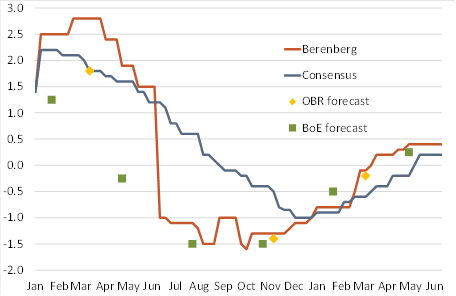

Above image courtesy of Berenberg Bank.

Berenberg currently does not foresee the UK economy falling into recession, although they have lowered their projections by a modest amount in a recent review.

"Should we worry much about a monetary-policy driven recession? No, although the risk is rising from a low level," says Pickering. "Am I still positive on the UK economic outlook in the medium term? Yes."

Data from the Bank of England suggests households are still flush with cash and economists say this can minimise the impact of rising mortgage rates, however; a key risk to the outlook is that savings rates are increased in anticipation of hardship.

"Looking ahead, the chief risk to the economy is that households who have a mortgage which does not need to be refinanced immediately step up their optional repayments of mortgage debt, or save more so they can pay off debt when they refinance, in response to the renewed increase in new mortgage rates," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics.

Above: Data from the Bank of England shows significant amounts were saved during the era of the Covid crisis.

Research from Pantheon Macroeconomics finds the direct blow to overall household disposable incomes from mortgage refinancing will be relatively modest because only 7% of the stock of fixed-rate mortgages has to be refinanced every quarter.

It finds that some households will be able to lower the impact of higher rates by switching to a lower LTV ratio loan, due to the rise in house prices over the last two years.

Data from the Bank of England also reveals the effective interest rate on the stock of mortgage rose only to 2.82% in May, from 2.75% in April.

"We continue to expect the effective rate on the stock of mortgage to rise to about 3.5% by the end of this year, inflicting a 0.2pp blow to aggregate household disposable income in each quarter," says Tombs.

That’s an unpleasant headwind, but not one that likely will be big enough to push the economy into a recession," he adds.

Economists at Berenberg maintain a forecast of 0.4% for 2023 GDP growth but reduce their 2024 call to 1.0% from 1.2% previously, and maintain a call for 1.7% for 2025, which is above the Bloomberg consensus for 0.2%, 0.9% and 1.5%, respectively.

"Although the even steeper path for the bank rate adds downside risk to our medium-term economic calls, the risk of a policy-induced recession starting later this year remains low, in our view. Lacklustre growth for longer remains the most likely outcome," says Pickering.

Pantheon Macroeconomics meanwhile sees households receiving a boost to the tune of 0.8% next week from a 17% fall in energy prices.

The key risk to the economic outlook, however, would be a desire by households to save more on concerns for the future, which would dent spending.

"If a large fraction of borrowers start to save more or pay off debt, then a recession is possible," says Tombs. "For now, though, we think that risk is low; the recent recovery in consumers’ confidence, including in those groups most exposed to the jump in mortgage rates, suggests that households won’t lurch decisively towards caution."

Furthermore, he expects many households already have savings that they can use to pay off debt when they refinance without having to cut their expenditure now.

"We continue to think, therefore, that a recession will be avoided," he concludes.

But economists at Capital Economics - an independent research provider - reckon the UK economy is on course for recession as households cut back on expenditure.

Ashley Webb, UK Economist at Capital Economics, notes the Bank of England's latest statistical bulletin revealed the monthly increase in consumer credit slowed from £1.5bn in April to £1.1bn in May.

She notes households' deposits in banks fell by £4.6BN in May, which was the biggest decline since the data series began in October 1997. Some of this money is expected to have been diverted to higher-yielding assets, such as government bonds, but some of it is likely to have financed spending.

"We suspect this will decline further as the growing drag from higher interest rates may mean households cut back on their borrowing and spending, tipping the economy into recession," says Webb.