UK Households Can Defy the Mortgage Crunch

- Written by: Gary Howes

Image © Adobe Images

Households can beat the 'mortgage crunch' by extending the length of their mortgages with their existing provider, according to a new analysis.

The findings come amidst increased anxiety over the health of the UK housing market as mortgage rates rise sharply as markets bet the Bank of England is now set to hike Bank Rate to as high as 6.0% as it grapples with inflation.

It is now reported the average interest rate on a two-year fixed mortgage has increased to over 6% for the first time since December last year.

But analysis from Pantheon Macroeconomics finds the impact of the hectic rise in Bank Rate has been slow to work through to the housing sector, and the economy in general, in part because of a trend towards households refinancing mortgages with their current lender.

"Many banks have offered lower interest rates to existing borrowers than to new customers recently, as they have not sought to increase their market share and are better able to assess the creditworthiness of existing borrowers," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics.

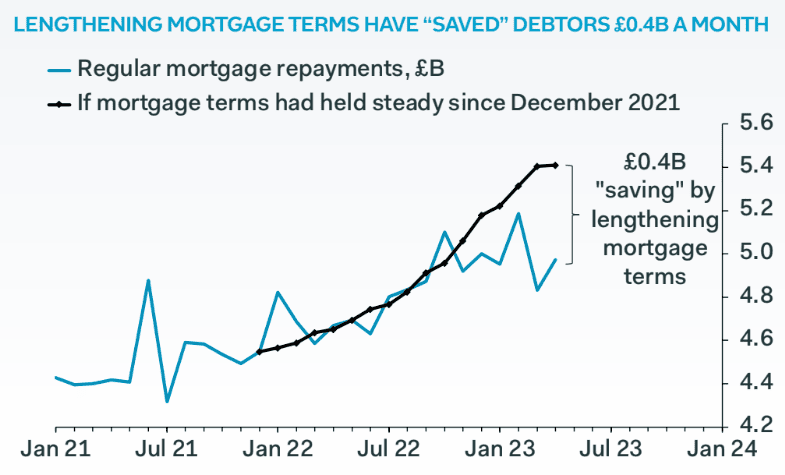

Image courtesy of Pantheon Macroeconomics.

Andrew Wishart, Senior Economist at Capital Economics, says the average quoted mortgage rate will pick back up from 4.3% in April to over 5% imminently and reach a peak of 5.7% in Q1 2024.

"Our forecast of a further 8% drop in house prices was looking uncertain based on our previous interest rate profile. But with rates now expected to rise further and stay higher for longer, it is again a reasonable central case," says Wishart.

Fears have grown for a cohort of people who became homeowners during the pandemic when ultra-low interest rates at the Bank of England and government stimulus prompted house prices to rocket.

Two years ago the government introduced a stamp duty holiday in an effort to counter the effects of the pandemic but also helped contribute to record-high house prices for 1.3 million homebuyers that entered the market.

Mortgage broker, Better.co.uk, says those who took advantage of the holiday and opted for a two or three-year fixed deal, when rates were much lower, are now facing significant increases in their mortgage repayments while their homes are decreasing in value."

According to Amanda Aumonier, Head of Mortgage Operations at Better.co.uk, the majority of those who purchased property during the pandemic did so with two or three-year fixed-rate mortgages – many of which are now due to expire.

"As such, we still haven't seen the full impact of the Bank of England's strategy to increase the base rate over the past 18 months. If the BofE decides to raise the base rate once again this week, it will not only continue to jeopardise the housing market overall but could also have catastrophic effects on this group of homeowners, who now need to remortgage," she says.

But according to Tombs, Bank of England mortgage data reveals refinancers collectively have saved £437M per month, by extending the term of their mortgage.

By refinancing borrowers typically agree to lengthen the lifespan of their mortgage, thus locking in more competitive rates than those attached to new mortgage deals.

"Lenders must treat you fairly and consider your requests to modify payment methods. Depending on your situation, options may include payment breaks, extended repayment periods, or switching to a more affordable mortgage," says Aumonier.

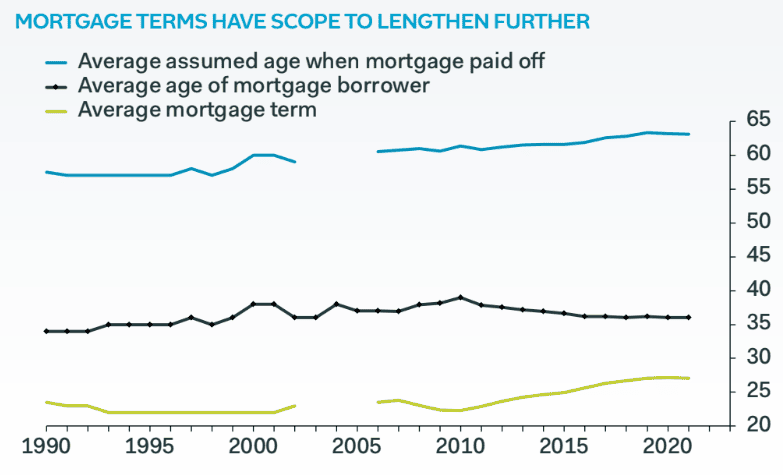

Crucially, Pantheon Macroeconomics says mortgage terms can continue to lengthen as the rise in the pension age over the coming years allows workers to stay in employment for longer, thereby allowing them to extend the life of their mortgage and bring down repayment rates.

Image courtesy of Pantheon Macroeconomics.

The scrapping of the default retirement age in 2011 also affords flexibility to lenders and borrowers when looking to extend the lifetime of a mortgage.

"Virtually all lenders now are willing to lend for 35-year terms and on the basis of repayments extending until someone is 75 years old, with some, such as Nationwide, willing to lend until the borrower is 85 years old," says Tombs.

Given the weakened passthrough effect of a rising Bank Rate on mortgages, Pantheon Economics reckons the economy can still avoid recession, despite the prospect of further hikes.

"We still think that the blow to households’ incomes from mortgage refinancing will not be large enough to drive the economy into a recession," says Tombs, "especially when the pressure on households’ incomes from higher energy prices is about to fade."

He says for a consumer-led downturn to unfold households must decide to increase substantially ad hoc repayments of debt, and finance this by spending less.

However, research from Capital Economics reckons a recession is now a very real prospect for the UK as they calculate the recent rise in lending costs will be enough to tip the economy "over the edge".

"Although the economy has proved resilient to the cost of living crisis, which is coming to an end, we think the cost of borrowing crunch will send it over the edge. The drag on activity from higher interest rates is the main reason why we think real consumer spending and real private investment will fall," says Paul Dales, Chief UK Economist at Capital Economics.

"Unlike most other forecasters, we still expect that the rise in interest rates will trigger a recession in the UK, and that this is necessary to reduce inflation to 2.0%," he adds.