UK Economy Rebounds in April

- Written by: Gary Howes

Image © Adobe Images

There were no negative surprises for the Pound and UK assets after the Office for National Statistics said the UK economy returned to growth in April following the contraction recorded in a damp March (-0.3%).

The 0.2% growth was in line with economist expectations as the services sector rebounded, growing by 0.3% in April 2023, following a 0.5% fall in March 2023.

In the year to April, the economy expanded 0.5% said the ONS, which was up on the 0.3% recorded in March but just below consensus expectations for 0.6%. The overall picture is one of an economy that remains relatively subdued with growth flatlining around current levels.

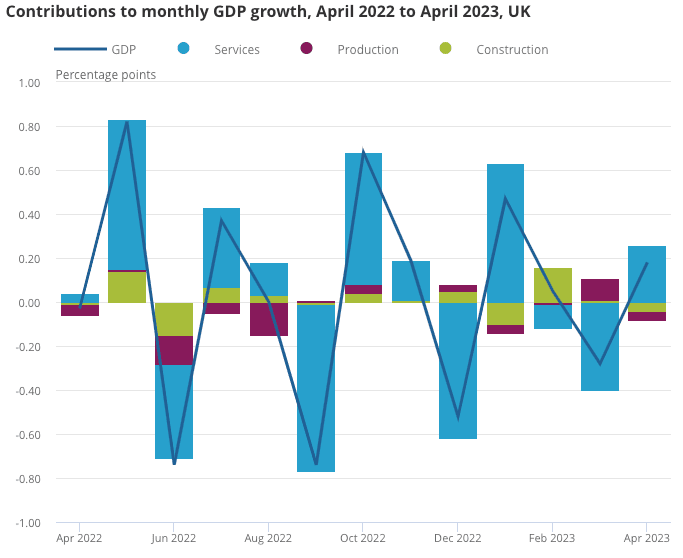

Above: The growth in services was slightly offset by falls in both production and construction. Image source: ONS.

The rolling quarterly figure showed the economy expanded 0.1% in the three months to April, which is better than the -0.1% the market was expecting and unchanged on the previous three months.

Production output was a drag as it fell by 0.3% in April 2023, after recording growth of 0.7% in March 2023.

The construction sector is another source of concern after recording a contraction of 0.6% in April 2023, following growth of 0.2% in March.

"The services sector continues to set the tone for the UK economy, growing 0.3% in April – driven by vehicle sales and repairs together with an uptick in the tv, film and music industries. In production it was advanced manufacturing that suffered, with declines in pharmaceutical and computer/electronic products, while private housing work held back construction," says Nicholas Hyett, Investment Analyst, Wealth Club.

The GDP data comes a day following the release of UK labour market statistics that revealed a fall in unemployment in April as job growth continued. Payroll data meanwhile revealed inflation-busting wage growth suggesting the labour market remained tight and the Bank of England has more work to do in order to get a grip on inflation.

"More important than monthly shifts in the economy is what the numbers mean for the future direction of interest rates. With wages and prices continuing to rise the Bank of England is expected to raise rates further to stem inflation. GDP growth, albeit modest, creates the space for the Bank of England to be more aggressive in its rate hikes. The chances of a 0.5% rate hike just got higher," says Hyett.