UK Government Borrowing Surges in April, But Too Soon for Treasury to Panic Says One Economist

- Written by: Gary Howes

Image © Gov.uk

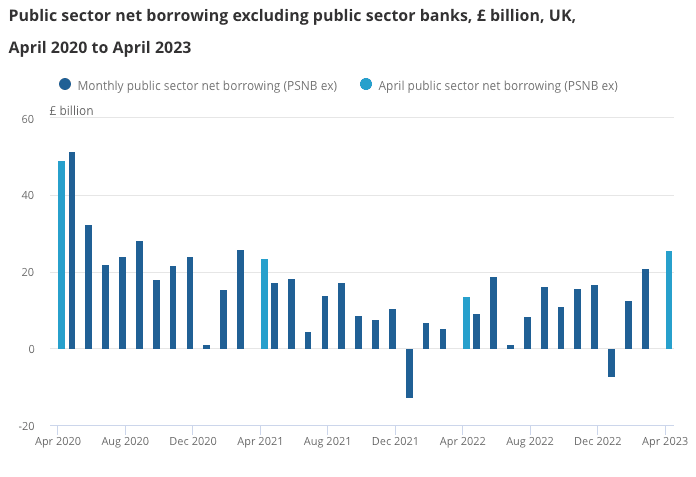

UK Public Sector Net Borrowing experienced an unexpected rise in April, reaching £24.74 billion, up from £20.02 billion in March, said the ONS.

The figure far surpassed economists' expectations of £17.5 billion, marking the second-highest level for April since records began thirty years ago.

Economists say the numbers will be of concern to the government which will want to announce some 'giveaways' before the next election, however, one says it is too soon for the Treasury to panic.

"This is much higher than forecast and comes despite the economy showing signs of avoiding a recession," says Susannah Streeter, Head of Money and Markets at Hargreaves Lansdown.

Streeter highlighted that the flow of money into government coffers was slower than anticipated, with receipts falling below the Office for Budget Responsibility's forecasts, even though more taxpayers were pushed into higher tax bands.

Streeter also emphasized the government's challenge of dealing with the high cost of debt interest, exacerbated by the unexpected rapid rise in interest rates.

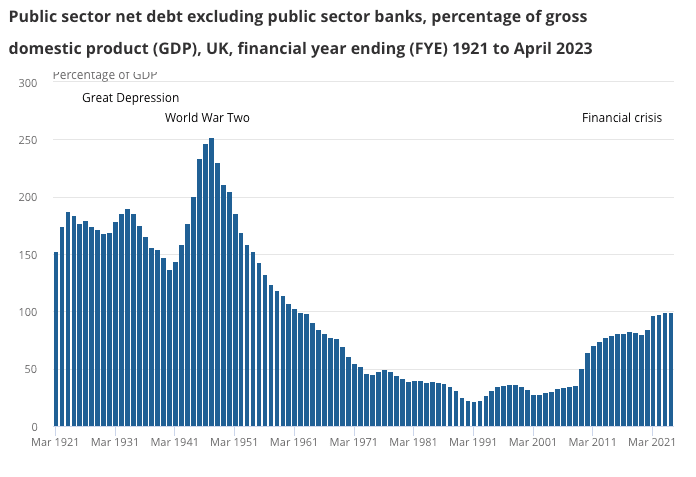

Moody's, a leading credit rating agency, has warned that prevailing social and economic conditions in the UK, including an aging population and increased healthcare costs, will likely lead to a continuous increase in the country's debt burden.

Streeter pointed out that this reduces the government's flexibility to provide additional spending, potentially limiting the number of incentives it can offer before the next election.

Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics, shed light on the factors contributing to the high borrowing in April.

He explained that the surge primarily resulted from a significant increase in central government net investment, rising from £5.4 billion to £17.0 billion compared to the same period last year.

Tombs noted that the Treasury's capital transfer of £9.8 billion to the Asset Purchase Facility played a role in this increase.

However, he highlighted that transfers from the Treasury to the Bank of England do not impact the Public Sector Net Borrowing (PSNB), although they affect the more commonly monitored "PSNB ex."

Tombs also said central government current expenditure, which stood at £89.2 billion in April, surpassing the Office for Budget Responsibility's forecast of £83.8 billion.

This increase was partly attributed to higher-than-anticipated interest payments. Meanwhile, central government current receipts of £69.7 billion slightly fell short of the OBR's forecast of £72.2 billion.

Tombs cautioned that the monthly public finance data are volatile and subject to significant revisions, suggesting that there may not be cause for immediate concern at the Treasury.

Looking ahead, he believes that the OBR's forecast for public borrowing of £131.6 billion for the entire fiscal year 2023/24 is still a reasonable estimate.

However, he expressed doubt that public borrowing will decrease to the low levels predicted by the OBR in the medium term, noting that the OBR's economic outlook may be too optimistic.

Pantheon Macroeconomics sees public borrowing settling at about 4% of GDP in the mid-2020s, rather than the 3% level forecast by the OBR.