Eurozone GDP: Germany Being Left Behind

- Written by: Gary Howes

© Adobe Stock

The Eurozone economy eked out growth in the first quarter of the year but looking at the details reveals Germany is proving a drag while peripheral nations such as Spain and Italy saw robust growth.

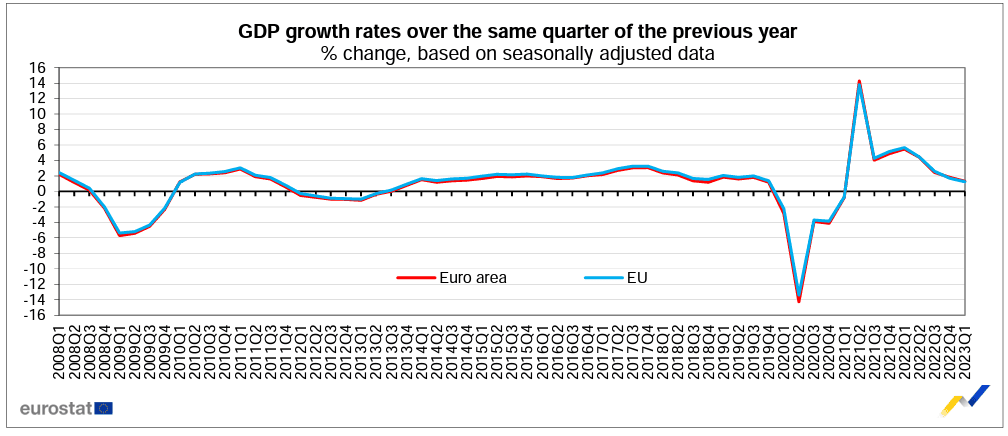

Eurozone GDP rose 1.3% year-on-year in the first quarter said Eurostat, which was slightly less than the consensus was looking for at 1.4%. It also marks a slowdown from Q4 2022's 1.8% jump.

The quarter-on-quarter increase stood at 0.1%, with a clear divergence in fortunes for Eurozone member states.

Germany disappointed with 0.0% q-q with the consensus looking for growth of 0.3%.

France saw its economy grow 0.2% in the quarter (in line with expectations) and Italy posted a strong 0.5% q-q, beating estimates for 0.2%, as it bounced back from -0.1% in Q4 2022.

"This divergence could also be the start of a more structural rebalancing of the eurozone economy as Germany’s economic business model is clearly the most affected by higher energy prices, energy transition and global trade tensions," says Carsten Brzeski, Global Head of Macro at ING Bank.

The periphery outperformed with Portugal recording growth of 1.6% as it defied expectations for -0.1%. Spain grew by a similar amount.

"The Eurozone economy has been resilient in the face of energy price increases and rate hikes over the past few months, and while growth is slowing, this remained the case in Q1," says Neil Birrell, Chief Investment Officer at Premier Miton Investors.

The data comes just days before the May 04 European Central Bank decision that will likely see another interest rate increase.

The mixed nature of the data does however leave question marks as to whether the central bank will opt for a 50 basis point or 25bp move.

The former would underpin the Euro's recent strength, the latter would potentially see the currency give back some recent gains.

Economist reactions to the data underpin divergent interpretations that will likely be shared in the halls of the ECB in Frankfurt.

"There is nothing in this data set to suggest that the economy is stalling or that inflation is beaten. In fact, the inflation data at country level suggests the opposite," says Birrell.

Brzeski says the eurozone economy carries on along the rim of stagnation.

"A meagre 0.1% quarter-on-quarter GDP growth in the first quarter with high divergence across member states is better than feared – but clearly no reason to cheer," he says.