"Not Nearly as Hot" - Labour Market Slowdown Underway say Economists

- Written by: Gary Howes

Image © Adobe Images

The UK reported another strong set of labour market statistics that will maintain pressure on the Bank of England to raise interest rates again in May, however, signs of a slowdown are becoming increasingly clear say some economists.

The country saw a rise in employment in the three months to February of 169K, which exceeds the 50K the market was expecting.

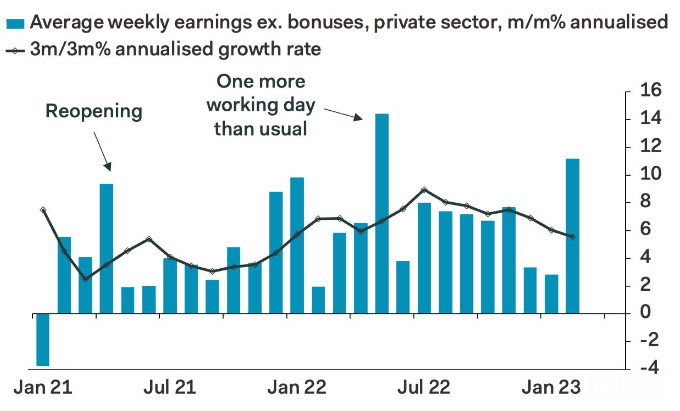

This came alongside a rise in headline wages (bonuses included) by 5.9% in the December-February period, exceeding consensus estimates of 5.1%, a figure that helped spur an advance in Pound Sterling.

"Alongside broader measures of economic activity – including orders, spending in cash terms and production – labour market data for the UK has consistently surprised to the upside since October," says Kallum Pickering, Senior Economist at Berenberg Bank.

But other economists have looked into the numbers and say signs of slack are building as previously economically inactive people look for jobs again and the number of available vacancies falls.

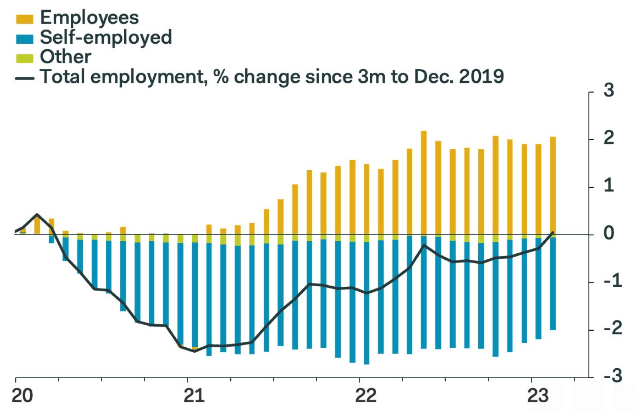

In addition, part-time and self-employment appears to have been the engine for a good portion of the most recent growth in employment.

"The labour market is not nearly as hot as the employment figures imply," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics. Brisk growth in employment in the three months to February was driven by a 134K rise in self-employment; employee numbers rose by a mere 18K.

Image courtesy of Pantheon Macroeconomics.

Full-time positions fell by 93K, while part-time positions increased by 111K.

"Some of the people who recently have become self-employed likely are working less than they would like and so represent hidden slack," says Tombs.

Tombs estimates the trajectory in the wage and jobs market is consistent with an undershoot to the Bank of England's previous estimates, which could take pressure off the Bank to hike interest rates again.

"Pressures are seemingly starting to ease as successive interest rate hikes bear down on momentum," says Ellie Henderson, an economist at Investec.

The unemployment rate unexpectedly rose to 3.8% from 3.7%, helped by an increase in people looking for jobs who were previously economically inactive as the quarterly change to the inactivity rate was -0.4pps.

Investec thinks the MPC will raise the Bank rate by 25bps to 4.50%, but that will be the last hike in this tightening cycle.

"Today's data release arguably supports that call: the labour market is still tight, suggesting a further tightening of the screws, but directionally there are tentative signs that the lagged impact of the successive increases in the Bank rate is starting to show in the numbers, justifying it being the last push," says Henderson.

Image courtesy of Pantheon Macroeconomics.

Pantheon Macroeconomics meanwhile notes other signals of easing tightness in the labour market which includes the employment index of S&P's composite PMI survey dropping to just 50.0 in March, from 51.3 in February.

The permanent staff placements balance of the REC Report on Jobs survey remained below 50 for the sixth consecutive month in March.

Elsewhere, the trend in the Insolvency Service's redundancy notifications data has deteriorated with the year-to-date total in the week ending April 2 being 9% higher than in early 2021, when employment merely flatlined.

Adzuna's measure of job vacancies also has almost returned to its level in the same week of 2019, having exceeded this benchmark by 18% on average in 2022.