Significant Jump in U.S. Unemployment Looms: BCA Research

- Written by: Gary Howes

Image: Doug Turetsky. Sourced: Flikr, licensing: CC 2.0.

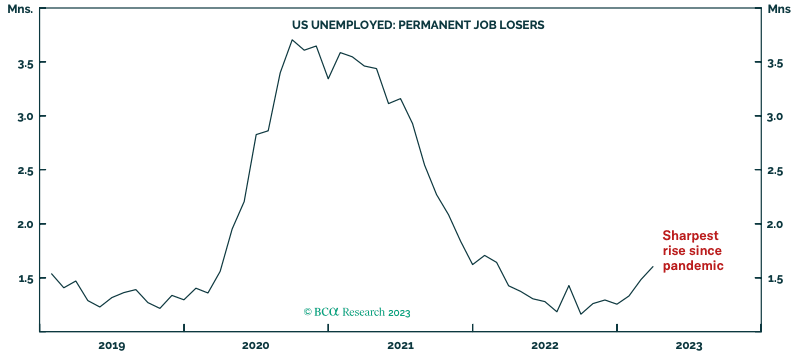

New research finds that the recent increase in permanent job losses in the U.S. could lead to a sharp rise in unemployment and investors should position for a U.S. recession starting in 2023 unless the number of 'job losers' drops significantly in the coming months.

According to Dhaval Joshi, Chief Strategist at BCA Research Inc., the number of US 'job losers' has surged by almost half a million through February and March in a development that hints at a looming sharp uplift in unemployment.

Indeed, this represents the largest two-month increase in Americans who have lost their jobs since last summer, although it's still well below the levels seen at the height of the pandemic.

The findings follow a run of relatively benign U.S. job reports: the Bureau of Labor Statistics said most recently non-farm payrolled employment rose by 236K in March. While this figure was lower than February's upwardly revised figure of 326,000, it was still higher than what economists had predicted.

However, there are concerns about the details buried in the report.

"Through February and March, the bulk of the near half million increase in job losers were 'permanent job losers' – people whose employment ended involuntarily," says Joshi. "The only thing that stopped unemployment from rising was a big drop in the number of so-called 're-entrants'. Meaning, the number of people re-entering the labor market to look for a job, and thereby classed as unemployed, fell sharply. The trouble is, with the number of re-entrants already close to an all-time low, it cannot save the day forever."

Above: "The Number Of U.S. 'Job Losers' Has Surged By Almost Half A Million" - BCA Research.

Joshi also warns that unemployment is notoriously non-linear and that once it rises to a tipping point, it can then jump up to a much larger increase.

"Once the unemployment rate rises by 0.4 percent, it is impossible to stop it from rising by well over 2 percent. This makes the 'soft landing' that some analysts are expecting a very tough ask," he says.

Despite the better-than-expected March figures, Joshi believes that the correct investment strategy is still to position for a US recession that starts in 2023, unless there's a big drop in the number of job losers in the coming months.

"The US labor market remains vulnerable to setbacks, especially given that job losses were recorded in a small number of sectors," says Joshi. "It's also worth noting that the bulk of the job losses in February and March were permanent. Therefore, it's important to remain cautious and not read too much into one month's data."

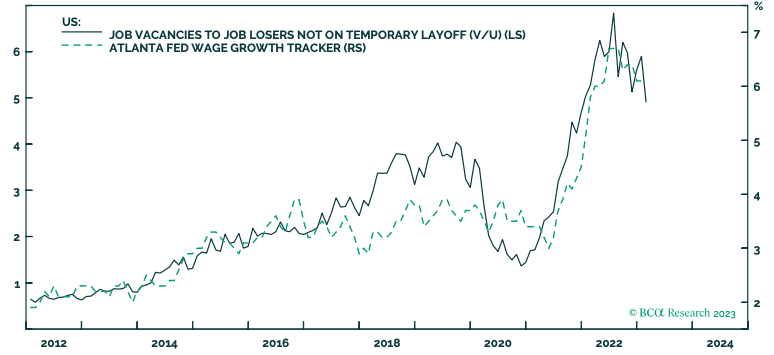

Above: The Ratio Of Job Vacancies To Job Losers Not On Temporary Layoff (V/U) Explains US Wage Inflation.