House Price Downturn Gathers Price with More to Come say Economists

- Written by: Gary Howes

Image © Adobe Images

The UK's second-largest mortgage provider says UK house prices recorded a seventh consecutive monthly decline in March.

The Nationwide House Price Index revealed a 3.1% year-on-year decline in UK house prices in March, the largest annual decline since July 2009.

The falls come amidst higher mortgage rates amidst ongoing increases in the Bank of England's Bank Rate.

Nationwide says all regions saw a slowing in price growth in the first quarter and upside momentum was unlikely to return to the sector anytime soon.

"It will be hard for the market to regain much momentum in the near term since consumer confidence remains weak and household budgets remain under pressure from high inflation. Housing affordability also remains stretched, where mortgage rates remain well above the lows prevailing at this point last year," says Robert Gardner, Nationwide's Chief Economist.

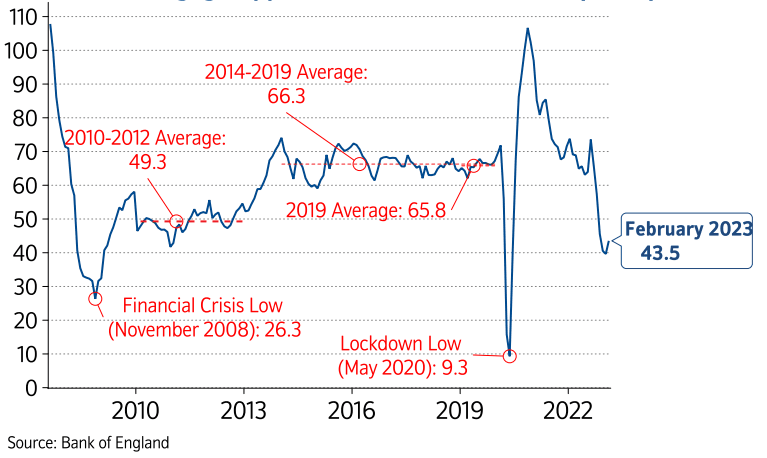

Above: Mortgage Approvals for house purchases (000's). Image courtesy of Nationwide.

"The downturn in the housing market now is in full swing," says Gabriella Dickens, Senior UK Economist at Pantheon Macroeconomics.

Economist Andrew Wishart at Capital Economics says UK house prices remain "significantly overvalued in today’s higher mortgage rate environment".

As a result, he expects most of the adjustment lower in house prices is yet to come.

Capital Economics says a typical First Time Buyer mortgage would currently cost 51% of the median full-time salary a month which is well above the long-term average of 41%.

This indicates housing remains "significantly overvalued in today’s higher mortgage rate environment".

Capital Economics forecasts a peak-to-trough drop in the average house price of 12%.

"Demand will not recover until either mortgage rates or house prices have fallen substantially further," says Dickens at Pantheon Macroeconomics.

She says the chances of mortgage rates dropping further in the near term are slim given that we likely are still several months away from the MPC giving a strong signal that Bank Rate has peaked.

"As a result, house prices likely will continue to drift down until monthly mortgage payments fall far enough to bring demand and supply back into balance. We continue to judge that the official measure of prices will not stabilise until it has fallen by about 8% from its late 2022 peak," says Dickens.