The 2023 Credit Crunch has Begun

- Written by: Gary Howes

Image © Adobe Images

A credit crunch is underway as banks tighten lending standards in response to recent stresses in the U.S., Eurozone and Swiss banking sectors, say a number of noted economists we follow.

As banks become more conservative in lending practices the impact on the real economy will be felt by slowing activity that could potentially evolve into a global recession.

"Even if a full-blown financial crisis is averted, we still see repercussions for the non-financial sector from these events. Our main concern is that uncertainty over their liability bases will encourage banks to tighten lending standards and that weaker credit flows will act as a brake on growth," says Philip Shaw, Economist at Investec.

Shaw's assessment comes on the day Deutsche Bank shares collapse by 10% amidst a spike in the bank's credit default swaps (CDS) - a form of insurance for bondholders - which shot up above 200 basis points on Friday.

Investec is not alone in thinking that we are not about to witness another crisis on the scale of 2008, given banks are better capitalised and authorities are proving more nimble in dealing with stresses.

Yet, the real economy will still feel the impact of current stresses as financial conditions tighten as banks take a far more conservative approach to lending.

Madhur Jha, Senior Global Economist at Standard Chartered, this week released a research note entitled "The macro impact of the coming credit crunch" in which she says "bank lending standards will likely tighten further in the U.S. and Europe."

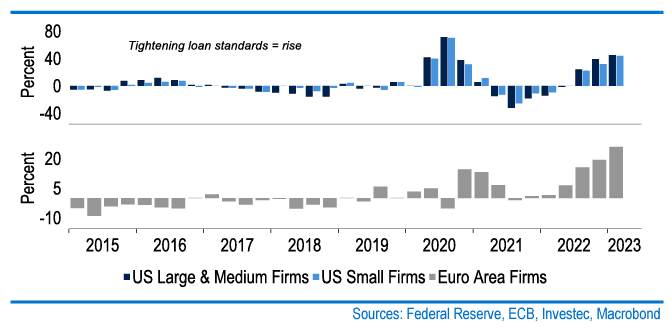

Above: "Tightening lending standards are historically closely correlated with weaker manufacturing activity in the US " - Standard Chartered.

Standard Chartered says lending standards in the U.S. and euro area are already close to levels historically seen in recessions

"The macro impact will be felt by SMEs via weakening output, in turn leading to weaker labour markets," says Jha.

A credit crunch is typically defined as a decline in lending activity by financial institutions, the most recent example of which occurred in 2008.

The foundations of the 2023 credit crunch are however different to those of 2008 with rising central bank interest rates now being blamed for dislocations appearing in the U.S. and global financial systems.

"Rising interest rates have created an asset crunch, which is now at risk of becoming a credit crunch," says Andrea Cicione, Head of Strategy and COO Research at TS Lombard.

The impact of higher central bank interest rates will likely be amplified by a growing reluctance of lenders to extend credit in the current environment.

"Concerns that tighter lending standards will supercharge the impact of rate hikes remain a key focus for markets. History shows a pick-up in discount window - usually driven by banking sector stresses/falling confidence - usage tends to see loan standards rising," says Stephen Spratt at Citi.

"Distress in the banking sector is likely to accelerate the tightening of lending standards that was already underway," says Cicone.

Investec's Shaw says he in no way foresees a collapse in lending resembling the scale of the adjustment of the Great Financial Crisis.

"However weaker flows of credit to households and businesses could still have a material, negative impact on demand, carrying implications for the economy and the interest rate outlook," he explains.

Above: "Lending standards have tightened already prior to the banking sector turmoil" - Investec. Sources: Federal Reserve, ECB , Investec, Macrobond.

Standard Chartered warns the small and medium enterprise (SME) sector will likely be most affected as banks tighten lending conditions more for the less creditworthy.

According to the bank, formal SMEs account for about 90% of businesses and 50% of employment globally, with the numbers rising when the informal sector is included.

"The most immediate impact is likely to be felt via lower manufacturing activity (which is already evident), with tighter credit conditions historically having a more lagged impact on services activity," says Jha.

Lending conditions were already tightening ahead of the current banking stresses, according to the Federal Reserve's Senior Loan Officers Opinion Survey.

This was also confirmed by the ECB's Euro Area Bank Lending Survey, which showed banks were already planning to restrict lending to firms and households.

"A 2023 US recession and aggressive Fed cuts are even more likely than before. In addition, the downturn is more likely to happen earlier and be deeper than previously thought," says TS Lombard's Cicione.