Pound and Dollar Advance on the Euro Amidst a New Banking Scare

- Written by: Gary Howes

Image © Adobe Stock

The Dollar, Yen and Franc were the safe havens in demand on fresh signs of banking stresses at one of Germany and Europe's most important banks.

The Euro was a clear laggard, perhaps understandably, given Deutsche Bank sits at the heart of the Euro system.

Pound Sterling was a mid-field performer, advancing against the Euro, Krone and Krona while holding par with the Australian and New Zealand Dollars.

Foreign exchange markets are therefore beholden to banking sector developments ahead of the weekend as Deutsche Bank shares slump more than 10% and its credit-default swaps surge amid wider concerns about the banking sector.

Germany's biggest bank holds around $1.4 trillion in assets with some $880 billion in assets under management and is considered to be systemically important to the global financial system.

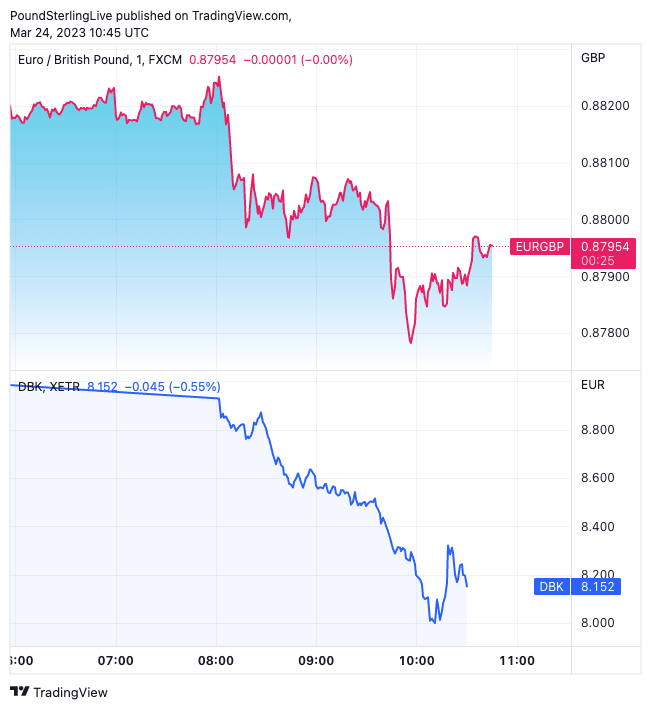

Above: EUR/GBP and Deutsche Bank's German listed shares. (Consider setting a free FX rate alert here to better time your payment requirements.)

"Spotlights turned on German Deutsche Bank today," says Mathias Van der Jeugt, analyst at KBC Markets. "The European source of today’s uncertainty and general risk aversion call an end to EUR/USD’s recent rally. EUR/USD currently changes hands around 1.0750 from an open around 1.0825. EUR/GBP copied the EUR/USD-move south, with the pair returning below 0.88."

Deutsche Bank shares were seen recovering towards the close of European trade and the Euro pared some of its losses.

German Chancellor Olaf Scholz rejected comparisons between Deutsche Bank and Credit Suisse as he sought to shore up confidence in his country’s biggest bank.

"Deutsche Bank has fundamentally modernised and reorganised its business and is a very profitable bank," he said at a summit in Brussels. "There is no reason to be concerned about it."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Deutsche Bank recorded a $6BN profit in 2022 as years of restructuring paid off and analysts say it will not suffer the same fate as Credit Suisse.

If the bank sails through the current stormy waters markets and the Euro would likely recover.

"We have no concerns about Deutsche’s viability or asset marks. To be crystal clear — Deutsche is NOT the next Credit Suisse," says Stuart Graham, of Autonomous Research. "We are relatively relaxed in view of Deutsche’s robust capital and liquidity positions."

But if Deutsche Bank's future is thrown into doubt it raises the prospect that the ECB might have to end its rate hiking cycle imminently.

The fall in Euro exchange rates on Friday suggests this is certainly a consideration amongst foreign exchange market participants.

Global stocks were deep in the red and commodities lower as the Deutsche Bank news comes alongside revelations Credit Suisse and UBS are among banks under scrutiny in a U.S. Justice Department investigation into whether financial professionals helped Russian oligarchs evade sanctions.

The Swiss banks were included in a recent wave of subpoenas sent out by the US government, according to Bloomberg.

At the time of writing the Pound to Euro exchange rate is at 1.1364, having been as low as high as 1.1394 earlier, the Pound to Dollar exchange rate is at 1.2223, having been as low as 1.2190 earlier.

The Euro to Dollar exchange rate is down a per cent at 1.0757 but had been as low as 1.0714.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes