Bank of England: 25bp Hike More Likely Following Sharp Drop in Lending Figures

- Written by: Gary Howes

Image © Adobe Images

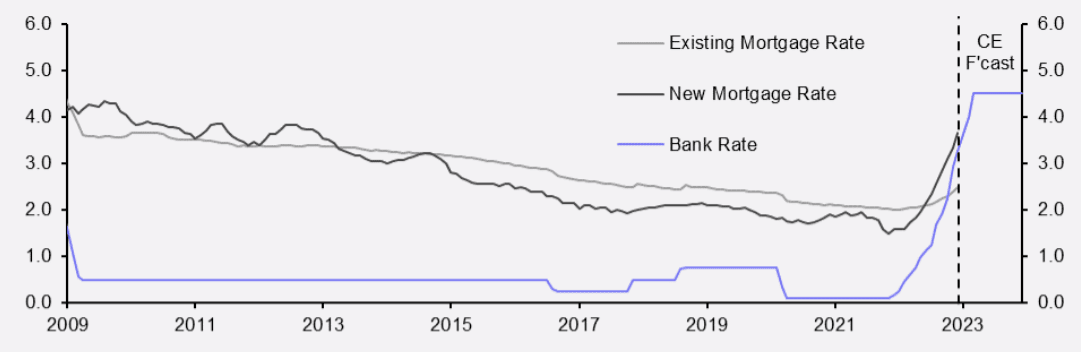

If the purpose of raising interest rates is to slow lending in order to bring down inflation, then the Bank of England will be confident the actions it took in 2022 are doing the job.

New data from the Bank show mortgage lending, lending to individuals and money supply have fallen sharply as the cost of borrowing rises in response to interest rate hikes.

House purchase mortgage approvals fell to 35.6K in December, from 46.2K in November, putting it on a par with the financial crisis lows of 2009.

The net flow of consumer credit was £0.5BN in December, down from £1.5BN in November, and lower than the previous 6-month average of £1.2BN.

The net flow of sterling money decreased to -£34.7BN in December, from -£24.0BN in November.

"December’s money and credit figures revealed that higher interest rates further dampened economic activity at the end of last year. Moreover, the drag on activity will continue to intensify this year as the Bank of England raises interest rates," says Ashley Webb, UK Economist at Capital Economics.

Above: Bank Rate and average mortgage rates (%). Sources: Refinitiv, Capital Economics. Image courtesy of Capital Economics.

The Bank has raised interest rates to cool economic activity in an attempt to ensure inflation does not become embedded above the 2.0% target level for an extended period of time.

Markets are poised for a 50 basis point hike but the lending figures out Tuesday suggest to some economists that the Bank can now consider bringing an end to the hiking cycle early in 2023, with January's hike potentially even being the last.

"These numbers are pretty consistent. We have a weaker mortgage market and money supply growth and maybe people unwilling to pay a higher interest rate for unsecured credit. To my mind that again points to the Bank of England raising interest rates by 0.25% this week rather than the 0.5% many still seem to expect," says Shaun Richards, an independent economist who advises pension and investment funds.

Richards is not alone as institutions such as HSBC, CIBC, RBC, Berenberg, Morgan Stanley, UniCredit and Bank of America are calling for a 25bp hike.

The British Pound is softer across the board at the time of writing, with losses potentially reflecting a lowering in market expectations for the scale of Thursday's hike.

"The reason for our non-consensus call is that after a VERY aggressive year of tightening, the BoE is likely to place greater weight on the impact of prior hikes," says Bipan Rai, Head of FX Strategy at CIBC Capital Markets.

"If we're correct, then watch for the GBP to fall," he adds.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Despite the recent lending data, most economists (70% according to a Bloomberg survey) expect the Bank of England to deliver a 50bp hike and money markets show a similar expectation amongst investors, suggesting there would still be enough of a surprise factor on a 25bp hike to prompt further weakness in the Pound.

"Because monetary policy works with a lag, policymakers will need to pause with rate hikes well before wages and core prices start to turn down in a major way. Since the future is unknowable, the next few policy decisions will be matters of judgment rather than science. Now that monetary policy is restrictive, the BoE can afford to move in small incremental steps," says Kallum Pickering, Senior Economist at Berenberg.

Webb, at Capital Economics, says the cumulative downward effect from higher interest rates appears to be starting to weigh more heavily on the economy.

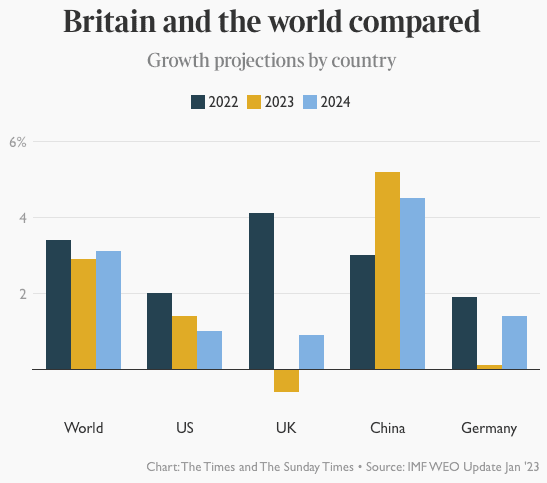

"Given the large share of fixed-rate mortgages, this effect is only going to grow throughout this year. We suspect the recession will be bigger than the IMF is predicting," she says.

Image courtesy of The Times.

The IMF caused a stir with the release of its latest economic forecasts on January 31 which showed the UK would be the only major global economy to fall into recession in 2023.

The Bank of England is meanwhile expected to raise GDP forecasts for 2022 but maintain a downbeat outlook for growth while also lowering inflation forecasts.

A smaller-than-expected rate hike combined with a softer inflation forecast could well weigh on the Pound for the foreseeable future, particularly if Wednesday's Federal Reserve and Thursday's European Central Bank decisions prove to be more 'hawkish' than investors are currently expecting.