UK Gilt Markets Unlikely to Implode: BNY Mellon

- Written by: Gary Howes

Image © Pound Sterling Live

The UK government is about to 'borrow big' again as it seeks to deal with its second major crisis of the past two years, leading to fears the market could lose confidence in the UK's ability to service debt.

The idea that markets could lose faith in the UK economy was a favourite line presented by former Chancellor Rishi Sunak, who was Liz Truss' contender for the role of Prime Minister.

But one economist we follow says the market will likely keep faith in the UK, allowing the government to fund its next borrowing spree, a view confirmed by a well subscribed bond sale carried out on Tuesday morning.

"We share concerns regarding the right balance of fiscal plans in the UK and expect some degree of fiscal risk premia to feature in the near term. However, we think fears of unfunded tax cuts and energy subsidies precipitating a fiscal collapse are not justified," says Geoffrey Yu, FX and Macro Strategist for EMEA at BNY Mellon.

It is widely reported the new Prime Minister plans to deal with the cost of living crisis by capping energy bills, which would involve the borrowing of an additional £130BN.

The timing of this borrowing spree is however unfortunate from a funding perspective, given the cost of servicing government debt is rising for all major economies as central banks quit quantitative easing and hike interest rates in the face of surging inflation.

This is particularly notable in the UK where the rise in the yield of short-term debt has exceeded that of Germany and the U.S, for example.

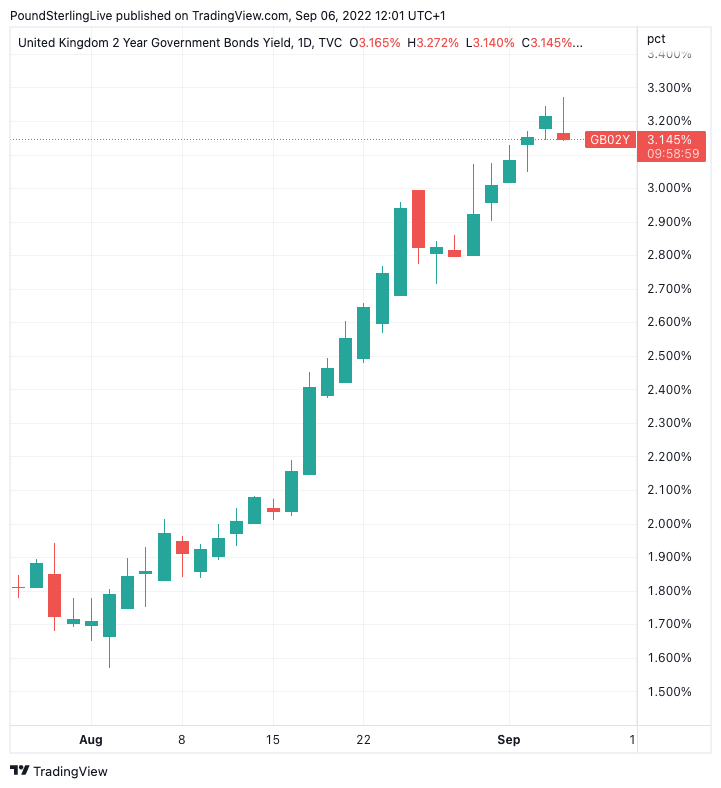

Short-term UK debt appears most vulnerable, with UK two- and three-year bonds (gilts), seeing their yields march steadily higher.

(Curiously, the yield on two-year gilts is actually lower on the day reports are surfacing of the significant boost in borrowing Truss intends to embark on):

Above: GBP two-year gilt yields have surged of late.

The recent rise in debt servicing costs can signal investors are becoming increasingly uncomfortable with the UK's fiscal position: investors will typically demand a higher yield if they feel the face value of the bond will be gobbled up by inflation, or the government will be unable to repay the bond at redemption.

But, some analysts caution against becoming too bearish on UK assets.

Yu says incoming Prime Minister Truss faces one of the most challenging fiscal outlooks of any new prime minister in recent memory, but there is capacity to be utilised.

"That, combined with the intrinsic advantages of the Gilt market, should for now continue to give Gilts the benefit of doubt," he adds.

The UK meanwhile appears to be finding healthy demand amongst investors, which will be a relief for the government as they sound out their plans.

The Debt Management Office confirmed Tuesday the government raised £3.5BN in gilts for maturity in three years, at a yield of 3.2%.

The all important cover ratio, which signals the strength of appetite for the debt, was at 2.57 times (this means the amount of bids exceeded offers by a factor of 2.57:1).

The narrative around the Pound and Sterling assets has been relentless negative of late, but it does appear chasing the downside will have its limits.