UK Manufacturing Outlook Improves: CBI Survey

- Written by: Gary Howes

Image © Adobe Images

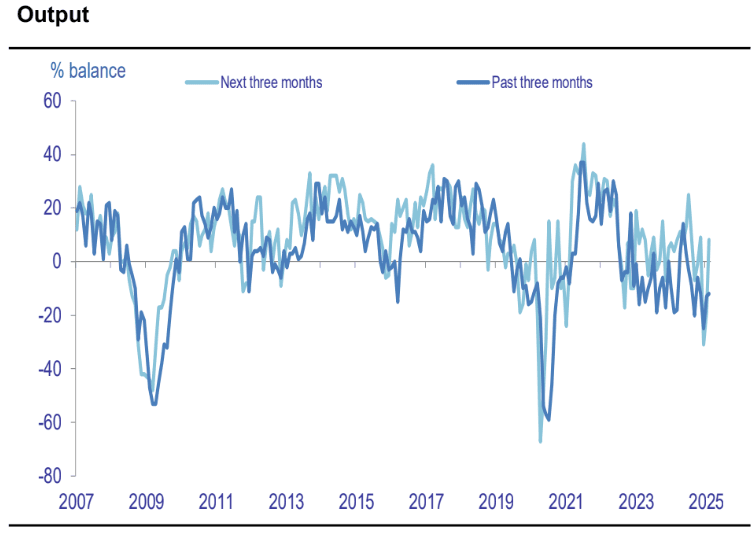

British manufacturers expect a modest rise in output over the next three months, despite continued weakness in order books and deteriorating stock adequacy, according to the latest Confederation of British Industry (CBI) Industrial Trends Survey released on Tuesday.

The survey found that output volumes fell at a similar pace in the three months to February as in the previous quarter, with 16 out of 17 manufacturing sub-sectors reporting declines. However, firms anticipate a rebound in the three months to May, with a net balance of +8% expecting an increase, compared to -19% in January.

“Manufacturers expect to raise output in the quarter ahead. But with firms having rapidly run down stocks of finished goods, it’s possible that the need to re-build inventories partly explains this rebound,” said Ben Jones, Lead Economist at CBI.

The total orders balance rose to -28 in February, from -34 in January, beating the consensus of -30. February’s data showed exports ticking up marginally to -36 in February, from -38 in January. This is less than the improvement in the total orders balance, implying that domestic activity drove the rebound in February.

"The CBI’s industrial trends survey for February offered some welcome respite for the manufacturing sector as total orders rose and price pressures fell according to businesses," says Elliott Jordan-Doak, Senior U.K. Economist at Pantheon Macroeconomics.

Order Books Remain Below Historical Levels

Total order books improved slightly in February, with a net balance of -28% compared to -34% in January. Despite the improvement, order levels remain significantly below their long-run average of -13%. Export order books were largely unchanged at -36%, also below their historical norm.

Stock Adequacy Falls, Price Inflation Eases

Manufacturers reported a sharp deterioration in stock adequacy, with the balance slipping to +4% in February, below the long-run average of +12%.

Meanwhile, expectations for selling price inflation eased compared to January, though they remain above historical levels. A net balance of +19% of firms expect to raise prices in the coming quarter, down from +27% last month but still above the long-run average of +7%.

Economic and Policy Uncertainty Persist

Jones attributed the recent weakness in manufacturing activity to low domestic business confidence following the Autumn Budget and a subdued global economic environment. Despite some signs of optimism, he stressed the need for government support to sustain manufacturing growth.

“The government has several levers to create the right conditions for the ambitious delivery of growth set out by the Chancellor last month. An international-facing industrial strategy and aligning skills to economic needs with changes to the Apprenticeship Levy would provide significant tailwinds for the sector,” Jones said.

"All told, February’s Industrial Trends survey contains some good news for the manufacturing sector—demand rose and price pressures fell. But the bigger picture of weak output growth and sticky prices is unchanged. Looking ahead, we expect manufacturing activity to remain tepid as the threat of barriers to trade keeps uncertainty elevated," says Jordan-Doak.