Santander UK Sparks Mortgage Market Shake-Up with Sub-4% Rates

- Written by: Sam Coventry

Image © Adobe Images

In a significant move for the UK mortgage market, Santander UK has become the first high-street lender in 2025 to introduce sub-4% fixed mortgage rates.

From Thursday, February 13, eligible customers can access new two- and five-year fixed-rate mortgage deals at 3.99% for a 60% loan-to-value (LTV) ratio.

"Santander has just smashed through the 4% barrier. Brokers and borrowers across the country will be punching the air and racing to lock in deals. It was only a matter of time before one of the big lenders released a sub-4% rate. Fair play to Santander, who have shown a real appetite for lending," says Ben Perks, Managing Director at Orchard Financial Advisers.

Additionally, the bank is rolling out reductions of up to 0.40% across more than 80 mortgage products, including residential purchases, remortgages, new-build purchases, and buy-to-let options.

Industry experts believe this bold move will trigger a wave of competition.

Iain Swatton, Director at Exemplar Financial Services, sees it as a potential turning point: "Santander has fired the starting gun, becoming the first major lender in 2025 to go sub-4% on two- and five-year fixed mortgages. With rates of 3.99% at 60% LTV, this move could be the catalyst the market needs after a hesitant start to the year. Other lenders will no doubt follow suit—great news for borrowers looking for a better deal."

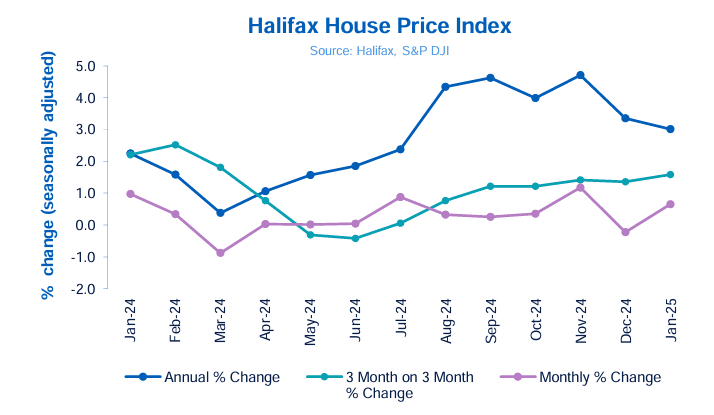

Above: Falling mortgage rates will sustain house price increases.

Analysis from Capital Economics shows mortgage rates will fall from 4.6% in December to around 4.0% in 2026.

The cut to sub-4% by Santander suggests this forecast could be at risk of revision.

Santander's move now puts pressure on competitors. "I'm sure other contenders will follow soon in the next round of fixed-rate cuts," says Simon Bridgland, Director at Release Freedom.

The timing of the mortgage rate cut aligns with a recent decline in swap rates, making it an opportune moment for borrowers.

Swap rates have tracked UK bond yields lower, which reflects expectations for lower interest rates at the Bank of England in the coming months.

Last week, the Bank of England cut interest rates by 25 basis points and committed to further interest rate cuts, noting the UK economic outlook had deteriorated significantly since November.

According to data from Halifax, house prices rallied in January to a record high as many buyers rushed to complete deals before a stamp duty increase this spring.

The average property price rose by 0.7% in January to £299,138 after dropping 0.2% in December, Halifax said.

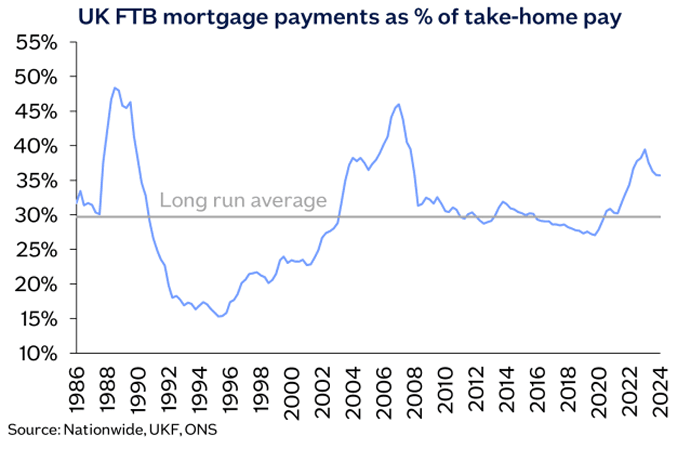

Above: Mortgage affordability

Economists and industry analysts expect house prices to continue to rise during 2025, as supply remains constrained and demand stays relatively stable, despite concerns over the UK economy’s momentum from the Bank of England.

The upward trend in house prices will be bolstered by falling mortgage rates, particularly if other lenders follow Santander's lead.

"Mortgages being sub-4% is a symbolic milestone and will create confidence among prospective buyers," says Katy Eatenton, Mortgage & Protection Specialist at Lifetime Wealth Management.

Nationwide's measure of house prices remained higher than a year ago, with a +4.1% increase compared to January 2024.

Despite the slowdown in price growth, affordability remains a key issue for first-time buyers. Nationwide’s data suggests that mortgage payments for a typical first-time buyer purchasing a property with a 20% deposit now consume 36% of take-home pay, well above the long-term average of 30%.

Additionally, the house price-to-earnings ratio for first-time buyers stands at 5.0, much higher than the long-term average of 3.9, underscoring the difficulty of entering the property market without substantial financial support.

Falling mortgage rates will ease affordability concerns.