ECB, BoE and Fed Policy in Focus: Notes and Quotes from Sintra Forum

- Written by: James Skinner

© European Central Bank, reproduced under CC licensing

The latest Forum on Central Banking in Sintra, Portugal, offered insight this week into the thinking of the European Central Bank (ECB), Bank of England (BoE) and Federal Reserve (Fed) while also providing clues about the things that will matter for their interest rate policies in the months ahead.

ECB, BoE and Fed chiefs were joined on the final day of the ECB’s annual conference on central banking by the General Manager of the Bank for International Settlements, Augustus Carstens, and Bloomberg’s Francine Lacqua for a panel discussion on Wednesday this week.

Each was quizzed about everything from the outlooks for economic growth and inflation to interest rates and the merits of current market expectations for the path of borrowing costs during the months ahead as part of this Policy Panel.

The biggest takeaway for markets was that neither the ECB’s President Christine Lagarde nor BoE Governor Andrew Bailey came close to being as resounding in their endorsements of current market expectations as Fed Chairman Jerome Powell.

But much more of relevance was also covered, some of which is repeated or otherwise summarised below.

LIVE: the policy panel at the #ECBForum on Central Banking https://t.co/ZFHX2hjlcD

— European Central Bank (@ecb) June 29, 2022

ECB President Christine Lagarde’s Key Quotes and Notes

“Our reaction function is what matters and as long as that is understood, the fact that we are on this normalisation path, that we’re going to be gradual but optional, the fact that we’ve indicated very clearly what is likely to happen in July. What’s likely to happen in September. And in the path that we’re on, yes I think markets have full understanding and appreciation of what we’re doing,” President Christine Lagarde said at one point.

“We need to look at how the uncertainty we have on the horizon is going to clear and I think in that respect what happens on the energy front, what happens on the war front unfortunately, what happens in relation to wage negotiations and how inflation expectations continue to stay anchored just as they have re-anchored are some of the elements that we will be looking at very carefully in the job that we have to do,” she later added.

President Lagarde picked no bones with expectations of European interest rates while saying nothing on Wednesday that would encourage financial markets to go further than they already did when recently wagering that Europe’s deposit rate is likely to rise from -0.50% to 1% before year-end.

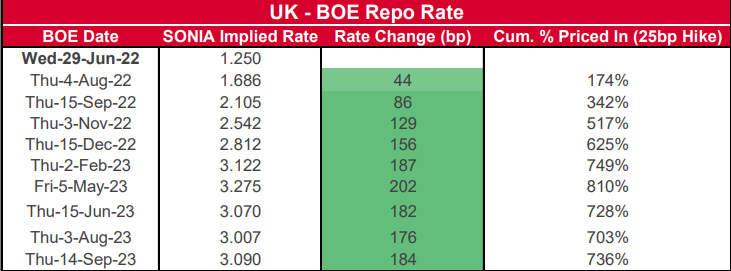

Above: Market implied expectations for ECB’s deposit rate at each policy meeting date. Source: Westpac.

Above: Market implied expectations for ECB’s deposit rate at each policy meeting date. Source: Westpac.

She also reminded on two occasions, in what might have been highly pertinent remarks, of the “optionality” the ECB seeks to have on the timing and size of any changes in interest rates following the 0.25% July uplift that was effectively already announced as part of the June policy decision.

There was no detail, however, and very little comment on the widely as well as eagerly anticipated plans for a new tool intended to ward off instability in Southern European government bond markets as the ECB’s interest rates rise for the first time since the Eurozone sovereign debt crisis.

“This risk of fragmentation that is much talked about is something that is very inherent to the European construction and due to the fact that we have 19, soon 20, but let’s say 19 for the moment members states that each have their respective fiscal policy, that each have their respective financial markets and as a result of that our unique monetary policy has to be transmitted throughout this imperfect market,” President Lagarde explained.

..

BoE Governor Andrew Bailey’s Key Quotes and Notes

BoE Governor Andrew Bailey offered, alongside many other things, some contextual insight that would be highly relevant for all of those seeking to understand or otherwise assess the merits of current market expectations for the Bank Rate, which was raised to a post-2008 high of 1.25% in June.

“We can obviously see direct market pricing and an implied market curve which prices in what we’re going to do. We also as you probably know, and we just started doing this recently, we publish a market survey,” he said.

“That actually shows a lower path of rates so we spend quite a bit of time understanding the difference between those two and I don’t think it’s actually hard to explain because I think the underlying reason is the market curve prices in the risk and the risk is on the upside,” the governor also added.

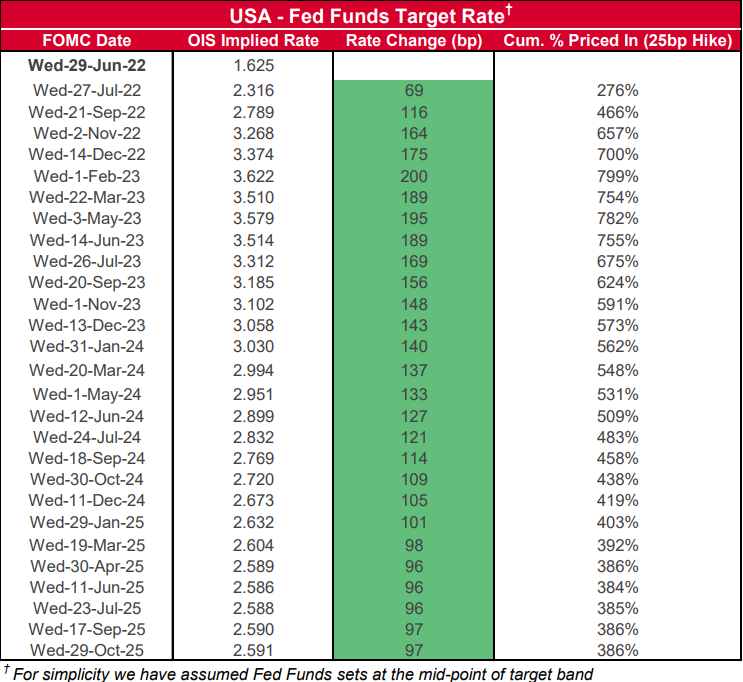

Market-implied measures of expectations for central bank interest rates are often derived from the Overnight Index Swap market, which is a derivative market that is used more by investors for hedging or protecting against the risk of changing interest rates than it is by those speculating on rates.

Above: Overnight Index Swap implied expectations for BoE Bank Rate at each policy meeting date. Source: Westpac.

Prices in the overnight Index Swap market have implied since the middle of June that there is a high risk of the BoE’s Bank Rate rising from 1.25% to 2.75% or more before year-end, although the BoE’s Market Participants Survey suggests an expectation for Bank Rate to rise to only 2%.

“We are being hit by a very large national real income shock which is coming from outside. There is uncertainty around two parts of that in terms of monetary policy. One is of course the eventual scale of it because, unfortunately, it’s still evolving. Secondly, the impact of it and precisely how it passes through to the economy and what the effects of it are. But the scale of the shock is very substantial and in and of itself it will reduce domestic demand and it will pass through into the labour market and it will pass through into inflation,” he said.

“But monetary policy of course has a very important role to play in this because it will act alongside that shock and it’s very important when we come to the language that we use that of course it’s there to tackle the second round effects as they come through price setting and wage setting so the message that we gave and was in the language of our last meeting, as you rightly said was, that if we see greater persistence in second round effects then we will act more forcefully and we will have to act more forcefully,” he added.

..

Fed Chairman Jerome Powell’s Key Quotes and Notes

Chairman Jerome Powell was unabashed when welcoming on Wednesday the extent to which financial markets have been able to understand the Fed’s forward guidance and the speed with which they’ve moved to price-in the series of interest rate rises now underway.

He did, however, also say nothing to encourage the markets to go any further than they have already and instead made clear that everything about the outlook for the Fed’s interest rates depends on the path taken by U.S. inflation rates during the months ahead.

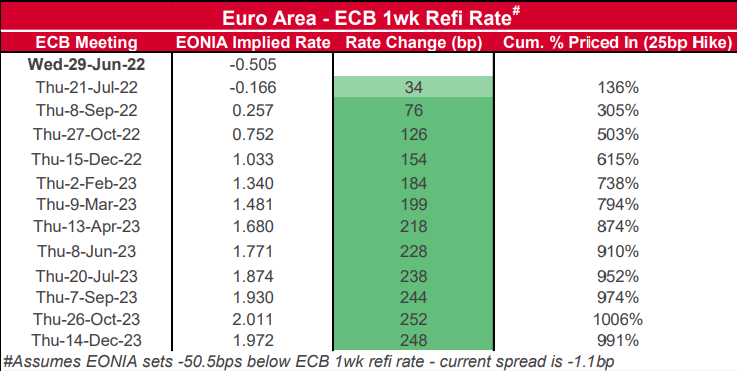

“I think people will look back on this period and say that we were able to have financial conditions tighten quite substantially and we’ve only had three meetings at which we’ve raised rates. Nonetheless, the forward rate curve is pricing in a rate path that looks a whole lot like the summary of economic projections that my colleagues and I submitted in June so that’s a good thing. That’s the market understanding and finding credible what we’re writing down and of course it’s all highly conditional but nonetheless I’d say that’s a positive thing,” Chairman Powell told the panel.

“As I mentioned earlier we are very strongly committed to using our tools to bring down inflation. The way to do that is to slow down growth, ideally keep it positive, and as I mentioned supply and demand get back into balance. That’s what we’re trying to accomplish. Is there a risk that we will go too far? Certainly there’s a risk but I wouldn’t agree that’s the biggest risk to the economy. The bigger mistake to make, let’s put it that way, would be to fail to restore price stability,” he also later added.

Above: Overnight Index Swap implied expectations for Fed Funds rate at each policy meeting date. Source: Westpac.