Bank of England's New Headache: A Summer of Strikes

- Written by: Gary Howes

- A summer of strikes to commence

- Higher pay rewards are inflationary

- And would keep pressure on BoE to hike

- Huw Pill confirms BoE's hawkish shift

- Says to keep an eye on wage pressures

Image © Adobe Stock

Fears of a 1970's-style general strike are rising and if the government and employers eventually yield then the public sector could see a major wage impulse over coming months.

For an increasingly data-reactive Bank of England this inevitably increases pressure to hike interest rates at a rate faster than they and economists have been expecting.

The Bank of England's Chief Economist Huw Pill underscored a 'hawkish' pivot at the Bank by reiterating the Monetary Policy Committee stands ready to act more forcefully if inflation metrics do not start levelling out.

Pill said he was particularly interested in the "wage setting behaviour" of businesses in assessing the outlook for inflation.

"If we see greater evidence that the current high level of inflation is becoming embedded in pricing behaviour by firms, in wage setting behaviour by firms and workers, then that will be the trigger for this more aggressive action," Pill said in an interview with Bloomberg on Friday.

Pill's intervention and emphasis on wages comes on the eve of a massive strike on UK railways as unions demand better wages and conditions.

The RMT union which is delivering the strike are demanding a minimum 7% pay increase for its members.

Reports out Monday also suggest teachers, airport staff and other public sector workers could consider joining the strike.

Fears of a 1926-style general strike are rising and if the government and employers eventually back down then the public sector could see a major wage impulse over coming months.

"The stark reality is that the most effective vaccine for the strike-virus is a one-off material rise in wages," says Savvas Savouri, Chief Economist at Tosfcacfund.

This would be inflationary according to Pill's assessment and the application of economic 101 which would suggest higher wages makes for higher inflation, all else being equal.

But Savouri suggests this might in fact not be the case, "to be clear, because this will help significantly shift the UK’s supply curves to the right, it would not naturally trigger a wage-price spiral," he says.

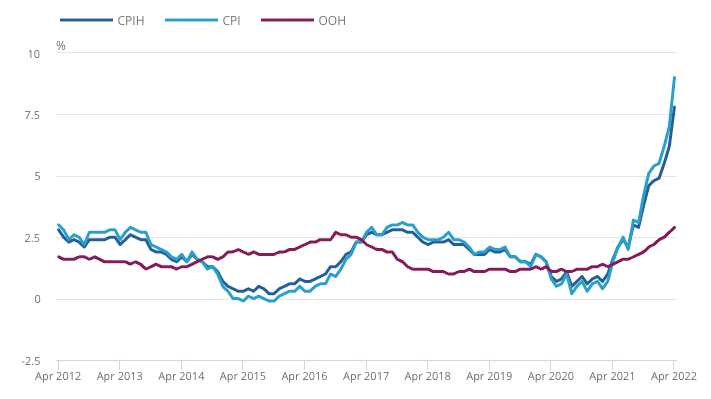

Above: UK inflation components continue to rise. Source: Office for National Statistics.

But the Bank of England is proving increasingly alert to inflation and last week met expectations by hiking interest rates 25 basis points while altering their guidance on the likelihood of future hikes.

Pill said the old guidance that "most members judge some degree of further tightening may still be appropriate" had become "a bit stale."

Instead the Bank indicated it was now firmly determined to follow the data and adopt a more reactionary approach to interest rates.

It said it would act "forcefully" if deemed necessary, something analysts say is indicative of a 50 basis point hike coming in the future.

"Altogether, we now think that the ingredients for larger rate hikes have crystalised," says Sanjay Raja, Senior Economist at Deutsche Bank. "Inflation and labour market pressures have risen, rather than abated over the near to medium term."

Deutsche Bank says the breadth and scale of price pressures have become harder to ignore and as such they now anticipate the Bank of England to raise the Bank Rate by 50bps in August and September.

Pressure on the Bank of England to act comes as Chancellor Rishi Sunak is seen to be increasingly concerned by the slow approach to raising interest rates.

Whenever UK inflation is a percentage point either side of the Bank's mandated 2.0% target the Governor is required to write a letter to the Chancellor of the Exchequer explaining why the mandate had not been met.

The Chancellor in turn responds.

Financial commentators noted that usually the exchange of letters between the Bank of England and the Treasury are unremarkable, but this week Sunak's tone changed noticeably.

"I know and expect that you and the other members of the MPC will take the action necessary to get inflation back on target and ensure inflation expectations remain firmly anchored," Sunak said in his letter to Bank of England Governor Andrew Bailey.

In May Sunak said "I know the Governor and his team will take decisive action"

In March Sunak was more sanguine, "I welcome the Committee's intention ... to take whatever action is necessary."

The Government is increasingly nervous about inflation and it is shown in Sunak's communications with the Governor.

It also suggests Sunak will be loathe to cave into the unions' demands for higher wages and suggests a period of disruption for the UK economy awaits.