Growing Cost Pressures Support July ECB Rate Hike: Eurozone PMIs for May

- Written by: Gary Howes

Image © Adobe Stock

Ongoing Eurozone economic expansion and growing cost pressures are likely to embolden European Central Bank policy makers to pursue higher rates.

Business survey data for May showed the Eurozone's economic growth remained robust, despite the war in Ukraine and surging commodity prices, with the services sector showing particularly strong activity.

S&P Global PMI survey data for May showed growth was led by the service sector, which recorded its second-strongest expansion in the past eight months.

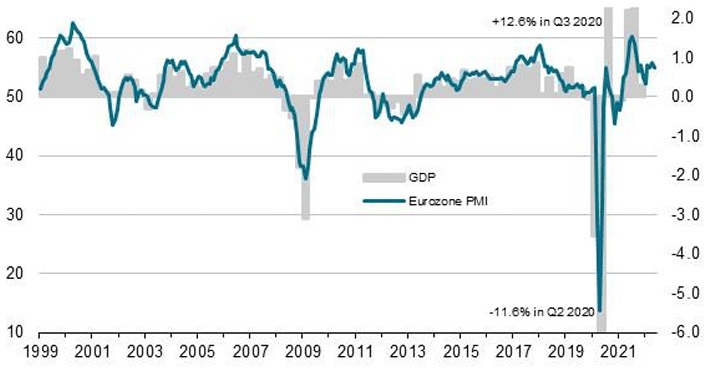

Nevertheless, there are signs growth rates are slowing: the Services PMI for May read at 56.3, which is softer than the 57.5 the market was looking for and down on the previous month's 57.5.

A reading above 50 represents expansion.

Above: S&P Global Flash Eurozone PMI Composite Output Index. Sources: S&P Global, Eurostat.

Eurozone Manufacturing PMI for May read at 54.4 which was below the consensus expectation for 54.9 and below the previous month's 55.5.

The Composite PMI, which gives a broader snapshot of the economy, read at 54.9, which is below the consensus expectation for 55.3 and below the previous month's 55.8.

S&P Global reports factory output continued to be constrained by widespread supply shortages, with the Ukraine war and China’s lockdowns having exacerbated existing pandemic-related supply chain pressures.

Manufacturing new orders fell for the first time since June 2020.

But the ECB won't be derailed in their plans to raise interest rates in July given the underlying signs of building cost pressures.

The service sector reported the strongest jobs gain for almost 15 years and prices charged for goods and services rose at the second-highest rate yet recorded by the survey.

On Monday ECB President Christine Lagarde wrote in a blog posting on the ECB website that it was the assessment of the ECB that the Eurozone was moving away from a period of structurally low inflation.

As such, a rate hike in July and another by September was now considered to be appropriate.

Euro exchange rates pushed higher on the developments and there is nothing in the incoming data that pushes back against these developments.