Why the EU Can Live with a Complete Sanction of Russian Gas

- Written by: Gary Howes

"As the cold season recedes, the danger that Europe could run out of gas in the near term if Russia were to turn off the tap is declining... the EU is not running out of gas" Berenberg.

Image © Adobe Stock

A complete sanction on Russian gas could be feasible sanction for the EU to consider in the event full scale war breaks out in Ukraine.

Economists at Berenberg Bank find the EU has become less vulnerable to a stoppage in Russian gas imports as a combination of a mild winter and increased gas supplies from other sources reconfigure the European and global gas market.

"How vulnerable is Europe to a potential interruption of energy flows from Russia?" asks Holger Schmieding, an economist at Bereberng.

"The EU has become less vulnerable - and continues to do so week by week," is his finding.

This reality has been borne out by Tuesday's decision by Germany to freeze the approval of the Nordstream 2 gas pipeline, which would have materially increased gas flows to Europe.

Germany's Chancellor Olaf Sholz said in a statement on Tuesday the government would not certify the Nordstream 2 line, in what amounts to the most significant Western sanction placed on Russia yet.

The decision has heightened fears of a gas supply crunch into Europe which is already seeing elevated prices, although prices are still well below the peaks reached in December.

The Euro has struggled amidst the heightened tensions with analysts pointing out that the Eurozone economy is particularly vulnerable to drying Russian gas imports.

"Even at current low levels, Russian pipeline imports will account for more than a fifth of the EU’s gas demand this winter, on our estimates. Such demand is inelastic: for example, in Q3 21, EU gas prices were almost six times as high as in Q3 2020, but demand was down only a little over 10% y/y," says Amarpreet Singh, analyst at Barclays.

But Schmieding finds that Germany and Europe could now ultimately get by without Russian gas at all, a vindication of EU Commission President Ursula von der Leyen's assertion that "we are able to make it through this winter without Russian gas but with supply from others".

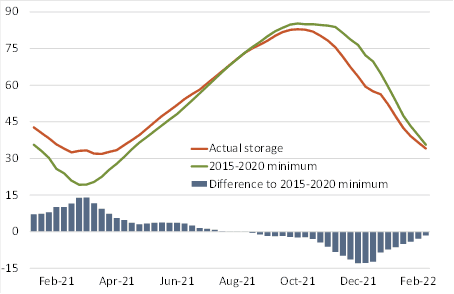

Above: In billion m³, weekly data. Sources: McWilliams, Sgaravatti, Zachmann (2021): European natural gas imports (Bruegel Datasets); Berenberg calculations.

The above chart from Berenberg compares the gas storage levels in the EU from the start of 2021 onwards to the minimum levels recorded for the same calendar weeks in the 2015-2020 reference period.

It shows that until August 2021 storage levels were still above the minimum.

But with fewer imports of natural gas from Russia than usual, storage levels then fell further below the minimum for the remainder of 2021.

"But due to record imports of liquid natural gas and a comparatively mild winter in parts of Europe, the gap has narrowed significantly since the beginning of 2022. In this sense, the EU has become less vulnerable - and continues to do so week by week," says Schmieding.

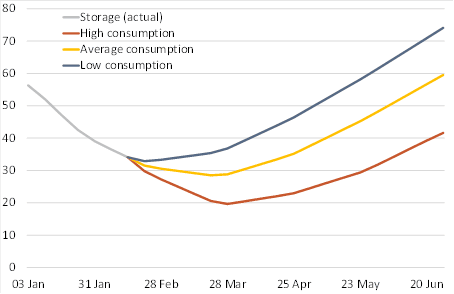

Above: Weekly data. Sources: Eurostat; McWilliams, Sgaravatti, Zachmann (2021): European natural gas imports (Bruegel Datasets); Berenberg calculations.

"As the cold season recedes, the danger that Europe could run out of gas in the near term if Russia were to turn off the tap is declining," says Schmieding.

The above chart shows scenarios for EU gas storage levels devised by Berenberg. For their calculations they assume that:

1) gas production within the EU equals the respective monthly levels in 2021;

2) imports from Russia fall to zero; and

3) imports from other sources stay at their latest observed levels.

They also distinguish three potential paths for gas consumption: low, average and high.

"In all three scenarios, storage levels remain positive for the remainder of the cold season. The EU is not running out of gas," says Schmieding.

Indeed, Berenberg finds that as other countries increase their supplies to the EU in reaction to higher prices, these scenarios may be "slightly on the conservative side".

Reliance on Russian imports has risen over recent years as a result of Europe’s natural gas production's continuous decline owing to production limits on the Groningen field in the Netherlands and declines in the mature fields in the North Sea.

To meet demand, Europe’s natural gas imports, particularly from Russia, have increased in recent years.

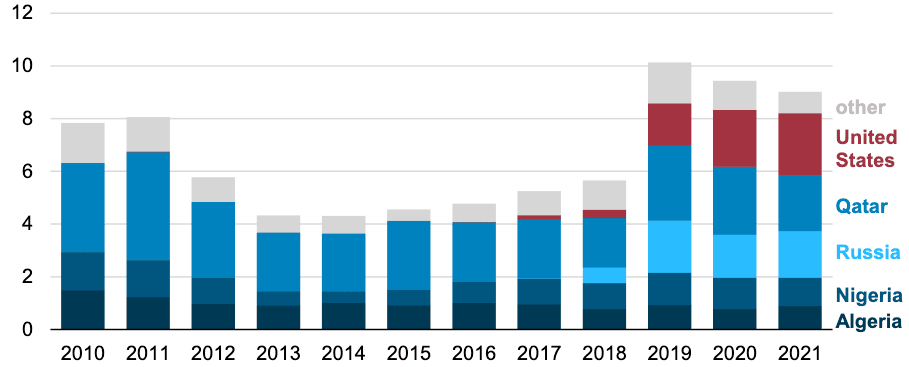

Above: Europe (EU27 + UK) LNG imports by source country, 2010-2021. Billion cubic feet per day. Source graph by U.S. EIA, based on data from the International Group of Liquefied Natural Gas importers annual LNG trade reports (2010-2020) and CEDIGAZ (2021).

How Germany and the rest of Europe source gas in light of tensions with Russia will be a key consideration for European gas dynamics and politicians going forward.

The U.S., Russia and Qatar between them account for almost 70% of Europe’s (including the UK) total liquified natural gas (LNG) imports, according to the EIA.

Pivoting away from Russia will therefore almost certainly represent a gain for Qatar and the U.S.

"The long-term implications of tight European gas supply and elevated geopolitical tensions between Russia and the West present an opportunity for Qatar Energy to increase its presence in European markets as it adds new production capacity, in our view," says Barclays' Singh.

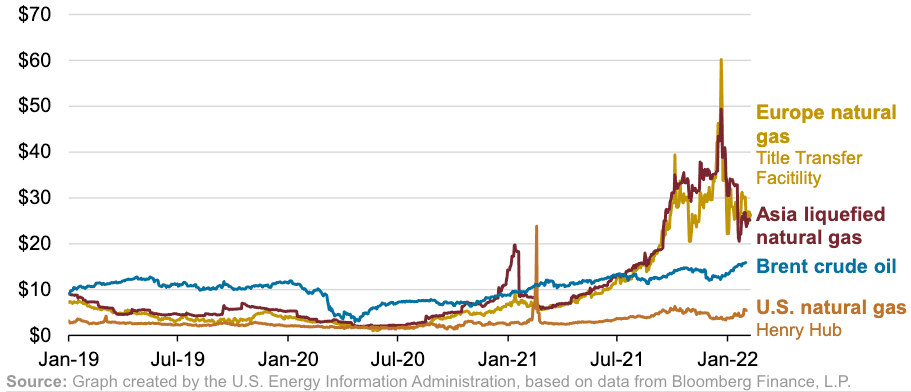

The EIA says historically spot natural gas in Europe has traded at prices lower than LNG spot prices in Asia.

But in recent months natural gas prices in Europe have closely tracked LNG prices in Asia and on some days, the natural gas price in Europe has exceeded the LNG price in Asia, attracting higher volume of flexible LNG supplies to Europe.

Above: Daily crude oil, natural gas, and LNG spot prices, Jan 2019-Feb 2022. Dollars / million British thermal units. Source: EIA.

The EIA says LNG imports to Europe increased in December 2021 and January 2022, averaging 10.8 Bcf/d and 14.9 Bcf/d, respectively, partly in response to the price at TTF rising above LNG spot prices in Asia.

European gas prices peaked at $60.20/MMBtu on December 21, 2021.

A warm winter and increased supply of LNG from the U.S., Qatar and other global suppliers - in response to elevated prices - has however capped European prices in December.

Berenberg finds that some European countries have a greater dependency on Russian gas than others, in fact the Czech Republic and Hungary receive almost all their gas imports from Russia.

But France, Spain, Portugal and Belgium buy less than 20% of their gas imports from Russia.

However the interconnectivity of the European gas network has improved markedly in recent years finds Berenberg.

"Big regional disparities could likely be smoothed somewhat by re-distributing the available gas within the region," says Schmieding.

The German bank does however hold a base-case assumption that a long-term and complete interruption of natural gas flows from Russia to the EU seems highly unlikely as an outright ban would "likely hurt Russia’s petro-economy even more than it would hit the EU," says Schmieding.