U.S. Inflation Forecasters Still See Prices Falling Around Spring Time

- Written by: James Skinner

- U.S. inflation still seen rolling over in Spring

- Helped by updates to consumer price basket

- New weighting of goods to weigh on U.S CPI

Image © Adobe Stock

U.S. inflation reached a new multi-decade milestone high in January, likely worrying policymakers at the Federal Reserve (Fed), although many forecasters remain confident that inflation is still likely to begin falling around Spring time.

Month-on-month and year-over-year declines in inflation rates remain likely for the months ahead despite U.S. price growth having accelerated to its fastest pace since February 1982 during the opening month of the new year.

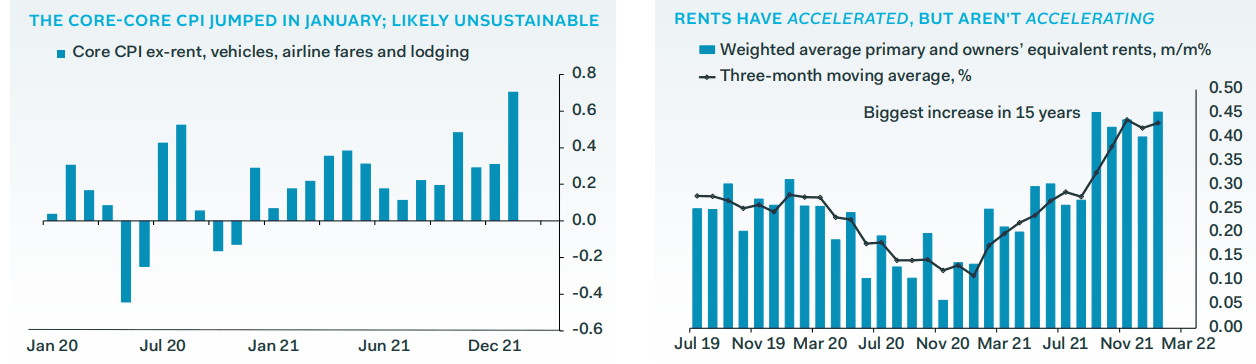

"These data don't change our view that the month-to-month core CPI numbers will slow sharply in the spring, and the year-over-year rate will roll over. Nonetheless, the immediate outcome of the January report will be to increase the political and media pressure on the Fed still further," says Ian Shepherdson, chief economist at Pantheon Macroeconomics.

"We're sticking with our forecast of a 25bp increase in rates next month, but the chance of a 50bp hike has risen sharply, and the balance sheet hawks— who have mostly been quiet since mid-January—have already started again to make the case for a faster and earlier run-off," Shepherdson wrote following a look at January's inflation figures.

Thursday’s Bureau of Labor Statistics data suggested the overall rate of inflation reached 7.5% last month and reported the more important rate of “core inflation” as having risen to 6%, leaving each measure far above the Fed’s two percent average target.

Source: Pantheon Macroeconomics.

January's data already prompted Federal Reserve Bank of St. Louis President James Bullard to call for an immediate and larger-than-usual increase in the Federal Funds interest rate, but it was likely an alarming disappointment to other Fed policymakers too, many of whom had looked for inflation to begin topping out in the new year before declining over the remainder of the period.

However, Pantheon’s Shepherdson remains confident that this is still likely to be the case while others say that the eventual declines in prices could be larger than previously thought following an update to the consumer goods basket for which the Bureau of Labor Statistics measures changes in prices, albeit that these declines could take longer to materialise.

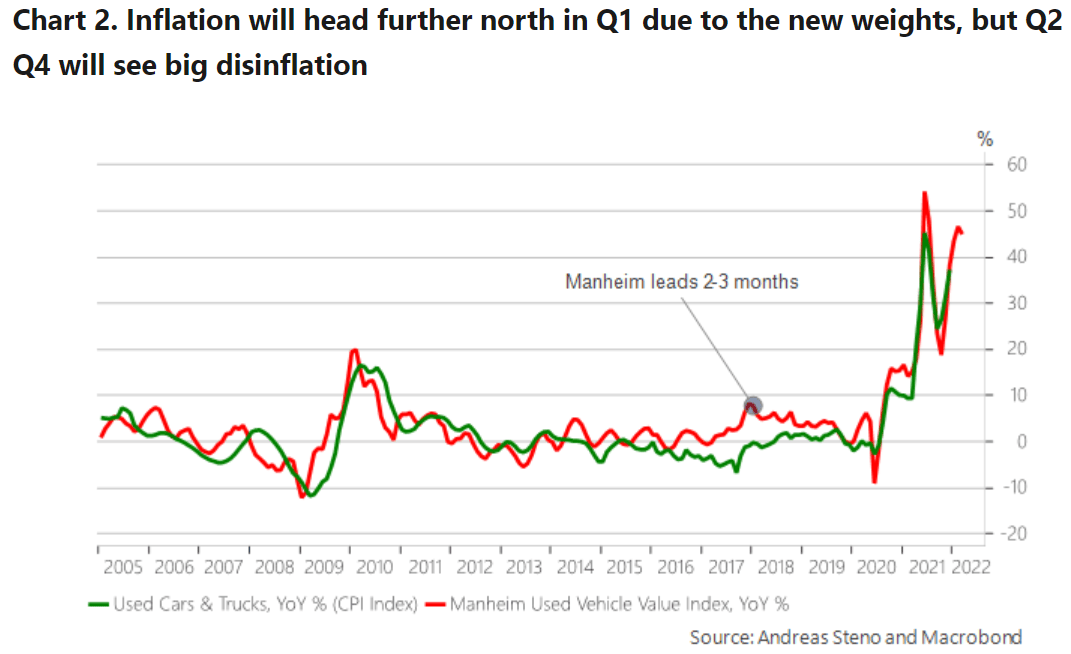

“The US CPI weights have been updated based on consumer expenditure data from 2019-2020, which means that the statistical bureau has looked at the actual spending over the past years and updated the “consumer basket” on the back of it,” says Andreas Stenos Larsen, author of the Stenos Signals newsletter and former chief FX strategist at Nordea Markets.

“The changes made by the BLS hence provide a net/net negative impact on inflation down the line (likely during H2-2022 already), but not before another positive tilt to inflation is seen in the very short-term,” Larsen had written before the data was released on Thursday.

Source: Stenos Signals.

One effect of the pandemic and measures used in attempts to contain the coronavirus was that households spent larger shares of their income on goods of all kinds, ranging from kind made in factories to those grown in fields, and with this being the case the Bureau of Labor Statistics has adapted its consumer price basket to include a greater number of these goods relative to services.

That’s important because it’s goods prices that have been causing much of the recent inflation, due partly to disrupted supply chains and also because of increased demand, but it’s further significant because prices of goods are widely expected to decline as businesses and households move on from the pandemic and spending on services returns to more typical levels.

“Goods prices are generally more flexible than service prices,” Larsen says. “If restrictions are now more permanently being lifted (my base-case), we should expect goods consumption and maybe also prices to drop, which should now matter even MORE given that goods have been given a higher weight in the newly updated consumer basket."

This likely sets up U.S. inflation rates for an even larger fall later this year than many economists and policymakers have so far anticipated, which could potentially ease some of the pressure on the Federal Reserve, which is now widely expected to lift U.S. interest rates as many as five times in 2022.

Pricing in the market for overnight-indexed-swaps, a form of financial derivative used by companies and investors seeking to protect themselves against changes in interest rates, shifted significantly on Thursday to imply some probability of a larger-than-usual rate rise in March.

The implied midpoint of the 25 basis point wide Fed Funds interest rate range for March 16 had risen from 0.41% on Thursday morning to 0.60% by Friday and suggests a very high implied probability that the Federal Open Market Committee could lift its benchmark interest rate by 50 basis points next month so that it occupies the range between 0.50% and 0.75%.

"We continue to believe that inflation will cool somewhat in the coming months beyond the year-ago base effects. As total spending growth slows and shifts toward services, goods inflation is likely to ease from the dizzying rates witnessed this past year. The moderating effect on the headline should be amplified by the relative importance of core goods having increased with the new weights,” says Sarah House, a senior economist at Wells Fargo.

“Today's report keeps the door open to a 50 bp rate increase in March, but FOMC members will get an additional look at inflation with the February CPI report, released on March 10. If, as we expect, it shows the peak in inflation has likely been reached, we anticipate the FOMC will take a more measured approach, opting to raise the fed funds rate by 25 bps in March but signaling additional hikes will be right on its heels,” House and colleagues also said.