2021 Will be Better than Expected: Capital Economics Forecast for the UK Economy

Image © Gov.uk

On the day the UK announced another rise in unemployment, economists at independent research house Capital Economics offer an upbeat view on what 2021 and 2022 hold for a battered UK economy.

According to a note to clients out on Tuesday, Dec. 15, a 'no deal' Brexit would be less severe than many assume while the economy should see little scarring from the covid-19 pandemic.

And, in good news for Chancellor Rishi Sunak, there will be no need to hike taxes in the next two years as the economy should plug its spending black hole 'organically'.

"We think that the economic recovery in 2021 will be quicker and fuller, the Bank of England will continue to shy away from negative interest rates, the Chancellor won’t tighten fiscal policy and if there’s a no deal Brexit, the economic fallout won’t be as severe as most fear," says Paul Dales, Chief UK Economist at Capital Economics.

Capital Economics have a proven track record of correctly forecasting the UK's economic path since the pandemic arrived in early 2020. They were amongst the first to realise the severity of the crisis and in April accurately predicted that GDP would fall by around 25% from its peak to its trough.

In June, they were the only forecasters expecting the Bank of England to follow an increase in quantitative easing (QE) in July with a further expansion in November.

So what are Capital Economics saying about 2021?

1) Brexit

"If there is a no deal, while the pound may initially drop from $1.34 to $1.15, we think the

economic fallout will be less severe than most fear. That’s mainly because a lot of agreements are already in place, which means it will probably be more a 'cooperative' no deal than an 'uncooperative' one," says Dales.

Capital Economics forecast UK GDP growth in 2021 as a whole would be just 1.0% lower under a 'no deal' outcome than if there were a Brexit deal.

The path to a 'cooperative no deal' was almost certainly secured when the UK agreed to bin those elements of the Internal Markets Bill that would have undermined the Withdrawal Agreement secured at the end of 2019. The UK sought to override some elements of the Agreement pertaining to the Northern Ireland protocol, which soured relations between the EU and UK.

2) Economic recovery

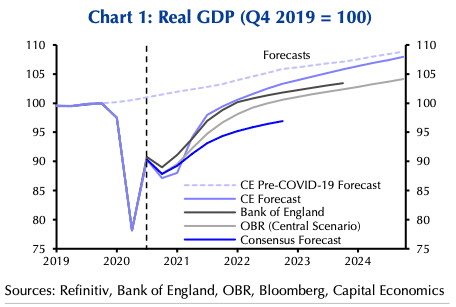

Brexit aside, Capital Economics predict annual GDP will grow by about 7.5% in both 2021 and 2022, which is a faster recovery from the COVID-19 crisis than the consensus forecasts of 5.4% and 4.5% respectively.

Also setting them apart from consensus, Capital Economics think the COVID-19 crisis will lead to minimal long-term scarring and that later this decade GDP will return to the path it would have been on if COVID-19 never existed.

3) Monetary policy

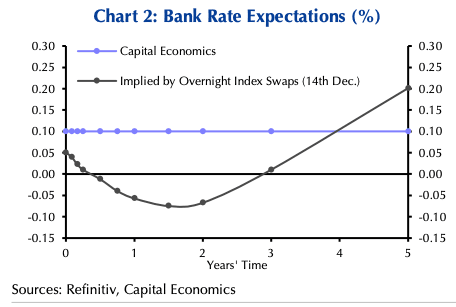

Capital Economics predict the economic recovery will be faster than the Bank of England expects suggests that monetary policy won’t be loosened in 2021.

They expect the MPC to maintain the stock of quantitative easing at the current target of £895BN.

They are expecting the Bank to cut interest rates into negative territory, which market pricing currently implies will be the case.

4) Fiscal policy

Conventional economic thinking is that the UK government will be required to tighten its belt following the splurge in spending in 2020.

"We don’t think there will be a fiscal consolidation in 2021 or 2022," says Dales. "The difference is that while most forecasters expect the COVID-19 crisis to leave a permanent hole in the economy and the public finances, our forecast that GDP will eventually return to its pre-crisis trend means the budget deficit can fall back and the debt to GDP ratio can fall without any fiscal

consolidation."

"In fact, tightening fiscal policy soon would be counterproductive as it would undermine the economic recovery and create the very fiscal hole the Chancellor would be aiming to fill!" adds Dales.