UK Economy's Growing £2 Trillion Debt Pile Said to Constrain Chancellor in Autumn Budget

- Written by: James Skinner

Homepage Image © Gov.uk. Webpage Image © David Holt, Accessed: Flikr, Licensing Conditions: Creative Commons

Homepage Image © Gov.uk. Webpage Image © David Holt, Accessed: Flikr, Licensing Conditions: Creative Commons

- GBP/EUR spot rate at time of writing: 1.1141

- Bank transfer rate (indicative guide): 1.0852-1.0930

- FX specialist providers (indicative guide): 1.0975-1.1042

- More information on FX specialist rates here

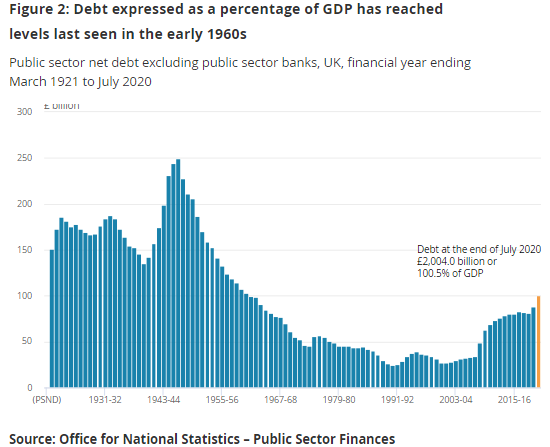

Public debt surpassed £2 trillion in the UK during July even as borrowing came in below market expectations, leaving the government on course for a record deficit that economists say could constrain Chancellor Rishi Sunak's ability to assist the economy in the autumn budget.

Borrowing rose by £25.9 billion last month, down from £28.8 bn previously and below the market consensus for an increase of £28.3 bn, although this took public debt across the £2 trillion as well as 100% of GDP thresholds.

Total debt was £227.6 billion higher last month than in the same period one year ago but if the market consensus is anything to go by, borrowing for 2020 alone will have risen to £322.2 bn. That's equal to some 16.1% of GDP, although some economists see the end number coming in even higher than that.

"Borrowing looks set to jump temporarily in August, as the government makes the second and last Self-Employment Income Support Scheme payment and funds the Eat Out to Help Out scheme. Thereafter, it will decline," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics. "Nonetheless, borrowing currently is on track to total about 17% of GDP in this fiscal year, a trajectory that likely will prompt the Chancellor to be relatively cautious when he draws up further measures to support the economy."

Friday's are all to some extent historic numbers that have roots in government support for households and companies after a flat-footed response to January's coronavirus outbreak in China, and then Europe, left Downing Street with little choice other than to shut the economy as the pneumonia-inducing disease spread from March onward.

"Note that this is partly due to the huge plunge in GDP this year," says Andrew Wishart at Capital Economics, referring to the debt-to-GDP figure of more than 100%. "The surge in debt has not rattled the bond market, where extremely loose monetary policy has anchored gilt yields close to record lows. And the government’s expenditure on debt interest is still falling. That will allow the Chancellor to continue to support to the economy in the Autumn."

Above: Office for National Statistics illustration of changes in UK debt-to-GDP ratio dating back to pre-war period.

HM Treasury had spent £35.4 bn on job retention by August 16, with 9.6 million employments from 1.16 million employers having depended on the furlough scheme at one point or another. "The number of employments furloughed peaked at 8.9 million on 8 May, then reduced to 6.8 million by 30 June. This peak is lower than the 9.6 million mentioned above since furloughed staff have been furloughed for different periods," the government says.

The furlough scheme is set to end of October 31 while support for the self-employed will draw to a close following the payment of "Tranche 2," the number of claimants for which will be announced in September. However, and after the claims period opened on August 17, the government said this week that some 296,850 individuals had submitted claims for a combined total of £768.9 million.

“It is clear the government wants the economy back to normal swiftly. But while the appetite to continue propping up the economy and jobs market cannot last forever, the government is yet to chuck the full kitchen sink at this crisis. They will be comfortable with the current level of debt given where interest rates remain, and appear to remain committed to their ‘levelling up’ agenda despite recent news," says Hinesh Patel, a portfolio manager at Quilter Investors.

Chancellor Sunak's Eat Out to Help Out scheme had drawn 85,000 premises by August 16 and paid out for 48,000 claims relating to 35 million meals, at a cost of £180 million. HM Treasury's VAT payments deferall scheme had seen £27.5bn worth of value-added-tax liabilities deferred until a later date, leaving the government with an income deficit that wouldn't have done anything to reduce the need for further public borrowing.

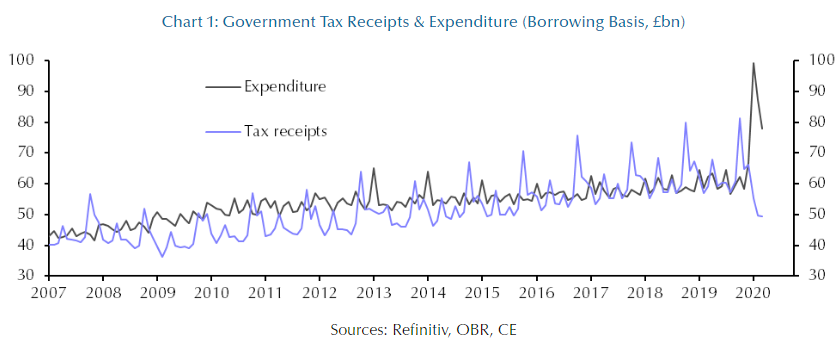

Above: Capital Economics graph illustrating changes in UK tax receipts and expenditure.

Friday's finances figures came alongside other data showing retail sales volumes were 3.6% higher in July following a third consecutive strong increase in spending that left total sales some 3% above the pre-coronavirus levels seen in February and 1.4% above July 2019 levels. However, these are expected to slow as the various government supports are withdrawn and as the economy remains suppressed by social distancing regulations.

"Despite June’s bounce back, economic output remains at a fraction of where it was in February. As a result, further stimulus is going to be required, particularly as the support schemes are removed. The Bank of England has left itself room to act from a monetary perspective. This shifts eyes onto the Chancellor, Rishi Sunak, to see if his innovations can be successful. “The ‘Eat Out to Help Out’ scheme appears to have gotten off to a good start, and it is this targeted stimuli that other industries will be craving next. Reversing households’ precautionary savings and providing businesses with confidence and support to spend capital and hire employees will be key," Patel says.

Friday's data place the economy on its front foot at the start of the third quarter following a historic contraction of some -20.4% in the prior period, which was by far the worst wound sustained by a major developed world economy. Eurozone GDP fell by -12.1% in the second quarter while U.S. GDP declined just less than -10% on an annualised basis, with the UK's services heavy economy having bitten it during the coronavirus pandemic.

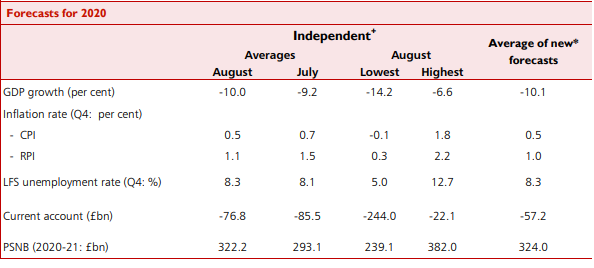

But economists downgraded forecasts for the full-year outcome this month and now look for an annual contraction of exactly -10% on average, where before the consensus favoured only a -9.2% decline back in July. The unemployment rate is seen rising from 3.9% in June to 8.3% by year-end.

Above: Economist consensus for major UK indicators. Source: HM Treasury.