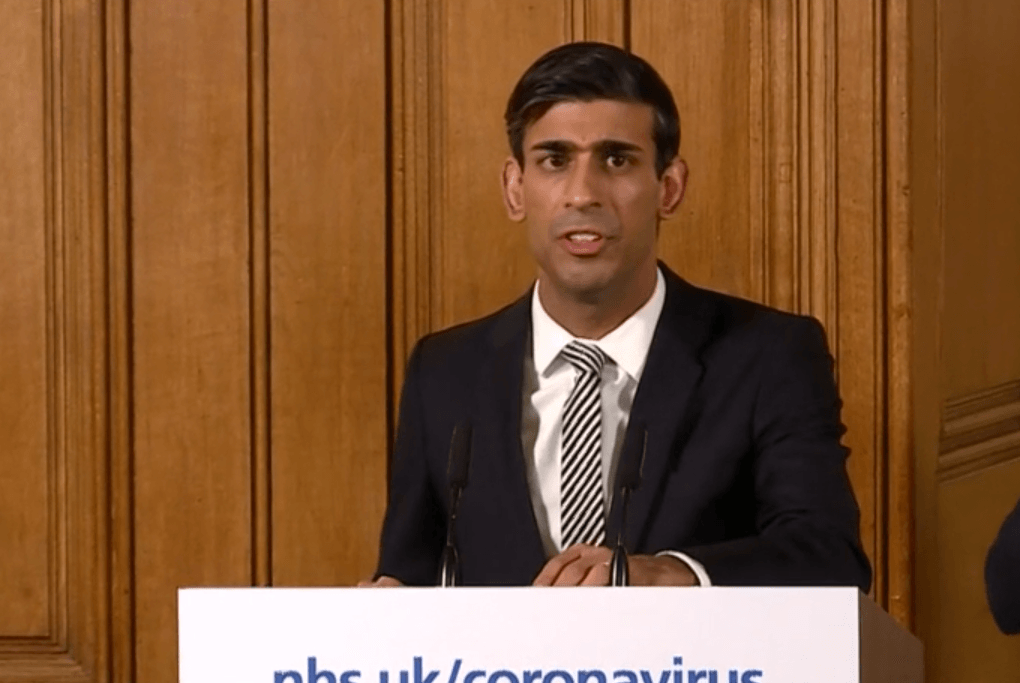

Sunak Fires Fiscal Bazooka to Support Coronavirus-hit Economy

The UK Treasury has arranged £330BN worth of guaranteed loans to be made available to UK businesses in order to cope with the coronavirus crunch, which is equivalent of 15% of UK GDP and ensures one of the largest fiscal responses to the coronavirus outbreak by any country to date.

"In peacetime we have not faced a fight like this," said Chancellor Rishi Sunak as he launched what he said was "an unprecedented package of support to businesses ... I said whatever it takes, and I meant it."

"Any business who needs access to cash will be able to access a government-backed loan, on attractive terms," says Sunak. "If demand is greater than the initial £330bn I’m making available today, I will go further and provide as much capacity as required."

To support lending to small and medium sized businesses, Sunak said he is extending the new Business Interruption Loan Scheme announced at the Budget last week from £1.2m up to £5m, with no interest due for the first six months.

Sunak announced small and medium-sized business could also apply for up to £25k in funding grants for those engaged in the retail, leisure and hospitality sectors who do not have insurance to help them through this period.

Cash grants to "the smallestl businesses" would be raised from the £3K announced last week to £10K.

This takes the entire total of the direct support made by the Treasury - including grants and tax cuts - to £20 BN.

Mortgage lenders will offer a three month mortgage holiday for those struggling with mortgage repayments. He said he will go much further to guarantee security for UK citizens.

"In the coming days, I will go much further to support people’s financial security. In particular, I will work with trade unions and businesses to urgently develop new forms of employment support to help protect people’s jobs and incomes through this period," said Sunak.

The Pound appears to have recovered some ground following the press conference, we note the GBP/EUR exchange rate could end the day higher as it is now quoted at 1.1013, which is 0.25% higher than where it started the day. However, the GBP/USD exchange rate is at 1.2088, a substantial 1.44% lower.

"The Pound is bouncing back after Chancellor Sunak's emergency fiscal measures. Business-first approach by UK government helping. Consumers also helped with mortgage relief. Not sure $USD liquidity problem solved. But some early signs investors will credit fiscal first responders," says Viraj Patel, FX and Macro Strategist at Arkera.

1/Chancellor @RishiSunak has announced further measures to support the UK economy against COVID-19 https://t.co/2F9dBTd4yV. This thread highlights some of the key measures. #Coronavirus pic.twitter.com/01qOlxPLjM

— HM Treasury (@hmtreasury) March 17, 2020

In response to the measures, the Federation of Small Businesses (FSB) described the package announced by the Chancellor as "very welcome".

"We will be working very closely with the Government to ensure the employment support package supports the self-employed," said the FSB.

In conjunction with the above mentioned initiatives, the Treasury and the Bank of England have also announced the launch of the Covid Corporate Financing Facility (CCFF), which is designed to allow the Bank of England to purchase unsecured short-term debt instruments issued by businesses.

"The CCFF will provide funding to businesses by purchasing commercial paper of up to one-year maturity, issued by firms making a material contribution to the UK economy. It will help businesses across a range of sectors to pay wages and suppliers, even while experiencing severe disruption to cashflows," said the Bank of England in a statement.

The facility will offer financing on terms comparable to those prevailing in markets in the period before the Covid-19 economic shock, and will be open to firms that can demonstrate they were in sound financial health prior to the shock.

The move by the Bank of England and the Treasury to support the UK economy comes amidst heightened expectations that the UK economy will fall into a deep recession as life in the UK responds to measures aimed at slowing the spread of the coronavirus.

"The Covid-19 outbreak in the UK has not yet led to Italian-style social distancing measures, but with the number of cases rising strongly, we expect similar lockdown measures soon," says Jacob Nell, Economist at Morgan Stanley. "Initial evidence suggests a sizeable hit to the economy even before such measures."

Morgan Stanley forecast the UK economy will shrink by 9.7% quarter-on-quarter in the second quarter of 2020, and by 5.1% year-on-year over the whole of 2020 as a whole.

GDP is forecast to return back its fourth quarter 2019 level only towards the end of 2021.