G7 Minutes and Central Bankers Disappoint Markets

- Written by: James Skinner

Image © European Central Bank

- GBP/EUR spot at time of writing: 1.1482, +0.28%

- Bank transfer rates (indicative): 1.1166-1.1246

- FX specialist transfer rates (indicative): 1.1300-1.1364 >> More information

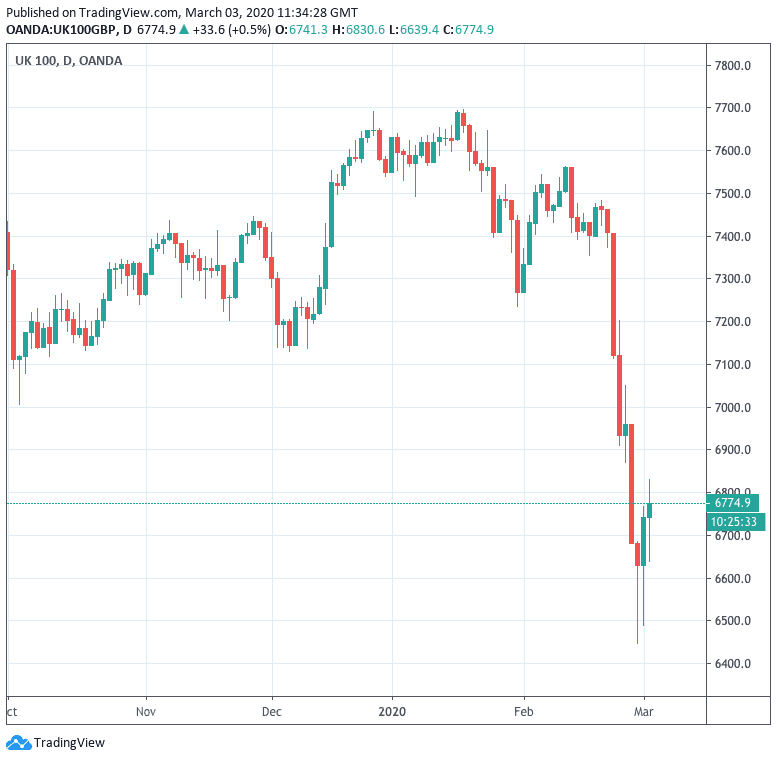

Finance ministers from the world's group of seven largest countries (G7) and central bank governors have completed a telephone conference, and the outcome has not impressed markets.

U.S. stock markets are set to open in the red after the group committed to monitor the outbreak's impact on the global economy, but they were not yet ready to detail any specific action.

The Dow Jones index is set to open half a percent lower according to futures, with the S&P 500 set to open 0.8% lower.

"Given the potential impacts of COVID-19 on global growth, we reaffirm our commitment to use all appropriate policy tools to achieve strong, sustainable growth and safeguard against downside risks. Alongside strengthening efforts to expand health services, G7 finance ministers are ready to take actions, including fiscal measures where appropriate, to aid in the response to the virus and support the economy during this phase. G7 central banks will continue to fulfil their mandates, thus supporting price stability and economic growth while maintaining the resilience of the financial system," read a communique from the meeting.

The statement added that Finance Ministers and Central Bank Governors stand ready to cooperate further on timely and effective measures.

"No coordinated policy action today - major disappointment," says a note from Danske Bank's research department. "Finance ministers and central bank governors stand ready to act but apparently not yet!"

While the U.S. is set to give back some gains, other global markets are playing catchup with the strong advance seen in U.S. markets yesterday.

While the G7 communique shows no coordinated response at the government level, at the central bank level there does appear to be motion.

Bank of England Governor Mark Carney told lawmakers in the UK Parliament on Tuesday that an international policy makers are preparing a “powerful and timely” response to any the negative effects posed by the coronavirus outbreak to the world economy.

"We appear to be within a stimulus phase, where the virus is cast aside in exchange for a renewed stimulus-led optimism. The pricing of a whole raft of central bank easing is difficult in the face of an ongoing health crisis. Traders will hope that today’s meeting between G7 finance ministers results in a commitment to raise fiscal spending in response to this crisis. The expectation of a sharp rise in monetary and fiscal stimulus provides plenty of short-term optimism, yet pessimists will likely wait for that initial bullish wave to pass before once again hitting the sell button should the virus continue to spread," says Joshua Mahony, Senior Market Analyst at IG.

The Reserve Bank of Australia (RBA) was the first major central bank to move as it cut its cash rate to a new record low of 0.50% overnight when just a fortnight ago it was seen by the market as likely to hold off on further rate cuts until well into the summer.

“The RBA eased overnight and today sees G7 Fin Mins and Central Governors hold a conference call at 07ET. A Communique will probably be released soon after. Expect that communique to feature phrases like, ‘closely monitoring’ and ‘prepared to act’, which may buy time for G7 central banks to ease at their regularly scheduled meetings, if not before. The BoC should cut this Thursday, the ECB may be looking at targeted measures (e.g. TLTROs) on March 12th and the Fed looks set to deliver a 50bp cut on March 18th, if not a lot sooner,” says Chris Turner, head of FX strategy at ING.

Words of assurance from central bankers have quickly crystalised into expectations of action in the market as coronavirus spreads at an increasing pace outside of China, with South Korea and Japan seeing outbreaks grow while both the U.S. and UK are now scrambling to clean up behind increasing numbers of their own cases including instances of ‘community infection’.

The Fed's Powell and others have said they’re watching the spread of coronavirus and the impact it’s having on the economic outlook closely and that should it present a sufficient enough threat they’ll step in using all policy levers available if necessary. The comments put an end to days of punishing losses in stock markets, which entered correction territory after falling by double digit percentages last week, and have helped to stabilise risk currencies but it remains to be seen how long calm will last for.

“We think market participants are placing too much faith in central banks rate cuts offsetting people’s fear of catching the virus. Fear is very powerful and stops people from working and shopping, except, apparently, buying toilet paper. The risk is people’s fear will have an enduring impact on economic activity. Financial markets can retrench further in our view,” says Joseph Capurso, a strategist at Commonwealth Bank of Australia.

British Health Minister Matt Hancock said Tuesday he won't rule out the idea of "no go zones" in the UK if the coronavirus infection spreads. Economically damaging containment measures are no longer a far-fetched concern.

The statement came as new coronavirus cases continued to grow faster outside of China than inside, with most major economies now affected. There 90,937 cases across the globe on Tuesday, with 3,113 deaths.

Markets are so far storing their faith in central bankers to soften the anticipated blow to economies from the virus although some doubt that such traditional policy support will be of any use in the face of a viral form of pneumonia that could see citizens increasingly isolating themselves in order to avoid infection.

Nonetheless, market pricing implies that investors feel certain the Fed will deliver 150 basis points of rate cuts in the coming months, taking the Fed Funds rate back to the ‘lower bound’, with the only uncertainty being whether the bank will wait until its March 18 meeting to start cutting.

“Our Fed watcher Philip Marey, who had already been calling Fed cuts this year, has now revised his 2020 rates call. He now expects the Fed to start cutting rates in March instead of April, with a 50bp reduction this month, again in June, and in September. In other words, it is back to the zero-bound by autumn (ahead of his original call, which was December). Arguably even more interesting are the other rumours that are flying about over the G-7 meeting” says Michael Every, a strategist at Rabobank. "Crucially, will this be the start of an open coordination between the government and central banks?"