Swiss Franc's Period of Outperformance Over for Now say some Analysts

Image © Adobe Images

- GBP/CHF market rate at time of publication: 1.2175

- Bank transfer rates (indicative guide): 1.1750-1.1840

- FX payment specialist rates (indicative guide): 1.2060

- More information on specialist rates available to you, here

The Swiss franc remains one of the best performing major currencies of 2020, although gains have diminished over the course of the past month and further losses are possible in 2021 say analysts.

The Franc's 2020 advance sees it up 5.40% against the Pound, 6.0% up on the Dollar but unchanged against the Euro.

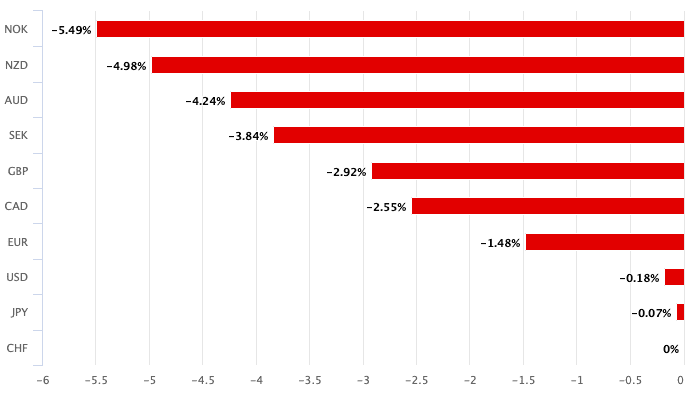

However, a look at the performance of the currency over the course of the past month reveals it to be the laggard:

Above: Franc performance over the past month.

The decline over the past month can be expected given the Swiss currency's traditional 'safe haven' role in global finance, whereby it tends to advance in times of fear - as was the case in early 2020, and fall in times of improved investor sentiment.

Investors are finding their appetite for risk taking once more now that a number of successful vaccines have been announced while U.S. political risks have also diminished with signs that President Donald Trump has agreed to commence the transition process.

"In addition to the Pandemic Panic, CHF benefitted greatly from US political discord and ongoing Brexit tensions. Global reflation efforts amplified CHF strength as it tracked other trends," says Mark McCormick, Global Head of FX Strategy at TD Securities. "These 'triple threats' appears to be diminishing rapidly. If confirmed, the primary rationale for holding CHF longs goes with it."

"The bearish case for the CHF continues to build," says Lefteris Farmakis, Strategist at UBS in a recent research note. "Rising confidence in a cyclical upswing can be expected to weigh on the franc at the point when economic lockdown concerns ease".

TD Securities say the Franc stands out as looking particularly vulnerable to weakness over coming weeks, in particular as market positioning risks are said to be the most acute within the G10 complex.

"High-frequency valuation concerns have diminished, somewhat, in recent weeks but we struggle to call the franc 'cheap'," says McCormick.

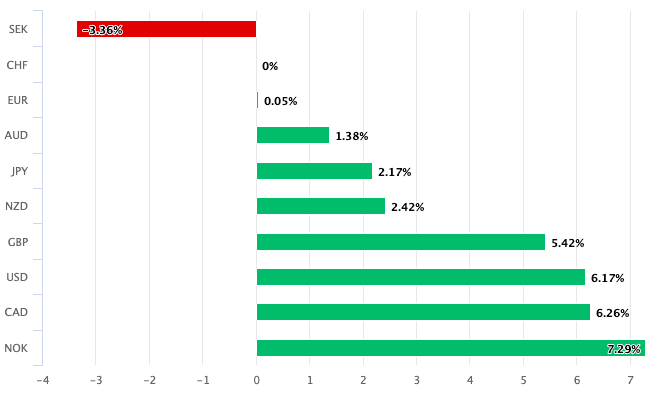

Above: The Franc in 2020.

UBS meanwhile say a cyclical upswing in the global economy is likely in 2021 as vaccines are approved and U.S. political uncertainty dissipates.

"While that looks premature to bet on today, it’s notable that the hurdles for further significant CHF appreciation have only grown," says

UBS are looking to express their views on the 2021 landscape by buying Pound Sterling and selling the Franc. "Combining our especially tactical bullish GBP view with the structurally negative CHF one through GBPCHF upside can create considerable leverage while neutralising or supplementing alternative EURUSD exposure," says Farmakis.

The Pound-to-Franc exchange rate is forecast by UBS to trade between 1.30 and 1.40 in 12 months' time.

TD Securities meanwhile adopt a strategy to buy USD/CHF on dips, targeting a rally to 0.9360.