Swiss Franc Strength Could Force SNB to Slash Interest Rates to -1.0%

- SNB likely to cut interest rates again

- Currency manipulator tag opens door to CHF gains

- CHF is best performing currency of past week and month

Image © Albert Czyzewski, Adobe Images

- Pound-to-Franc spot rate: 1.2573 | Euro-to-Franc spot rate: 1.0741

- Indicative bank rates: GBP/CHF: 1.2130-1.2220 | EUR/CHF: 1.0360-1.0440

- Indicative boutique rates: GBP/CHF: 1.2400-1.2460 | EUR/CHF: 1.061.0644 Find out more.

The Swiss Franc continues to march higher and the Swiss National Bank (SNB) might find it will have to cut interest rates in response, according to Andrew Kenningham, Chief Europe Economist at Capital Economics.

"We think that the SNB would more likely than not cut its policy rate to -1.00%," says Kenningham.

The SNB has reason to consider interest rate cuts: the economy is showing signs of weakness: strip out energy exports and pharmaceuticals from the latest set of data and the economy showed no signs of growth. Inflation at 0.2% in December is meanwhile incredibly weak.

The fundamentals in the economy therefore advocate for the kind of boost that a rate cut would offer. However, the other big target to aim for at the SNB will be the rising Swiss Franc, which will continue to make Swiss exports evermore expensive on global markets. By cutting interest rates, the attractiveness of parking deposits in Switzerland declines and in turn lowers demand for the Franc.

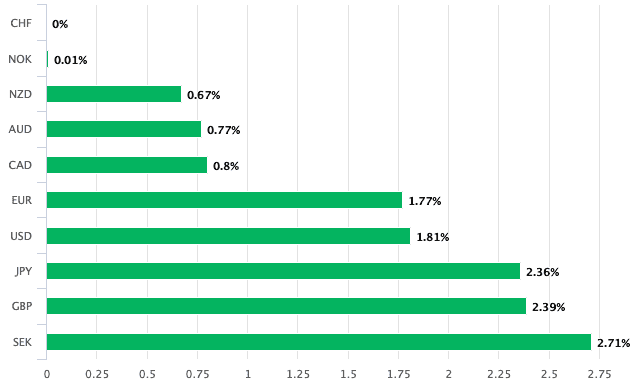

To the dismay of the SNB, the Franc has advanced against all the currencies that make up the G10 basket of the world's largest freely-traded currencies over the course of the past month:

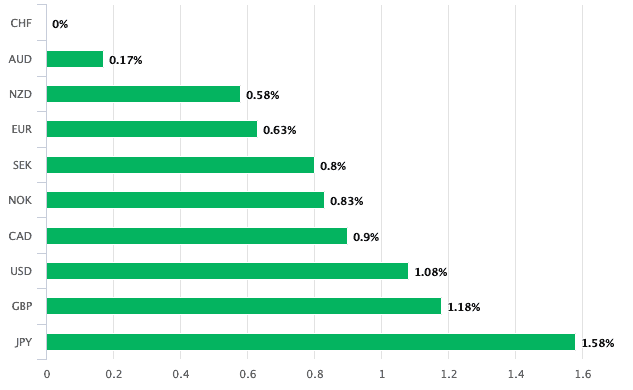

And gains have accelerated over the course of the past week following the U.S. decision to tag Switzerland as a currency manipulator:

The decision by the U.S. Treasury has been a long time coming, as the Swiss National Bank (SNB) is one of the few international institutions that overtly, and openly, targets the level of the currency.

The rule-of-thumb is that the SNB gets active in the market anywhere around the 1.08 marker in EUR/CHF. It no longer targets a set floor, but oversight of the bank's balance sheet does show it tends to intervene.

"The SNB appears to have intervened in the FX market in early January to resist upward pressure on the Franc," says Kenningham.

But, with the U.S. Treasury now signalling it is taking a keener interest in the SNB's activities, markets are buying the Franc as a bet that the SNB will be more cautious when it comes to intervention.

In short, the SNB is unlikely to be a bar to further CHF upside, meaning the risk reward to going 'long' on the Franc has improved markedly.

"To avoid negative further attention from US policymakers, the Swiss National Bank (SNB) will have to exercise restraint in intervening against further CHF strength as it has done regularly since the traumatic revaluation of the CHF after abandoning the CHF ceiling exactly five years ago today in 2015. Removing the assumption of a powerful central bank leaning against the currency's strength could mean a significant repricing of the franc higher," says John J Hardy, Head of FX Strategy at Saxo Bank.

The SNB will almost certainly still remain engaged in the market, but it is becoming increasingly clear that the only effective route to paring back demand to the Franc is to lower interest rates again. By lowering interest rates, the attractiveness of parking money in Switzerland is eroded, particularly if the gap between the interest rate offered in the Eurozone to that offered in Switzerland widens.

"The decision by the SNB to scrap its currency ceiling five years ago coincided with it slashing interest rates to a record low to reduce the attractiveness of holding Swiss francs. Alas, this ‘deterrence effect’ is not what it used to be: whereas the gap between Swiss and euro-zone interest rates widened to 55bps in January 2015, it has narrowed to just 25bp following the ECB’s slow-motion easing cycle," says Kenningham.

Saxobank's Hardy says the current environment favours a stronger Franc, that could appreciate to reach parity with the Euro.

"Shorting here with a stop north of 1.0850 and a target below 1.0500 or even close to parity for a stretch target is one strategy, as any move back above 1.0850 would suggest that for now, this move lower has been a false break," says Hardy.

The obvious risk to any trade on Swiss Franc appreciation is a shift in the global investor environment: the Franc tends to struggle when global investors are in a bullish mood and are investing in stocks as they draw reserves out of Swiss accounts in order to invest.

The other obvious risk is that the SNB ignores the U.S. Treasury and intervenes in the market again. Or, an aggressive interest rate cut is delivered.

While Capital Economics see a rate cut coming, it could yet be some time away, therefore the Franc might yet have some ground to take.

"The Bank will remain poised to resist further spikes in the currency. If our forecast for the ECB to loosen policy this year proves accurate, we think that the SNB would more likely than not cut its policy rate to -1.00%, probably in H2," says Kenningham.

Time to move your money? The Global Reach Best Exchange Rate Guarantee offers you competitive rates and maximises your currency transfer. They offer great rates, tailored transfers, and market insight to help you choose the best times for you to trade. Speaking to a currency specialist helps you to capitalise on positive market shifts and make the most of your money. Find out more here.

* Advertisement