Canadian Dollar Stars in Currency Portfolio Which Returns 6.6% Annualised

The Canadian Dollar has been the strongest G10 currency versus the US Dollar in 2017 and strategists at Westpac are continuing to bet on its rise.

A G10 currency portfolio created at Westpac bank, which returns an average of 6.6% a year, continues to prefer the Canadian Dollar.

Out of the three major commodity currencies (CAD, AUD, and NZD), the portfolio is most overweight the Canadian Dollar, then the Aussie, followed by the New Zealand Dollar third.

Canada's rising interest rates, better growth prospects and rising crude oil prices, are the main reasons for Westpac's preference for the currency.

Canada's growth 'signal', a proprietary indicator it has developed to indicate future economic growth, is much stronger than the other's, says Westpac.

The chart below shows the growth signals for the three currencies, with Canada beating the other two hands-down.

The signal score is generated from five inputs - consumer and business confidence, retail sales, unemployment and property prices.

The Canadian Dollar has also been supported by higher oil prices which is Canada's main export. Higher prices increase aggregate demand for the currency.

The Bank of Canada is meanwhile the only central bank out of the three to have raised interest rates in 2017. Higher interest rates tend to attract more inflows of foreign capital which supports the home currency via increased demand.

A supplementary factor is the growth-friendly fiscal policies of the Trudeau government which has increased public spending, pushing up inflationary pressures and thereby interest rates.

"Canada’s outperformance should continue a while yet. Trudeau’s 2016 fiscal stimulus is still washing through the economy, US growth prospects are firm and oil prices are at 2 ½ year highs," says Westpac.

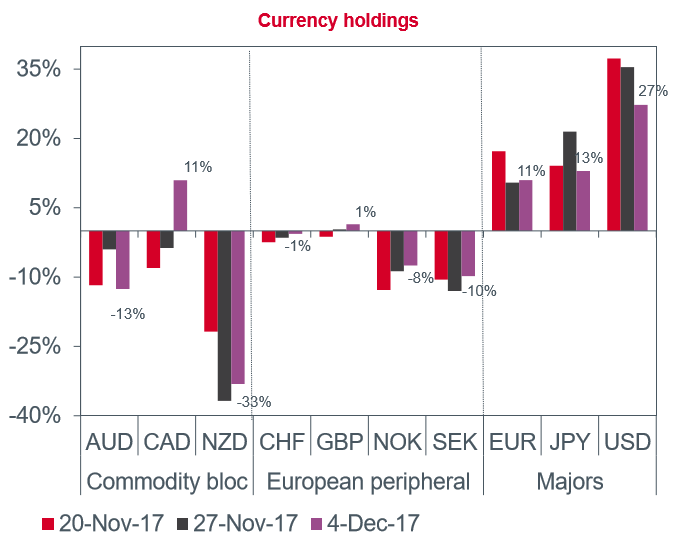

A total of 11.0% of the portfolio is held in bets the Canadian Dollar, will rise contrasted with 13% held in bets the Aussie Dollar will fall and 33.0 % in negative bets against the New Zealand Dollar.

Whilst the model is constructive for CAD, it is even more bullish for USD, EUR, and JPY.

The chart below shows all the G10 currencies graded on a scale according to the attributes the model takes into account when assessing how much to bet on each currency.

The scale goes from most bearish (far left) to most bullish (far right)

The rainbow of colours the bars for each currency are composed of each relate to a different variable used to rank the currency.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.