Pound / Canadian Dollar Rate Needs BoE Boost to Sustain Recovery

- Written by: James Skinner

- GBP/CAD rally could wane without BoE boost

- With USD/CAD correction stifling near 1.7150

- Risking choppy GBP/CAD range in short-term

- But GBP/CAD still a buy-on-dips at Scotiabank

Image © Adobe Stock

The Pound to Canadian Dollar rate could find itself road blocked in the 1.7150 area unless Thursday’s monetary policy decision from the Bank of England (BoE) provides Sterling with fuel to extend its recovery.

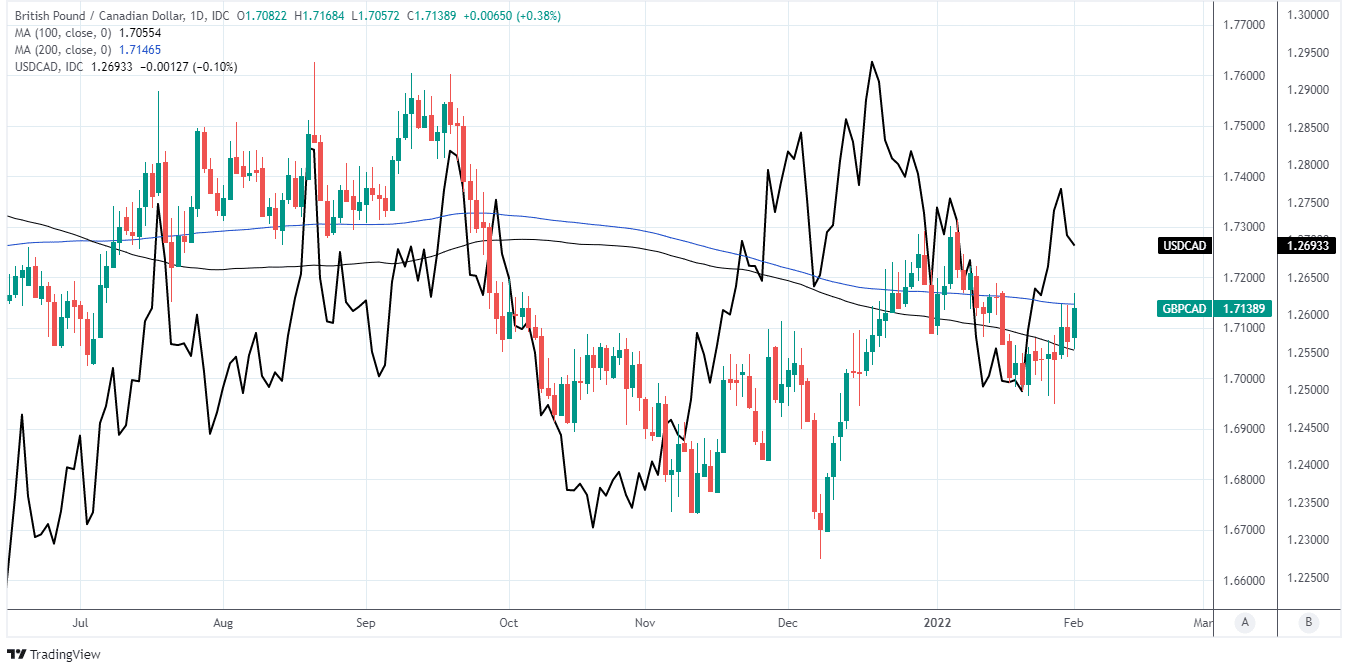

Pound Sterling made a third consecutive attempt at rising above its 200-day moving-average of 1.7146 against the Canadian Dollar on Tuesday but was quick to lose steam when the influential USD/CAD exchange rate turned lower in line with the broader U.S. Dollar complex.

GBP/CAD tends to closely reflect the difference in performance between the main Sterling exchange rate GBP/USD and USD/CAD but often demonstrates a positive correlation with the latter and so could now struggle to further its recovery.

This would be in keeping with Scotiabank’s latest analysis of the Pound to Canadian Dollar rate’s charts, which suggested on Monday that choppy range trading could be likely to define price action throughout the course of this week.

“GBPCAD is modestly firmer over the past week, with minor GBP dips to the mid-1.69s generating solid support for the pound. Daily and weekly charts reflect this trend and the late week squeeze higher suggests a solid floor in place now for now at least. Trend signals are flat on the daily and weekly charts, however, which rather suggests that choppy, rangey trade may persist,” says Juan Manuel Herrera, a strategist at Scotiabank.

Above: GBP/CAD at daily intervals with selected moving-averages and shown alongside USD/CAD.

- Reference rates at publication:

GBP to CAD spot: 1.7146 - High street bank rates (indicative): 1.6546 - 1.6666

- Payment specialist rates (indicative: 1.6992 - 1.7060

- Find out about specialist rates and service, here

- Set up an exchange rate alert, here

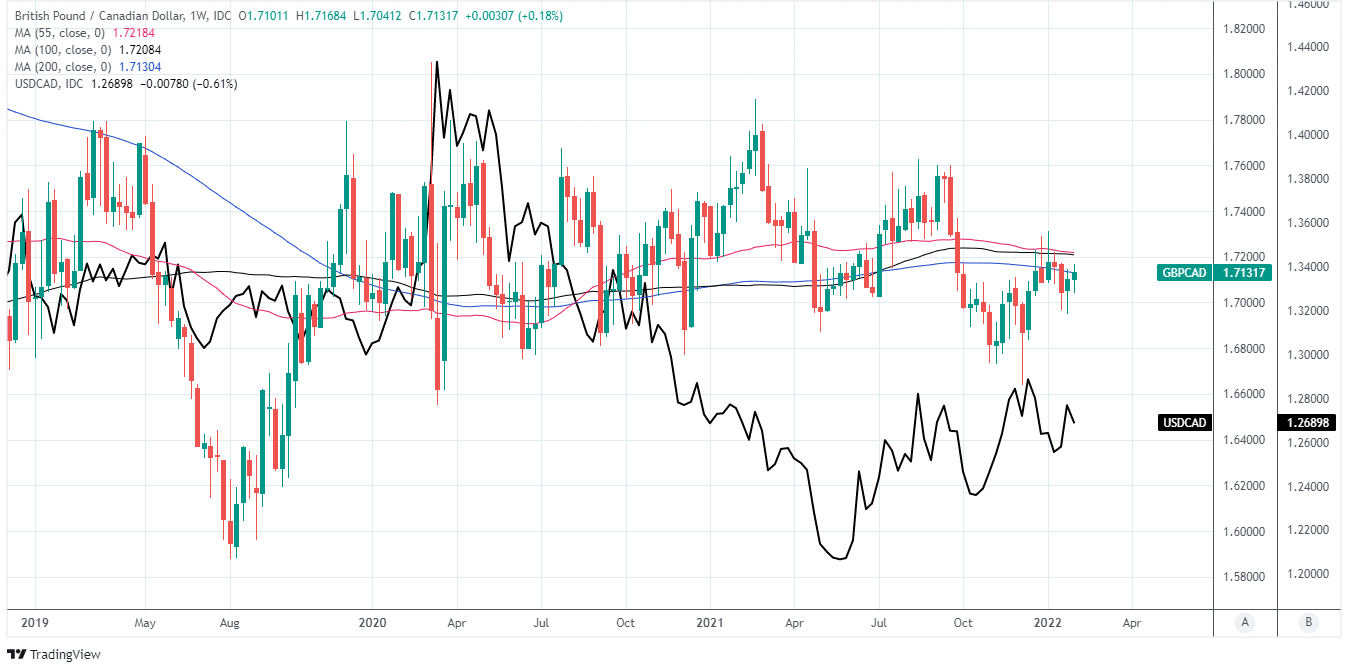

“We reiterate that the long-term charts do suggest a firm, major low formed in December (bullish, monthly key reversal) which tilts broader risks to the topside and suggests that GBP dips to the 1.68/1.69 zone remain a buy,” Herrera and colleagues wrote in a note on Monday.

USD/CAD was lifted sharply late last week in price action that helped pick GBP/CAD up from its 2022 lows just above 1.69 after the Bank of Canada (BoC) elected to provide advanced warning to businesses and households before making any decision to begin raising its interest rate.

This came as a disappointment to a portion of the market that was assuming the BoC would raise its cash rate to 0.50% without delay, although with the Canadian Dollar finding its feet early in the new week GBP/CAD’s recovery appeared to be running on fumes by Tuesday.

That could see the Pound to Canadian Dollar rate sidelined into the choppy range warned of by Scotiabank unless Sterling receives a further boost when the Bank of England announces its latest monetary policy decision this Thursday.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“We don't think they will pull a BoC next week, opting not to hike (again), but we also don't see them delivering a very hawkish message. Keep in mind that market pricing calls for roughly four hikes this year,” says Mark McCormick, global head of FX strategy at TD Securities.

Expectations for a second interest rate rise have built since Office for National Statistics data showed UK inflation reaching a multi-decade high of 5.4% in December and after other figures confirmed that workers’ wage packets are also rising in response to this acceleration.

The trouble for Sterling is that economists already widely expect the BoE to lift Bank Rate from 0.25% to 0.5% this week and many analysts view such a move as already having been largely baked into the price of the Pound, meaning that it could have little, if anything to gain from a rate rise this Thursday.

“At the very least, the BoE probably won't want to overdeliver at this week's meeting, underscoring that the balance of near-term risks points lower in GBPUSD,” TD’s McCormick and colleagues warned in a recent note.

Above: GBP/CAD at weekly intervals with selected moving-averages and shown alongside USD/CAD.