Pound / Canadian Dollar Rate Bought On Dips Below 1.69 at Scotiabank

- Written by: James Skinner

- GBP/CAD remains a buy on dips at Scotiabank

- Dips below 1.69 seen as mid-term opportunity

- Reclaiming 1.7085 hints of further gains ahead

- BoC decision in focus for GBP/CAD & USD/CAD

Image © Adobe Stock

The Pound to Canadian Dollar rate slipped back toward January lows early this week and ahead of Wednesday’s all-important policy from the Bank of Canada (BoC), although strategists at Scotiabank have advocated that clients buy GBP/CAD in the event of any dips below the nearby 1.69 level.

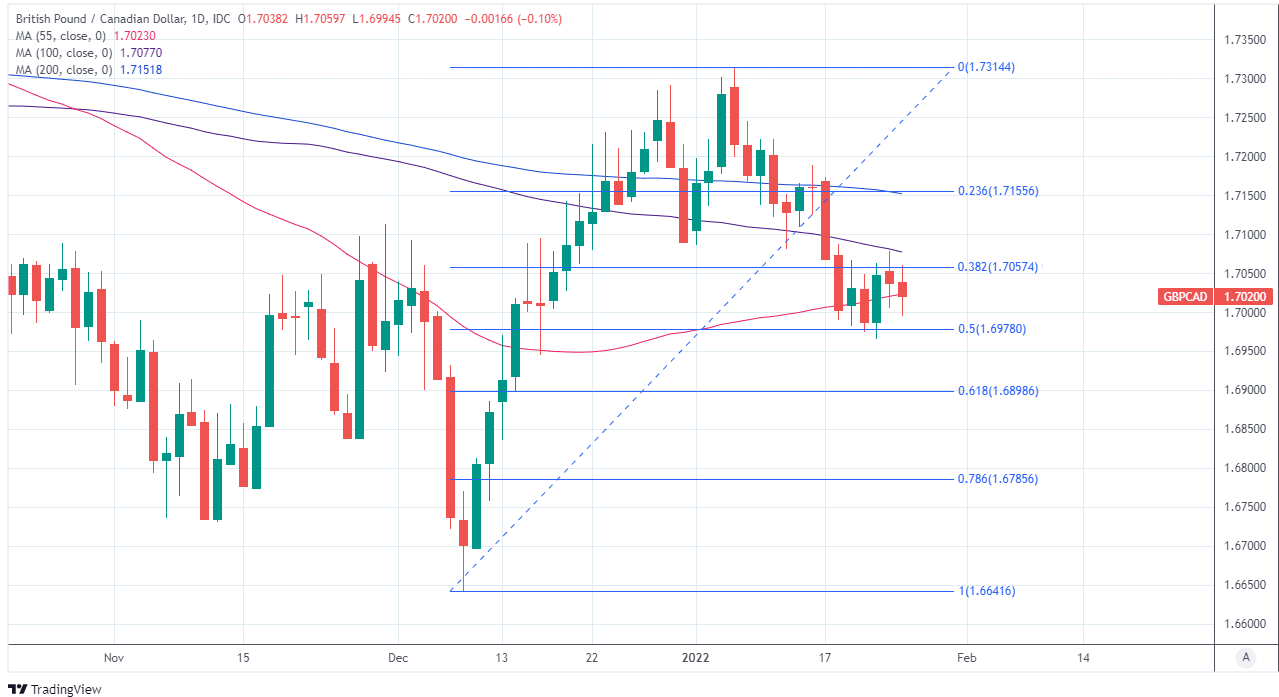

Sterling fell back near the 1.70 handle and was closing in on 2022 lows against the Loonie by Tuesday after an earlier attempted rebound ended with a retreat from GBP/CAD’s 100-day moving-average around 1.7076 early in the new week.

That sits just below 1.7085, which is an important pivot point that could now act as an additional layer of resistance to any further attempts at recovery by the Pound to Canadian Dollar rate.

“Recall that the break of the double top (1.7290) trigger at 1.7085 had put 1.6880 on the radar,” says Juan Manuel Herrera, a strategist at Scotiabank.

“We still rather think that dips towards 1.68/1.69 should represent a GBP buying opportunity. Longer run charts do suggest a firm, major low formed in December (bullish, monthly key reversal),” Herrera and colleagues said in a Monday review of GBP/CAD’s charts.

Above: GBP/CAD at daily intervals with Fibonacci retracements of December rally indicating likely technical support for Sterling.

- Reference rates at publication:

GBP to CAD spot: 1.7027 - High street bank rates (indicative): 1.6425 - 1.6544

- Payment specialist rates (indicative: 1.6868 - 1.6936

- Find out about specialist rates and service, here

- Set up an exchange rate alert, here

The Pound had risen strongly against the Canadian Dollar throughout December to trade back near 1.73 early in the new year before an accelerating oil price rally and a ‘hawkish’ shift in market expectations of the BoC cut short the recovery last week.

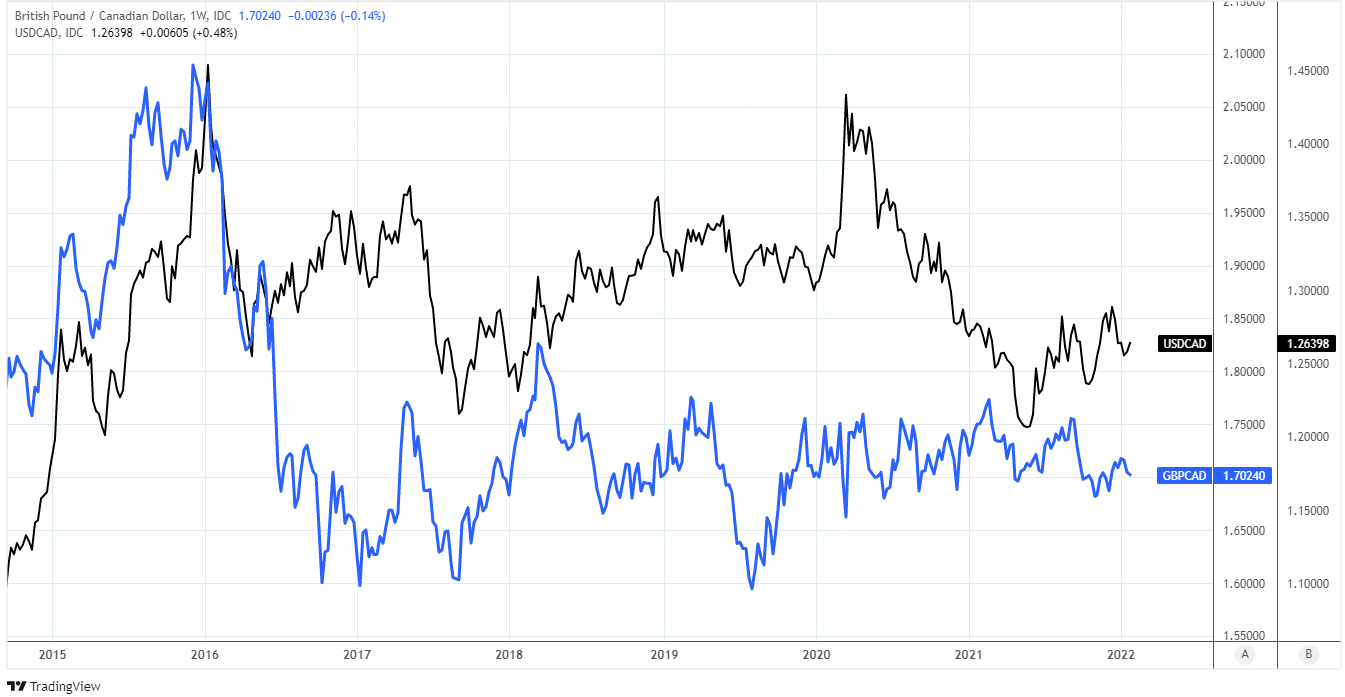

Much about the outlook for GBP/CAD now depends in the short-term at least on the outcome of Wednesday’s interest rate decision from the BoC and its impact on the USD/CAD rate with which the Pound to Canadian Dollar rate often shares a positive correlation.

“Increasing core inflation seals the deal for a January hike, in our view. Liftoff and possible discussion of quantitative tightening (QT) later this year should provide a catalyst for extension in the rates selloff and resumption of USDCAD downside,” says Ben Randol, a strategist at BofA Global Research.

“In the event the BoC opts to wait on rates, we would fade price action and sell rallies in the front-end and USDCAD assuming a hawkish tone teeing up a hike in March,” Randol and colleagues wrote in a research briefing this week.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

The BoC said in December that it would likely take until at least the second quarter of 2022 for Canadian economic conditions to merit an increase of its cash rate from the current 0.25%, while since then economically burdensome coronavirus containment measures have been reimposed across large parts of Canada’s economy.

This is one reason for why the BoC could be minded to stick with its earlier guidance this week, although many analysts see a high probability of the BoC departing from this by raising its cash rate to 0.50% on Wednesday after official data cast the labour market as going from strength to strength in its recovery while other figures revealed just last week that Canadian inflation continued to rise above the BoC’s target in December.

“We do think that the BoC is a bit more likely to surprise hawkishly (by hiking 25bps and/or laying out a balance sheet reduction timetable) than the Fed (which could surprise hawkishly by ending QE immediately),” says Greg Anderson, global head of FX strategy at BMO Capital Markets.

“With that in mind, we think it makes sense to shop for opportunities to exploit today's risk aversion and look for opportunities to sell USDCAD above 1.2600 with a target of 1.2500 or lower by the end of this week,” Anderson wrote in a Monday market commentary.

Above: GBP/CAD shown at weekly intervals alongside USD/CAD.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

GBP/CAD tends to closely reflect the relative performance of USD/CAD and its Sterling equivalent GBP/USD but is often seen falling in markets where USD/CAD is under pressure, which would likely be the case if the BoC does begin to lift its cash rate this Wednesday.

This is because many economists still forecast an unchanged 0.25% cash rate and pricing in the overnight indexed swap market continued to imply on Tuesday that investors see only a two-in-three chance of a change being announced, meaning that a rate rise has not been fully priced-in.

Should the BoC decision inspire a sell-off in USD/CAD then it could potentially produce dip-buying opportunities in GBP/CAD later this week.

“We expect the bank to hold off on a change, but in a very close call. Clearly, the conditions are in place to support higher rates. Inflation trends have evolved largely in line with the BoC’s forecasts from the October Monetary Policy Report (4.8% vs actual 4.7% for Q4). But that still represents consumer price growth substantially above the 2% target rate,” says Nathan Janzen, a senior economist at RBC Capital Markets.

“Macroeconomic disruptions from the new virus variant are expected to be significant but temporary, with some regions, including Ontario, already planning to roll back restrictions that were re-imposed in early January. Beyond those near-term virus risks, the BoC is clearly running out of reasons to keep interest rates at emergency low levels. Rates will rise soon,” Janzen and colleagues wrote in a research briefing last week.