Canadian Dollar Bulls Undeterred after BoC Bides Time on Interest Rates

- Written by: James Skinner

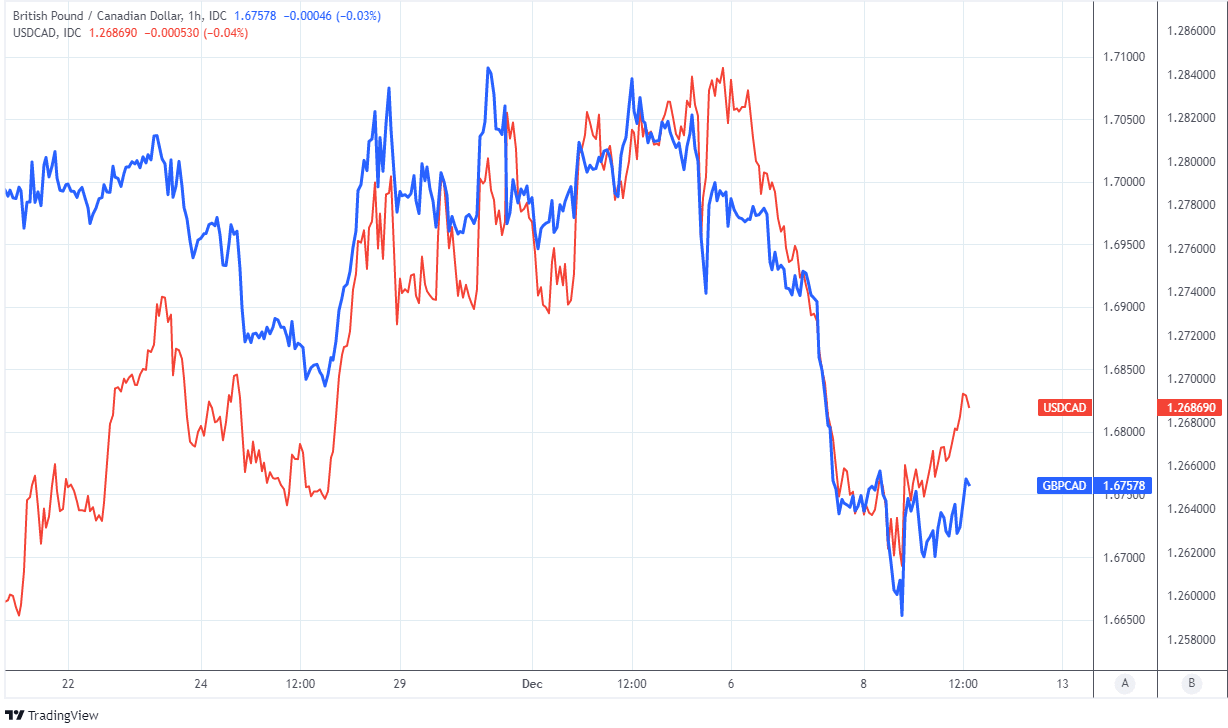

- USD/CAD & GBP/CAD paring pre-BoC losses

- But CAD bulls undeterred by BoC’s patience

- USD/CAD seen in 1.2475-1.28 range in Dec

- GBP/CAD may lose battle to recover 1.6900

- Running risk of fresh losses, new 2021 lows

Image © Adobe Stock

The Canadian Dollar pared earlier gains over the U.S. Dollar and Pound in the penultimate session of the week after its rally was stalled by a show of patience from the Bank of Canada (BoC), although this has done little to deter the Loonie’s admirers from their enduringly bullish outlooks.

Canada’s Dollar beat a further retreat from the greenback and Sterling on Thursday, leading USD/CAD to approach 1.27 and enabling the Pound to Canadian Dollar rate rise back above 1.6750 as the Loonie continued a corrective retrenchment that has been underway since Wednesday’s Bank of Canada monetary policy decision.

“A quiet BoC doesn't do CAD many favors with the market pricing 130bp in hikes over the next year. Even so, relative policy shifts favor CAD versus the lower yielders, where CHF remains the most mispriced,” says Mark McCormick, global head of FX strategy at TD Securities.

The BoC acknowledged signs of “significant momentum” in Canada’s economy at the start of the final quarter and single out the labour market especially for recent strength that has seen unemployment reach its lowest since the onset of the coronavirus crisis.

However, the bank said nothing to encourage or otherwise vindicate financial markets that had wagered with increasing confidence in prior weeks that BoC could be likely to raise its cash rate from 0.25% to 0.5% as soon as January next year.

Above: GBP/CAD rate shown at hourly intervals alongside USD/CAD.

- Reference rates at publication:

GBP to CAD spot: 1.6760 - High street bank rates (indicative): 1.6173 - 1.6290

- Payment specialist rates (indicative: 1.6600 - 1.6676

- Find out about specialist rates, here

- Set up an exchange rate alert, here

- Book your ideal rate, here

When it comes to interest rates the BoC merely reiterated October’s guidance that it expects inflation pressures to become sufficient enough to potentially merit an increase in borrowing costs some time between April and September 2022.

“The Bank continues to monitor inflation/wages, and while it noted increased uncertainty from BC floods/Omicron it did not sound overwhelmingly focused on those developments. We don't think today's policy statement takes any options off the table heading into Q1, although we continue to look for the first rate hike in April,” TD’s McCormick says.

Some parts of the market may have been expecting the BoC to provide notice on Wednesday that an initial increase in the cash rate would be likely to come sooner than was guided for in October, which would have formalised the message of Governor Tiff Macklem’s November Op-ed in the FT.

Such an eventual move would begin a likely steady withdrawal of the interest rate cuts that were announced in support of the economy early in the pandemic, a period and process that saw the cash rate reduced from 1.75% to 0.25% between January and March 2020.

The BoC played for time in this week’s announcement and in the process layed a speed bump in the path of the Loonie, although the proximity and likely size of the eventual adjustment in interest rates is enough to have encouraged some analysts to stick with bullish outlooks for the currency.

“Markets may be overestimating the BoC’s pace of hikes and underestimating that of the Fed’s. The BoC may still get off the starting blocks a bit earlier than the Fed and that should still result in CAD gains, however,” says Shaun Osborne, chief FX strategist at Scotiabank.

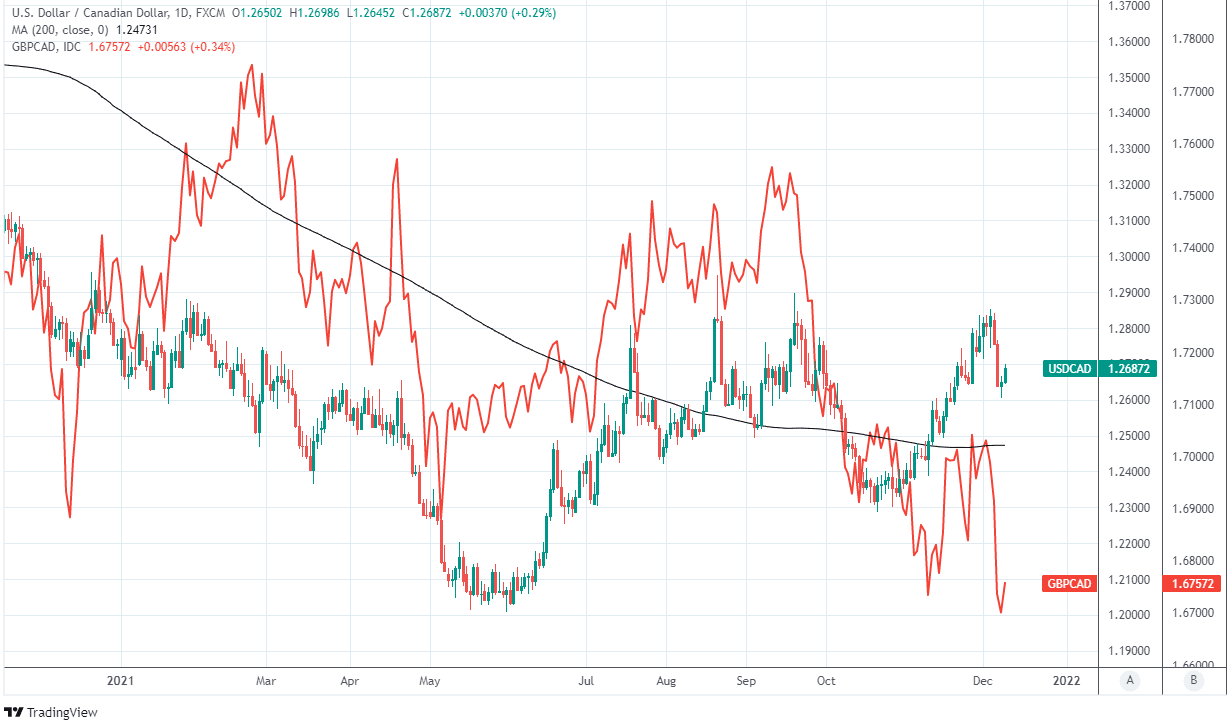

Above: Pound to Canadian Dollar rate shown at daily intervals alongside USD/CAD.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The BoC is still widely expected to begin lifting its interest rate months before the Federal Reserve, which is a big part of why analysts see the greenback struggling to lift USD/CAD past the nearby 1.28 handle in the weeks and months ahead.

“The CAD can still perform well against the USD (and more broadly) next year as rate hikes start. We continue to target a drop to 1.20 in H2. Turn-of-the -year volatility might still see the CAD slip somewhat but we expect losses to remain capped around 1.28,” Osborne also said this week.

These expectations suggest the Pound-to-Canadian Dollar rate likely has only limited scope for recovery in the weeks and months ahead as well as plenty of lingering downside risk, as GBP/CAD always closely reflects the relative performances of USD/CAD and GBP/USD.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

The Pound-to-Canadian Dollar rate would likely struggle to recover above the 1.69 handle in any market where USD/CAD is road blocked around 1.28, given the weakening of GBP/USD in recent days.

GBP/CAD could potentially fall below 1.65 ahead of year-end should USD/CAD fall back beneath 1.25 as anticipated by TD Securities and if in the meantime the main Sterling exchange rate GBP/USD is unable to recover above Thursday’s 1.32 level.

“The knee-jerk USDCAD move matches our expectations that market pricing of the BoC is a bit too aggressive. There isn't a smoking gun in the headlines, but market pricing expects a near 130bp in hikes over the next year. We don't see anything that reflects any urgency to match those expectations (even though the BoC will hike),” TD’s McCormick said on Wednesday.

“For now, USDCAD is likely to hang around the top-end of the range. Yet, we like fading rallies towards 1.28 and eye the 200dma [1.2475] as support in the very short term,” he adds.