Australian Dollar Rally Soured by New Chinese Import Bans

- Import ban darkens outlook for AUD

- But rising markets ahead of U.S. vote propels AUD higher

- RBA decision looms

Image © Adobe Images

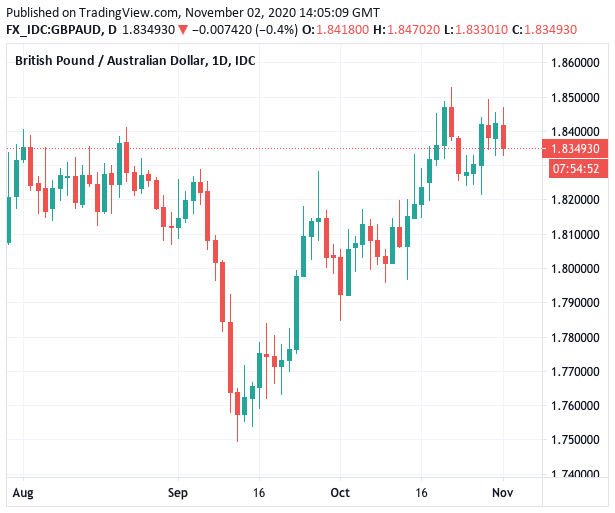

- GBP/AUD spot rate at time of publication: 1.8354

- Bank transfer rate (indicative guide): 1.7712-1.7840

- FX specialist providers (indicative guide): 1.7920-1.8189

- More information on FX specialist rates here

News that China is looking to ramp up a trade war with Australia could weigh on the longer-term outlook for the Australian Dollar according to analysts, however near-term price action in the currency was positive at the start of what is billed to be a busy week as global investors looked towards the U.S. election.

Equities, commodity prices and 'risk on' assets like the Australian, New Zealand and Canadian Dollars went higher Monday as investors anticipated a Joe Biden win in the U.S. presidential election which gets underway on Tuesday.

Tuesday will also see the Reserve Bank of Australia (RBA) deliver their latest policy decision that could include the expansion of quantitative easing.

However, focus at the start of the new week was on reports that China is now expected to ban imports of Australian copper and sugar, in addition to having already banned imports of Australian lobster, timber and barley.

The developments come as uncertainty over the status of Australian coal imports remains high, given reports out last month that domestic coal users have been ordered to avoid Australian coal.

China is Australia's most important trade partner and is easily the most important destination for Australian exports, any deterioration in that relationship could deliver a significant negative impact on Australia's foreign exchange earnings potential.

"The development of a trade war with China is a major issue for Australia and may give China a template to work from as it flexes its economic muscle and dominant position in the resources industry," says John Meyer, an analyst at brokerage SP Angel.

Above: GBP/AUD daily. Lock in your ideal exchange rate automatically when it is reached. Find out how, here.

The South China Morning Post reported on Monday China has banned timber imports from Queensland and barley shipments from another Australian grain exporter, with copper and sugar to follow this week.

The newspaper reported Australian rock lobster shipments were also delayed in Shanghai at the weekend.

Officially the bans are linked to biohazards: a China foreign ministry spokesman confirmed to the South China Morning Post on Monday that Chinese authorities have repeatedly found biohazards in imports of Australian timber. China’s customs agency also said it had found contamination in barley shipments from Australian grain exporter Emerald Grain and had ceased imports from the company from Friday.

The contamination was from bromus rigidus, a grasslike weed.

China has in the past cited technical breaches as a reason for banning agricultural products, but political analysts say this is a technical guise for a political decision.

Indeed, it remains unclear as to why copper imports face restrictions, confirming a suspicion the moves are politically motivated.

"China rejected Australia's appeal to lift tariffs on barley imports and SMCP reports that imports of copper and sugar could be banned this week which does not bode well for the AUD," says Kenneth Broux, an analyst at Société Générale. "We believe the move is in retaliation over Huawei."

"Worsening trade ties between Australia and China could be weighing on the aussie too after Beijing announced a ban on some Australian imports, including copper," says Raffi Boyadjian, Senior Investment Analyst at XM.com.

Despite the deterioration in the China-Australian relationship, the Aussie was seen trading higher against peers at the start of the new week in sympathy with a rally in stock markets, equities and other 'risk on' currencies as investors positioned for a potential win by Joe Biden and the Democrats in Tuesday's vote.

The Pound-to-Australian Dollar exchange rate went lower by half a percent to trade at 1.7186 while the Australian-to-U.S. Dollar exchange rate went 0.5% higher to trade at 0.7042.

The moves imply a market preparing for a 'blue wave' election outcome, whereby Biden takes the White House and the Democrats the Senate.

"The U.S. election outcome is likely to be in focus next, with a delayed outcome or status quo weighing on the AUD while a “blue wave” could lead to rally, given the AUD's correlation with equities," says Nikolaos Sgouropoulos, an analyst with Barclays.

A risk for the Australian Dollar is that President Donald Trump upsets pollster expectations and wins, or comes close enough to contest the result; in the event of such uncertainty the Dollar would likely rise owing to its 'safe haven' status while stocks and currencies such as the Australian Dollar would fall.

"Market reaction to any contested election scenario developing on Election Night could prove brutal, with equities sharply lower, treasuries spiking higher and in FX, JPY crosses likely the most volatile (USDJPY probably sharply lower, but brutal market uncertainty usually means the liquidity of the U.S. dollar keeps it in the safe haven column). Given my belief that a Trump win could immediately break the nation, I would be very cautious if the market begins celebrating early results that show a clear tilt in Trump’s favour," says John J Hardy, Head of FX Strategy at Saxo Bank.

Further aiding an expectation for Australian Dollar volatility this week is Tuesday's RBA decision, which is expected to result in changes to the quantitative easing programme.

"Expectations of a dovish RBA and the US elections make this an interesting and potentially volatile week for the AUD," says Sgouropoulos. "Any dovish surprise by the RBA will likely limit participation in a bullish risk environment while exaggerating participation with weak risk sentiment.

Barclays expect the RBA to lower the cash rate, TFF rate, and the yield target on three-year Australian government bonds to 0.10% from 0.25%.

"We expect the rate cut and longer-dated bond purchases to weigh on back-end yields and the AUD," says Mayank Mishra, Global FX and Macro Strategist at Standard Chartered Bank.

Other analysts say the RBA could expand its quantitative easing programme by purchasing longer dated bonds like ten-year bonds in addition to three-year bonds.

Such a move would come as being considered an aggressive approach by the RBA and could result in Aussie Dollar weakness.

However, the currency could rise should the RBA take a less proactive approach and minimise the changes it carries out.

"Some market participants also expect further easing through a quantitative easing (QE) programme. We, however, do not expect the RBA to announce the beginning of QE, or a new commitment to regularly purchase a specified quantity of bonds in November. Instead, it is likely to state its commitment to continue to buy bonds as necessary and to focus its purchases across the curve," says Mishra.