Pound-to-South African Rand 5-Day Forecast: Correcting in an Uptrend

Image © Natanael Ginting, Adobe Stock

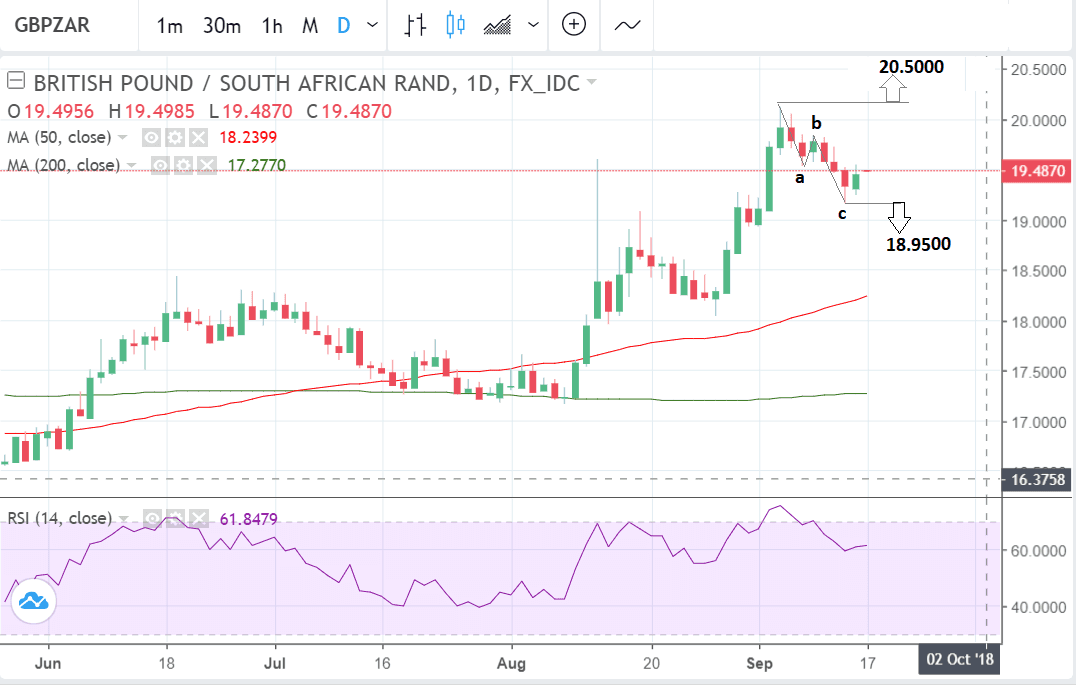

- GBP/ZAR pulling-back after peaking above 20.00

- Technically at pivotal crossroads in trend

- ZAR eyes SARB meeting this week

The South African Rand has recovered by over two and a half percent against the Pound over recent weeks despite not inconsiderable headwinds from both domestic and external sources.

The Pound-to-Rand exchange rate fell from a high of 20.13 on the 5th of September to last Friday's close of 19.48, a substantial decline by any standards.

There does not seem to be a clear fundamental driver for the sell-off which we see as essentially driven by profit-taking, but the SA unit was probably helped by easing emerging market (EM) concerns as the Turkish central bank finally took action to defend the Lira and president Trump engaged Beijing in trade talks.

EM contagion had been a major driver of Rand losses, but things started to look up last week and this probably provided a supportive backdrop for ZAR's recovery.

The Pound has been in an established uptrend versus the Rand since the March lows when it was trading at a little over 16.00. Given the old adage the 'trend is your friend' GBP/ZAR is more likely to continue rising than not.

The one possible spoiler to the bullish view is action from the reserve bank (SARB) which has its next meeting on Thursday, September 20.

The Rand has weakened so much recently that a rate hike would not be out of the question as raising interest rates would likely lend the currency some upside as global investors buy into the higher returns on offer.

Such a move would appreciate the Rand back to more palatable levels and deal with rising inflation, which registered 5.1% in July, and is now nearing the upper boundary of the SARB's target range between 3-6%.

The governor of the central bank, Lesetja Kganyago, has said the bank will act if consumer prices deviated "significantly away from the midpoint of the inflation target range". We may now be there.

From a technical standpoint GBP/ZAR is not showing strong enough reversal signs yet to view this as anything more than a mere pull-back in an intact uptrend. The move looks decidedly corrective rather than the beginning of a new downtrend which would be expected to be sharper.

It is roughly composed of three waves in a classic abc zig-zag format as is the case with most corrections. As things stand it probably just represents a 'breather' before a resumption of the uptrend.

If the trend is going to resume, moreover, the correction looks ripe for reversal soon. From a technical perspective the week ahead looks more like it could witness a bullish rebound than further declines.

Much depends on the next move - if the 20.13 highs are breached the bullish trend is set to continue, possibly to an upside target of 20.50. Currently at the time of writing on Monday morning the bulls looks to have the upper hands and the pair is trading at 19.61 suggesting a resumption may be on the cards.

On the other hand it is also possible that should the 19.14 lows be broken the argument for a trend change would grow more convincing, and move down to the next target at the 18.95 support shelf gain credence; since at that point the down-move will have formed two lower lows, and be on course for forming two lower highs.

The South African Rand: What to Watch

The main domestic event in the week ahead for the Rand is the meeting of the SARB at 14.00 B.S.T on Thursday.

As mentioned above there is a chance the SARB will decide to raise interest rates at the meeting which would have a positive effect on the Rand.

Investec sees a 40% chance that the SARB will raise interest rates twice between now and the end of the year and given there are only two more meetings in 2018 it infers a greater than 40% chance of a hike on Thursday.

Another major release in the week ahead is SA inflation data for August, which is forecast to rise by 5.2% compared to a year ago, and by 0.2% compared to a month ago.

Core inflation is forecast to rise 4.3% and 0.1% respectively, when the data is released on Wednesday, September 19, at 09.00. Strong rises in inflation will increase the probability of a rate hike from the SARB the day after, and, therefore, be a positive driver for the Rand.

Also keep an eye on general market sentiment pertaining to global trade as this will impact the broader Emerging Market space, of which the ZAR falls into.

Reports over recent days suggest US President Trump is moving ahead with the next tranche of tariffs on $200bn of Chinese goods and that China may skip the proposed trade talks later this month if the US moves forward with them.

Therefore, much of the optimism triggered by last week's news the US and China were to sit down at the negotiation table might dissipate.

This leaves the 'risk on' currencies such as the Australian and New Zealand Dollars at risk.

The Yen and US Dollar tend to benefit when investor nerves are heightened.

At the time of writing markets have shown a nonchalant response; they will no doubt be awaiting details which the US might well release today.

Advertisement

Lock in GBP/ZAR recovery: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here