South African Rand Outlook Worsens amid Squeeze from External and Domestic Factors

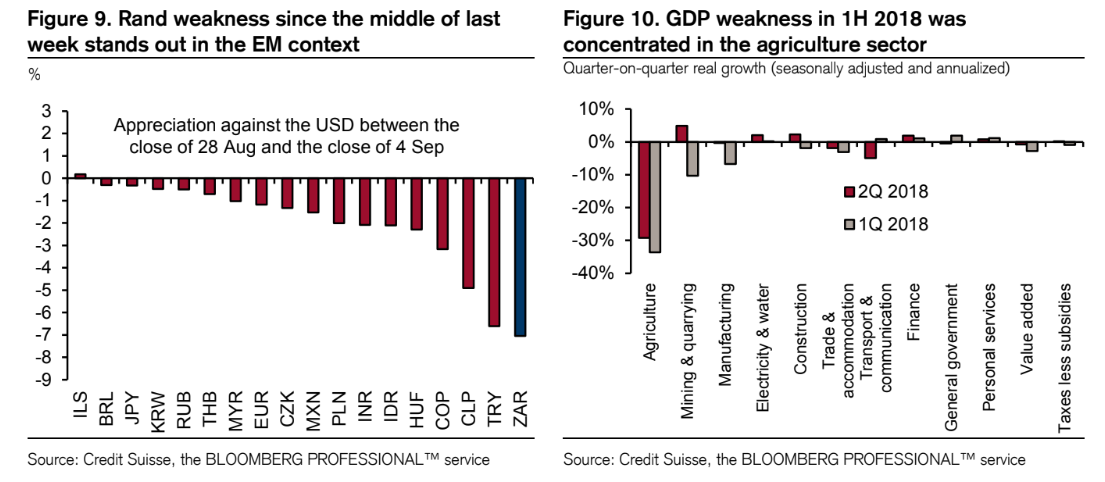

- Rand to fall ratings fears return amid falling growth.

- External emerging market factors to also weigh on ZAR.

- USD/ZAR forecast to rise and stay above 15.00 level.

Image © Comugnero Silvana, Adobe Stock

The South African Rand is likely to fall during coming weeks, according to Credit Suisse, because external and domestic drivers are both expected to continue weighing on the currency.

South Africa's currency will face headwinds as it continues to take its cue from the falling Turkish Lira and Argentine Peso, which have prompted investors to prefer safe-haven assets and driven capital outflows from emerging market economies.

"From an internal standpoint the currency is challenged by poor domestic growth which is now recessionary after two negative quarters. This is "unlikely to recover in a big way over the coming months (due to depressed gold and platinum prices and the pending land reform)," says Nimrod Mevorach, an analyst at Credit Suisse. "Further, a lack of growth poses risks for the economy's credit rating when Moody's reassesses it on October 12."

Above: Credit Suisse graph showing Rand and SA economic-sector performances.

"We see a decent chance that the rating agency will revise South Africa’s rating outlook to negative (from neutral) which will pave the way for a downgrade below IG down the line (from Baa3 currently both for hard and local currency debt). An outright downgrade next month cannot be completely ruled out either," Mevorach adds.

If S.A's local currency credit rating was downgraded it would be a catastrophe for the Rand. Moody's currently rates the government's bonds only one notch above investment grade so a cut would be a downgrade to "junk status", which would see them excluded from the Citi World Government Bond Index (WGBI).

Such an exclusion would mean they fail to meet criteria for inclusion in the portfolios of many institutional investors, likely forcing the wholesale-dumping of South African debt on the market, which would weigh heavily on the Rand since it is the currency that most of the nation's government bonds are denominated in.

"A potential exclusion of the country from the index will trigger substantial forced selling of government bonds by international investors. From this perspective we see value in USD/ZAR volatility and risk reversals around this event as it is posing asymmetrical upside risks to USD/ZAR, in our view," says Mevorach.

Credit Suisse forecasts the USD/ZAR rate will rise back above the 15.00 level and remain there through year-end as a consequence of these factors.

Above: USD/ZAR rate shown at daily intervals.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here