Populism at Heart of South African Rand + Emerging Market Sell-off: Algebris's Gallo

Above: South African President Ramaphosa. Enacting of populist policies at a time of Emerging Market stress has made the Rand one of the worst performing global currencies of the past month. Image © Government of South Africa.

- A common denominator in the EM crisis is the rise of populism

- These have worsened economic conditions in many EM countries making them more vulnerable

- The crisis is likely to worsen due to populist government economic policies

The rise of populism is an important "catalyst" in the downturn of the South African Rand and other key emerging market (EM) currencies says a leading fund manager.

Populist policies have laid the groundwork for the EM crisis by encouraging policies which have increased the risk factors for already risky EM investment destinations.

These include encouraging rather than discouraging greater public spending and tolerating a wider deficit, as well as encouraging cheaper borrowing by keeping interest rates low, out of a fear that raising them would strangle growth.

"You have leaders who are convincing their electorate that growth can continue, that infrastructure spending can continue, that they can re-allocate land," says Alberto Gallo, portfolio manager at Algebris Investments.

Gallo notes populism is spreading all around the globe and bringing with it greater extremes.

"You have polarisation - think of President Erdogan, for example, with infrastructure and construction as 10% of GDP; the reallocation of land in SA; the Brazilian election where you have a right and a left-wing populist potentially going into the second round with Mr Bolsonaro and Mr Haddad," says Gallo in an interview with Bloomberg TV.

President Cyril Ramaphosa's agenda of confiscating land - along racial demarcations - has drawn notable investor concern to the country. The ruling ANC party have one eye on next year's elections and are betting a populist redistribution policy will secure their vote.

At a time when sentiment towards emerging markets is already soft, such policies will create hesitancy amongst international investors who will question whether this land confiscation policy will open the door to further policies that would place their capital at risk.

The South African Rand has meanwhile also had to absorb news that the country is now in recession; policy uncertainty and a shrinking economy are now seen as a recipe for further sovereign ratings downgrades.

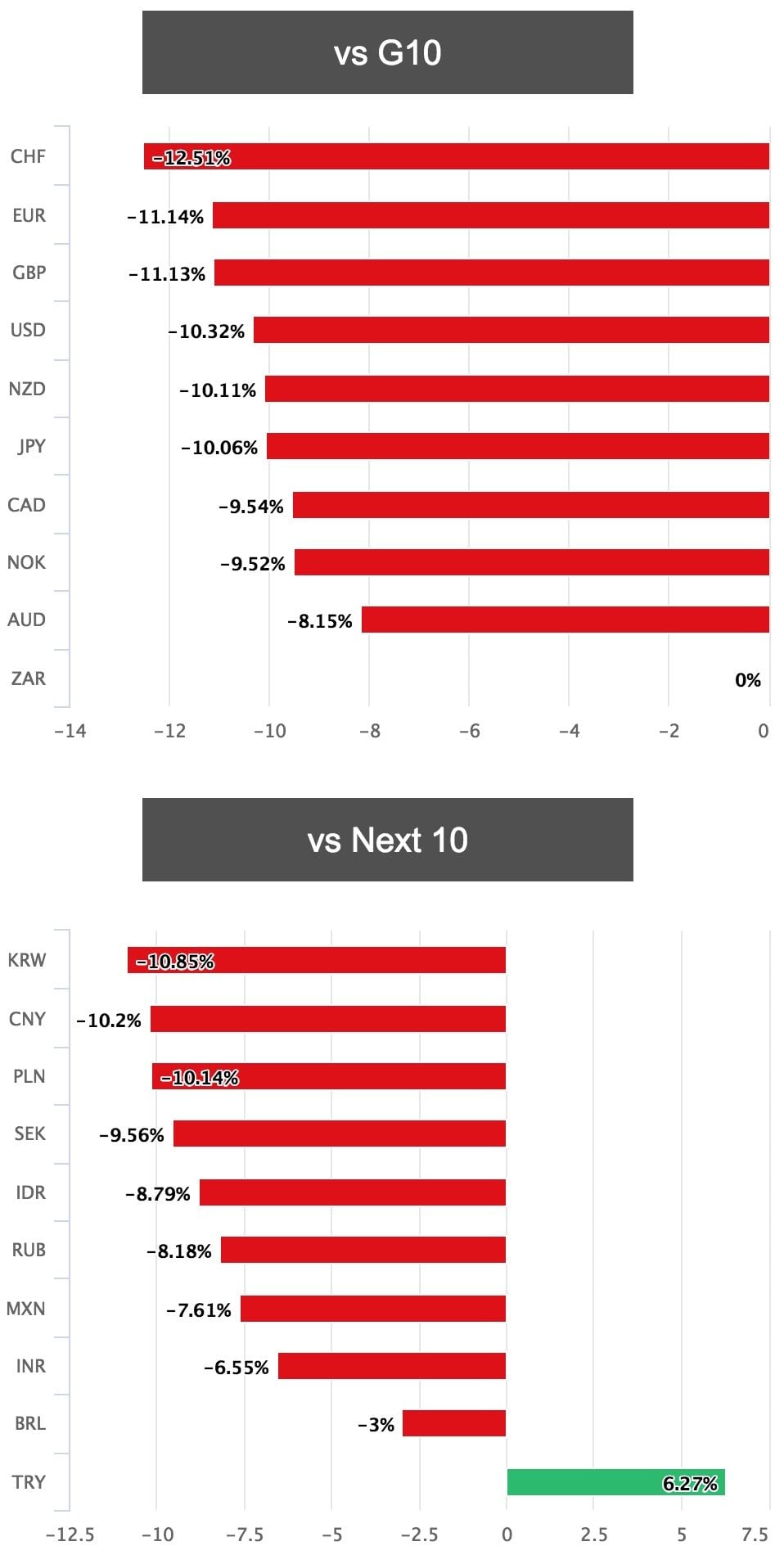

Above: The Rand's performance over the past month. Note the Turkish Lira and Brazilian Real occupy the bottom of the pile with ZAR.

Yet keeping interest rates low - right across the emerging market space - is not the medicine these economies need says Gallo, what they should be doing is hiking interest rates to to support their battered currencies and cutting imports and public spending to close their deficits.

But in reality few are willing to pay the price of such unpopular and painful policies.

And, according to Gallow the EM currency crisis has further to go because valuations in most of the EM remain higher than they ought to be given the increasing risks of contagion.

"Valuations are still - obviously in Turkey and Argentina, which are the weakest countries from a current account POV they have already repriced - but valuations in the rest of the EM world are still around long-term averages, so we don't think this is over, especially on the bond side," says Algebris's Gallo.

The roots of the EM crisis lie in the long-term post-financial crisis trend of investing in riskier emerging market assets because they offer greater returns. The extremely low rates on offer in the 'west' following the GFC exacerbated the trend to invest in EM.

"Investors have put money into emerging markets over the last 10 years because of very easy environment of financial conditions. We are now witnessing a reversal of this 10-year trend of inflows," says Gallo.

The US has benefited the most from the EM exodus because it combines safety with higher rates and potential growth, and this has caused a rise in inflows to US Treasuries and a rise in the Dollar, further exacerbating the crisis for many EM countries with high levels of Dollar-denominated debt.

Legacy debt imbalances are another major factor in the EM crisis.

"The debt imbalances which caused the crisis 10-years ago are still there. In emerging markets they are actually larger in some countries," says the Algebris portfolio manager.

Taking Turkey as a case study, the country's problems have been mainly due to a private debt "overhang" since public debt is relatively low.

"Public debt is not very high but private debt is for both corporates and SMEs," says Gallo.

One of the causes of the increase in private debt has been the easy monetary conditions in Turkey, which have been encouraged by President Erdogan who has not wanted the central bank to put up interest rates.

Yet this is now causing the run on the currency, which is driving up inflation.

And the cure?

Gallo says, "normally in a currency depreciation environment exports would help you, but the reality is that in most of the EM crisis eventually you need to hike rates. You are going to have a domestic credit crunch and you will also have to reduce the current account deficit."

This is in turn achieved "by cutting imports, by a large amount - between one quarter and three quarters," he adds.

The weakness in emerging market currencies ultimately acts as tool for enacting this cutting of imports as they lose purchasing power on international markets.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here