Pound / Rand Rate Eases from Near One Year Highs and Could Slip Further

- Written by: James Skinner

- GBP/ZAR easing from 21.50 & near one year highs

- As USD/ZAR retreats from 16.00 to open new year

- Softer USD a risk to GBP/ZAR despite buoyant GBP

Image © Adobe Images

The Pound to Rand exchange rate entered the new year close to 12 month highs but had softened by the mid-week session and could be at risk of further losses during the weeks ahead if U.S. Dollar exchange rates continue to ebb from their own recent highs.

South Africa’s Rand notched up gains over all of the major currencies in the G10 contingent during the opening week of the new year while also rising against many in the emerging market sphere following Wednesday declines in the all-important USD/ZAR exchange rate.

USD/ZAR failed in its first attempt to climb back above 16.00 earlier in the week and was seen lower on Wednesday alongside widespread declines in other Dollar pairs, which also helped pull GBP/ZAR lower from near one year highs despite a buoyant performance from the Pound also.

The Dollar has softened and the Rand has caught a bid with trading conditions normalising in the wake of the holiday, a period that had seen the South African currency’s December gains melting away with global market trading volumes.

"South Africa has seen its fourth wave of COVID-19 infections pass its peak, reaching a 7-day rolling average of 23 437 new cases mid-December,” says Annabel Bishop, chief economist at Investec, writing in a Wednesday note to clients.

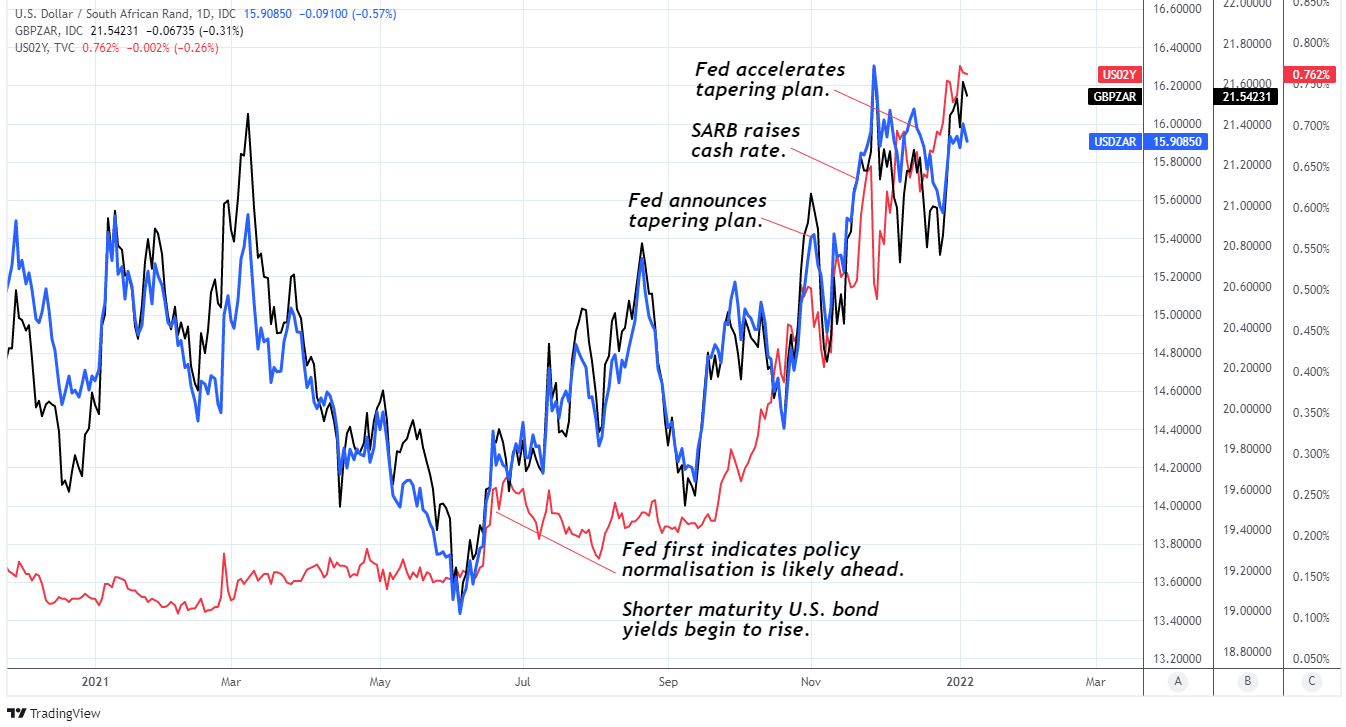

Above: GBP/ZAR rate shown at daily intervals alongside USD/ZAR.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

"Omicron has not seen escalated levels of lockdown restrictions in SA as the milder, but highly infectious new variant has resulted in significantly lower levels of hospitalisations and deaths than in the previous (third) wave driven by delta and looks to be driving out other variants,” Bishop also said.

Previously the Rand had been lifted alongside other risky currencies including Sterling as the greenback ebbed toward year-end and after a series of other international studies confirmed the initial findings of South African scientists in relation to the Omicron variant of coronavirus.

Multiple analyses have suggested in the last month that Omicron is likely a milder variant and lesser threat to public health than its predecessors while in the interim South Africa’s fourth wave of infections has come and gone.

{wbamp-hide start}{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Each of these factors helped last month to frustrate what has otherwise been a six-month rally in GBP/ZAR and USD/ZAR that is mostly the result of an accelerating shift in the monetary policy stance of the Federal Reserve (Fed), which was a boon for the Dollar in the latter half of last year.

“The currency is likely to be driven by global risk sentiment and local Covid-19 developments (the number of cases has declined in the past few weeks). The 15.50-16.25 is the USD/ZAR range to watch,” says Yuliya Kryzhanovska, a trader at Credit Suisse.

USD/ZAR’s nascent retreat from 16.00 could potentially extend as far as 15.50 over the coming days, according to Credit Suisse’s Kryzhanovska, and this might be likely to push the Pound to Rand rate back to 21.0 unless Sterling benefits in the interim from an extension of its own December rally.

Above: USD/ZAR and Pound-to-Rand rate shown at daily intervals alongside 02-year U.S. government bond yield.

The Pound to Rand rate tends to closely reflects the relative performances of USD/ZAR and the main Sterling exchange rate GBP/USD, which rose more than two percent during the month to Wednesday and could struggle to extend much beyond the nearby 1.36 level in the short-term.

“Sterling has had a good Christmas period. On a trade-weighted basis, it has broken to the strongest levels since early 2020. The UK government's decision to power through the Omicron surge with relatively few restrictions seems to have been rewarded by investors,” says Chris Turner, global head of markets and regional head of research for UK & CEE at ING.

While Sterling has been buoyant in recent trade much about the outlook for GBP/ZAR and USD/ZAR this January is hinged on whether the market remains as enthusiastic about the U.S. Dollar as it was in the latter half of last year when the Fed slowly but surely prepared the market for a withdrawal of the monetary support provided by its quantitative easing programme and near-zero interest rate throughout the coronavirus crisis.

The Fed’s stimulus withdrawal was accelerated in December with a new plan to wind down the QE programme by March this year rather than the initially intended June 2022, and could ultimately see U.S. interest rates rise as soon as the end of the first quarter, although the Dollar has not been able to capitalise on this accelerated policy shift since it was announced last month.

“We think it too early to declare that the dollar bull trend is over, but do acknowledge that some consolidation at higher levels can allow other stories to play out. That seems to be the case with the strong performance of Sterling and some of the CE4 currencies of recent weeks after the BoE pulled the trigger in December and central banks in the Czech Republic, Hungary and Poland have all accelerated their tightening cycles," Turner and colleague Francesco Pesole said in a note on Wednesday.