South African Rand Cushioned by Major Chart Supports as Outlook Hangs in Balance

- Written by: James Skinner

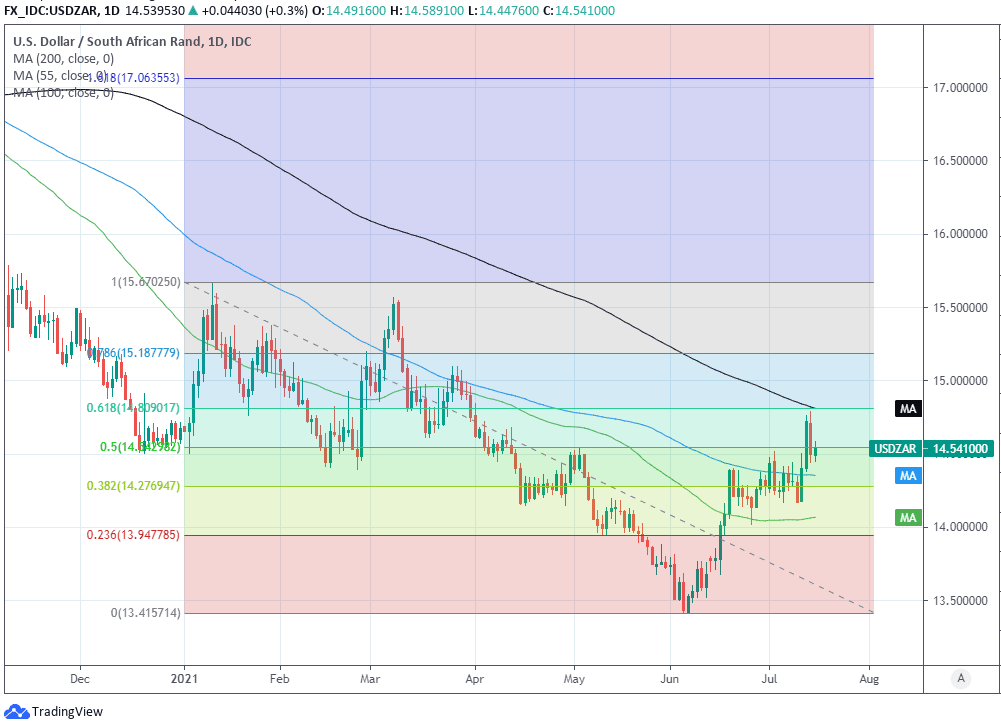

- USD/ZAR rally contained on charts but outlook in balance

- Fib level at 14.80 & 200-day average at 14.81 contain USD

- But disorder continues, acts as magnet for ZAR’s naysayers

Above: File image of President Ramaphosa. Image © Government of South Africa

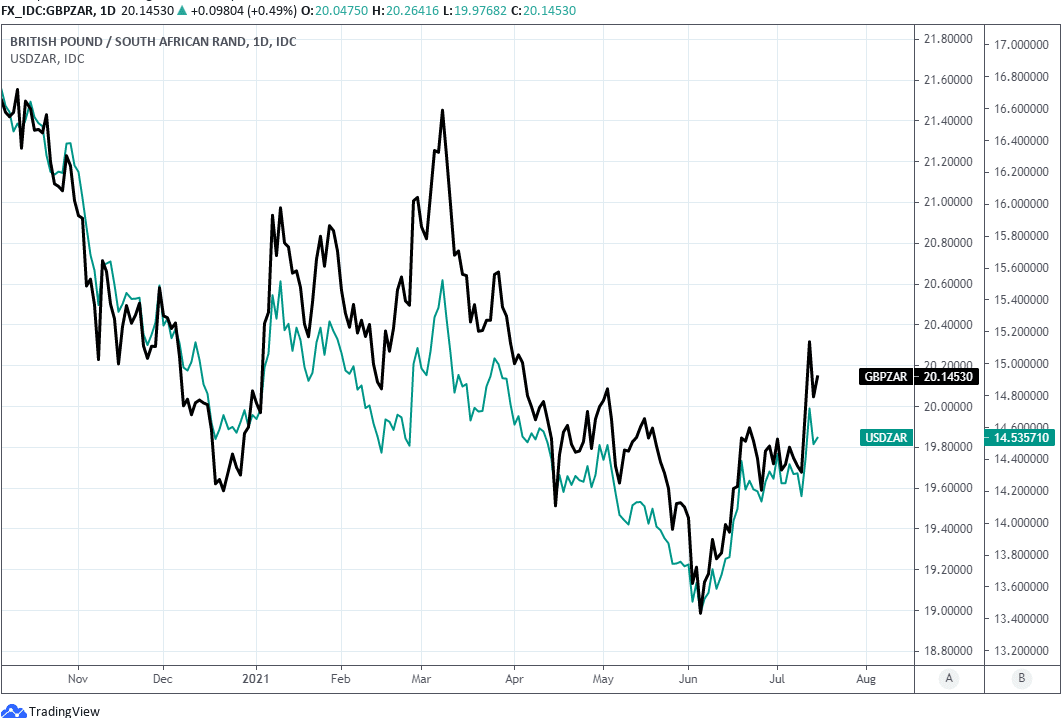

- GBP/ZAR reference rates at publication:

- Spot: 20.14

- Bank transfer rates (indicative guide): 19.43-19.57

- Transfer specialist rates (indicative): 19.95-20.00

- Get a specialist rate quote, here

- Set up an exchange rate alert, here

The Rand has been cushioned by a cluster of major technical support levels on the charts but with civil unrest disrupting South African society and further stalling its economic engines, the outlook for USD/ZAR and other Rand exchange rates hangs in the balance.

South Africa’s Rand took the market by surprise earlier in the year, quickly becoming the best performing currency of them all after USD/ZAR broke beneath 14.50 in April and began squeezing the Rand’s speculative detractors out of the picture.

But the danger is now that with the costs and possible implications of ongoing violent unrest stacking up, as the Rand nears major but pivotal levels of technical support on the charts, would-be naysayers could feel emboldened to return to old stomping grounds.

“Over the last week, the reversal we have been waiting for materialized,” says Brendan McKenna, an economist at Wells Fargo.

“While we did not assume nationwide demonstrations would be the catalyst for a weaker currency, we do, however, believe political dynamics could be the spark that forces market participants to pay attention to South Africa's underwhelming economic fundamentals,” McKenna writes.

South Africa’s Rand had been a prime beneficiary of huge gains for commodity prices earlier in the year, which helped to convert a longstanding and financial encumbering ‘current account deficit’ into a supportive surplus.

The above factors among others had helped to provide assurance to yield hungry investors who this year proved willing to look past “underwhelming,” but also well known, economic fundamentals like South Africa’s elevated debt burden, creaking infrastructure and governance challenges.

Above: Pound-to-Rand rate shown at daily intervals alongside USD/ZAR.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Newly-improved fundamentals remained intact on Thursday but with USD/ZAR having surged this week as large population centres descended into violence and disorder over the jailing of former president Jacob Zuma, parts of the market have clearly been spooked away from the Rand.

“Who would dare to invest in SA now?” asks Rob Rose, editor of South Africa’s Financial Mail, in a lamentation of the destruction seen this week.

USD/ZAR had been correcting higher and the Rand lower ever since early June although until Monday the exchange rate’s 100-day moving-average had limited the retracement and kept the Dollar contained, although that gave out this Monday before the Rand spiralled lower.

“As we write this letter, our journalists in KwaZulu-Natal and Gauteng are being threatened by the looting mobs,” writes the editorial board of News 24 in an open letter to President Cyril Ramaphosa.

“Gauteng and KwaZulu-Natal, as well as other parts of the country, will see severe petrol and food shortages in a matter of days. This will probably lead to another round of looting and panic buying,” News 24’s Thursday letter later states.

Above: USD/ZAR at daily intervals with Fibonacci retracements of 2021 fall and selected moving-averages.

The Rand’s sell-off appeared to run out of steam on Wednesday when USD/ZAR tested and failed for a second time to overcome the 61.8% Fibonacci retracement of this year’s recovery - often the most formidable of the Fibonacci levels in financial charting - which is located around 14.80.

That support has cushioned the Rand so far and is backstopped by USD/ZAR’s 200-day moving-average, which was at 14.8119 as of Thursday, although whether even these major technical levels are able to keep the exchange rate under wraps is an open question that has the outlook for the South African currency hanging in the balance.

“Riot-related disruption at the Port of Durban has seen global shipping giant Maersk shutting down its depots, warehouses, and cold stores in both Durban and Johannesburg. That means getting new food in could take time, exacerbating things on the ground,” says Michael Every, a global strategist at Rabobank.

“South African ports are also a key stop-off point for trade between Latin America and Asia: if unrest there is not rapidly contained, it could impact shipping and insurance rates between the two, which would push the price of commodities and food even higher than they were already going – and so exacerbate pre-existing socio-economic-logistical fault-lines that can create further supply-chain disruption.”