South African Rand Tipped for a Recovery

- Written by: James Skinner

- ZAR shows signs of recovery with fresh outperformance

- Fends off USD, aided by rising gold price, losses for oil

- Soc Gen eyes 14.0 as MUFG tips USD/ZAR dip to 13.86

Image © Pound Sterling Live

- GBP/ZAR reference rates at publication:

- Spot: 19.75

- Bank transfer rates (indicative guide): 19.06-19.20

- Transfer specialist rates (indicative): 19.58-19.62

- Get a specialist rate quote, here

- Set up an exchange rate alert, here

The Rand has been an outperformer during the opening weeks of July and analysts say the South African currency could now be on course to return toward its recent multi-year highs over coming months.

Despite recent turbulence, the Rand remains the best performer for the 2021 year-to-date even as USD/ZAR rallied from August 2018 lows around 13.30 in early June, to a peak of 14.51 this Monday.

In addition, it has comfortably outperformed all of its major developed and emerging market counterparts during the opening week of the new month including the Dollar, despite the U.S. currency itself making gains over many others along the way.

This could be one of a number of signs that the recent month-long sell off is all but over.

“The failure of USD/ZAR to again decisively breach resistance at 14.3832 (the 100-day moving-average) should embolden rand bulls who may target a retest of 14.00,” says Kenneth Broux, a strategist at Societe Generale.

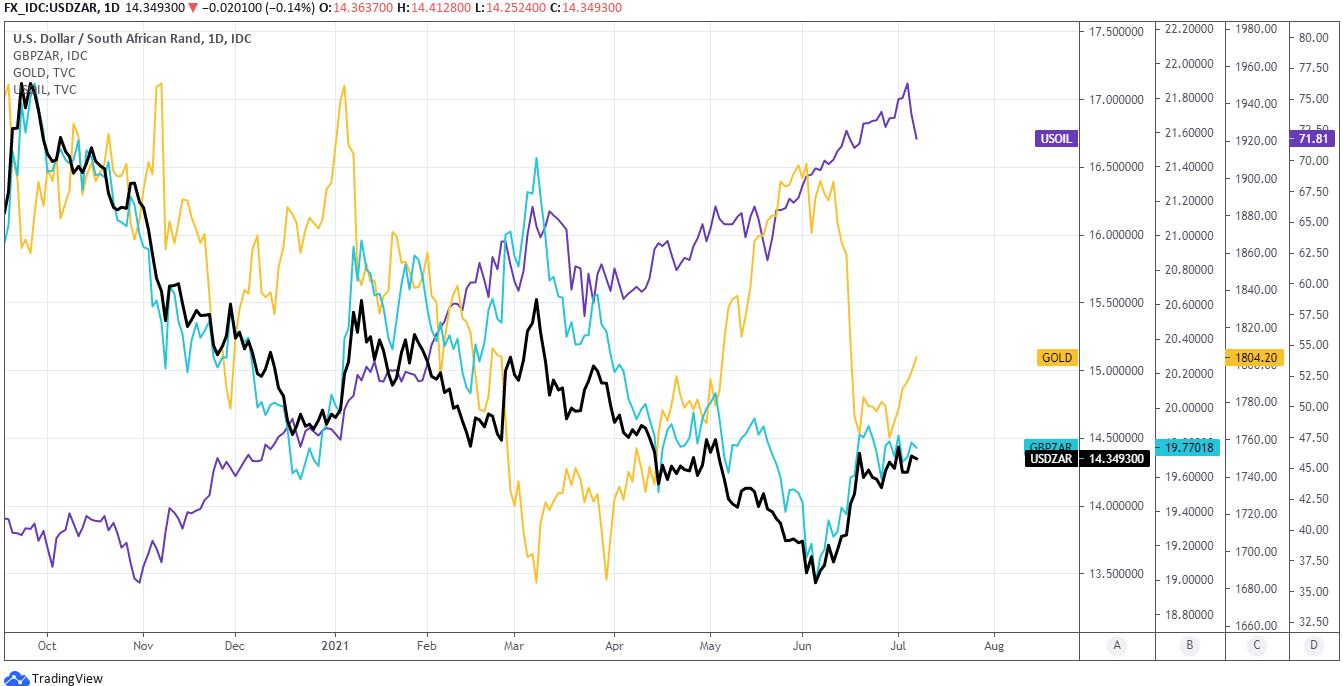

Above: USD/ZAR with Fibonacci retracements of April fall, 100-day moving-average and GBP/ZAR.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The Rand has effectively drawn a line under last month’s declines, which were inspired by an indication from the Federal Reserve (Fed) that it could begin lifting U.S. interest rates as soon as the end of next year.

“After such a sharp correction lower the ZAR now appears more attractively valued. Our base case scenario is for US rate hike fears to begin to calm down at the current juncture rather than continue to escalate,” says Derek Halpenny, head of research, global markets EMEA and international securities at MUFG, who recommended this week that clients buy the Rand by selling USD/ZAR around 14.36 and look for a move down to 13.86.

“ZAR should begin to rebound following the heavy sell off as Fed rate hike fears begin to ease. The positive fundamentals that have led to ZAR strength for most of this year including favourable carry, improving terms of trade and improving investor risk sentiment remain in place,” Halpenny adds.

Top of the list among the positive fundamentals referenced by MUFG’s Halpenny and supporting the Rand this week is a doubly favourable mixture of commodity price developments including gains for gold prices which have built at the same time as the oil market has begun to deflate.

A falling oil price is positive for the South African economy, which is heavily dependent on imports and as a result susceptible to the inflation that can be kicked up by changes in energy prices, although the currency benefits most through the impact that falling oil prices have on the terms-of-trade ratio.

Above: USD/ZAR and GBP/ZAR at daily intervals alongside WTI crude oil and gold futures price.

“Strong terms of trade gains and the persistent current account surplus are clearly ZAR-supportive factors from a fundamental standpoint. They will likely help to shield the currency against potential global market moves,” says Paul Mackel, global head of FX research at HSBC, who sees USD/ZAR around 14.20 at the end of September.

The terms of trade ratio measures the prices of a country’s exports against those of its imports, and can have an uplifting effect on a currency’s model-derived estimates of ‘fair value’ whenever it improves.

Declining oil prices will have put downward pressure on South Africa’s import costs as well as inflation, while rising gold prices would lift export revenues with the net result being a favourable increase in capital flows associated with international trade and an improvement in the terms-of-trade ratio.

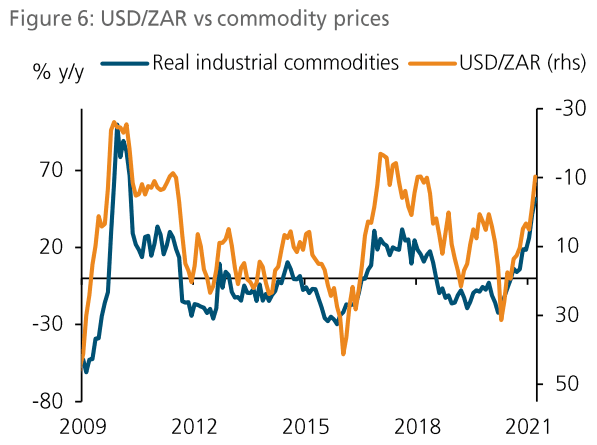

“To put the relationship between commodity prices and the rand into perspective, our 2Q21 USD/ZAR fair value estimate has strengthened from 15.60 in August 2020 to 13.36 currently, due almost exclusively to commodity prices (Figure 6). We expect commodity prices to rise at a far more muted pace in 2H21, so that the rand’s fair value averages 13.80,” says Kim Silberman, a currency and bond analyst at Rand Merchant Bank, in a May briefing.

“Apart from commodity prices, the rand’s outperformance can be attributed to the elevated FX swap basis, which, from a currency perspective, is equivalent to about a 150bp hike in the repo rate. That means the cost of shorting the rand against the US dollar is 150bp higher than it would have been if the basis were not elevated. We expect the rand basis to remain elevated for at least the next 12 months and possibly until SA’s IFI loans need to be repaid. This should keep the rand trading stronger and in a tighter range than has been the case since Nenegate,” Silberman says.

Above: Rand Merchant Bank graph showing changes in commodity prices plotted against inverted change in USD/ZAR.