South African Rand Outlook Remains Challenged as Emerging Markets are Tipped to Languish for Longer by El Erian

Image © Adobe Images

- El Erian says too early to buy back into struggling emerging markets

- Argues trade spats will continue and potentially grow bitter in the long-term

- SA Rand is vulnerable due to current account deficit and commodity bias

From peak-to-trough the Rand has lost over 25% against the Pound this year and although it has pulled back from its September lows - when one Pound bought you over 20 Rand - the overall year-to-date loses remain considerable.

Much of the weakness has been due to emerging market (EM) outflows caused by a series of increasingly belligerent trade spats between the US and key 'bete noire' EMs.

Image (C) Pound Sterling Live, TradingView.

At the same time, part of the outflow was due to investors diverting capital out of EMs and into the US due to runaway US growth offering better returns.

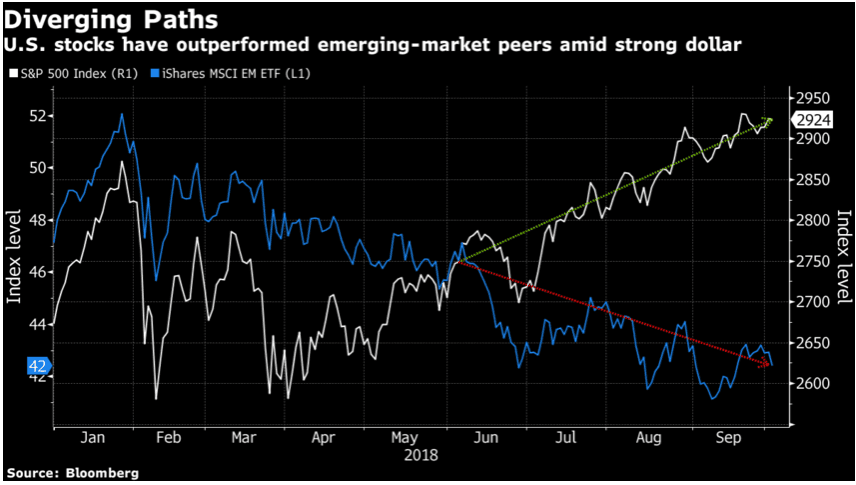

The divergence between US assets and EM's, however, has now widened to a point where it is so wide it is at risk of 'snapping shut' and this has led some investors to consider reinvesting in EM.

Image courtesy of Bloomberg.

Their investment thesis argues that EM currencies and assets have been so badly hammered that they now present 'value'. If this is true we may be about to see the see-saw swing back in EM's favour, with a concomitant rise in EM currencies, including the SA Rand.

One notable critic of the so-called 'divergence trade', however, is Mohammed El Erian, the former head of Pimco, the largest bond fund in the world, and a current advisor to Allianz SE.

El Erian says the macroeconomic backdrop does not favour back-flows into EM.

“Investors need to be cautious,” says El-Erian. “History suggests that rising oil prices, a strong dollar, tighter global liquidity conditions, and slowing global growth can be a disruptive combination for quite a few emerging economies.”

In support of his view, crude oil has climbed toward a four-year high, the Dollar is not far off its August 2018 highs and the Federal Reserve looks like it is going to continue with its fairly aggressive rate hiking regime, probably fuelling further gains for the Dollar, as foreign investors see the US as more attractive destination to deposit their money, due to higher interest returns.

El Erian also says that the pattern of previous trade disputes is likely to endure, and that pattern is characterised by nations making concessions to the US - such as has been the case with Mexico, South Korea, and Canada, and is likely to be the case with the EU.

The same will happen with other nations and this will work in the US's favour in the short-to-medium term. By extension, it is also likely to support the Dollar.

Longer-term, however, the risks increase that China will retaliate and wage a bitter trade war with the US.

Advertisement

Lock in Sterling's current levels ahead of potential declines: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

"Longer-term, there will be questions, this thing could tip one way or another. The Chinese have a much longer time-horizon. So it makes sense for them to make concessions in the short-term to play the long game and the long game could mean either a return to intensified trade conflict or a basic modernisation of the trading system. So it is increasingly bi-modal once you get through the short-term," says El Erian.

The reason why now may not be a good time for investors to return to EM, however, is because the short-term outlook favours the US using the same tough tactics - which El Erian explains as the "stick rather than carrot mentality" - to get what it wants and so there may be more market jitters as trade disputes continue.

Drawing on game theory analysis, El Erian argues that there are two ways to go about trading with other nations: 'cooperatively' and 'uncooperatively', and the US has chosen the latter. This ought to continue to put pressure on the most vulnerable EM nations, and their currencies.

He sees the concessions as leading to a system which will be inherently unstable and will eventually give way to either of the polar outcomes mentioned above of war or modernisation.

South Africa and the Rand are likely to remain vulnerable to the ripple effect from these conflicts.

South Africa has a large current account deficit and a reliance on commodity exports both of which make it particularly vulnerable to these macro factors.

Trade wars tend to push down commodity prices because tariffs stymie trade. A wide current account deficit must be financed from abroad, which becomes increasingly difficult with a weaker currency. Since most borrowing is done in US Dollars it gets even harder when the Dollar strengthens at the same time, as happened in 2018.

Countries with political risks are also vulnerable and the new Ramaphosa administration has somewhat disappointed with the economic reforms enacted, and although a package of pro-growth measures was recently unveiled it took the country falling into a recession for action to be prompted.

Investors have also expressed concerns at aspects of some of the forcible land distribution reforms which have been proposed, and the political landscape continues to pose a risk factor, as does the countries credit rating, which continues to teeter one notch above junk status.

Advertisement

Lock in Sterling's current levels ahead of potential declines: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here