Australian Dollar: Bullock Warns on Rate Cuts

- Written by: Gary Howes

Above: File image of Michelle Bullock. Image © RBA

Australian interest rates won't be cut in the "near term", warns the Governor of the Reserve Bank of Australia (RBA), confirming interest rates will remain a bedrock of Australian Dollar strength.

Speaking in Sydney, Michelle Bullock said underlying inflation in Australia is still "too high" to consider a near-term cut to interest rates.

The comments will underpin expectations that it won't be until the second quarter of 2025 that Australia might see the first reduction in interest rates.

The Australian Dollar has outperformed its commodity-dollar peers over recent months thanks to Australia's relatively high interest rates.

The prospect of rates staying higher for longer can underpin the Aussie currency's outperformance further.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

"We think Australia’s strong labour market implies relatively persistent inflation, leaving the RBA as a global outlier in the current easing cycle. We expect the RBA to begin cutting rates in May," says NatWest Markets.

Bullock said rates must remain in "restrictive" territory until the RBA is confident inflation is returned sustainably to the 2.0%-3.0% target band.

Australia's Headline inflation eased to 2.8% over the year to the September quarter of 2024, down from 5.4% over the year to the September quarter of 2023.

However, Bullock said the fall in inflation was largely driven by one-off factors, such as government electricity rebates. Because of this, she said there was some way to go before inflation was "sustainably" within the 2-3% band.

🎯 GBP/AUD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

"Despite the decline there is still some way to go to return inflation sustainably within our 2–3 per cent target range," she told the Committee for Economic Development of Australia (CEDA) Annual Dinner.

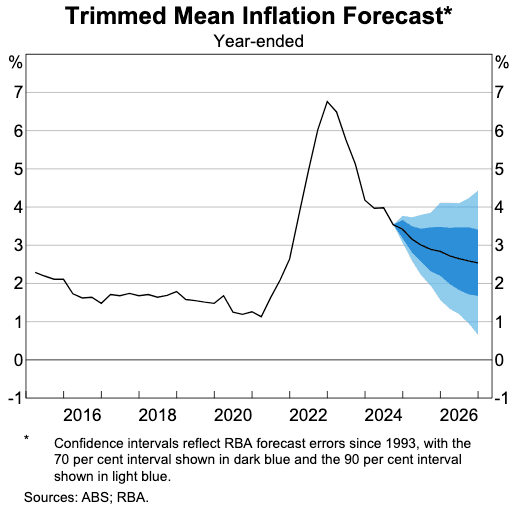

RBA staff expect inflation to return sustainably to the 2.5% midpoint of the target range by late 2026.

Bullock confirmed that the RBA remains in a data-dependent mode with no date identified for a first cut, primarily because the country's job market was "too tight" to be consistent with the required fall in inflation.

"Australia’s labour market conditions appear unusually tight, relative to those in other peer economies. Conditions in labour markets in those economies have eased significantly and unemployment has increased, such that labour markets are now assessed to be close to balance or have spare capacity. Given the tightness in Australia’s labour market, along with our assessment that the level of demand still exceeds supply in the broader economy, we expect it will take a little longer for inflation to settle at target in Australia," said Bullock.

She says demand for workers remains robust, particularly when compared to peer economies.

Given this, she thinks it will take "a little longer" for inflation to settle to target in Australia.