U.S. Public Debt to hit 8% of GDP, Reaching its Limits: Fidelity

- Written by: Gary Howes

Image source: Fidelity International

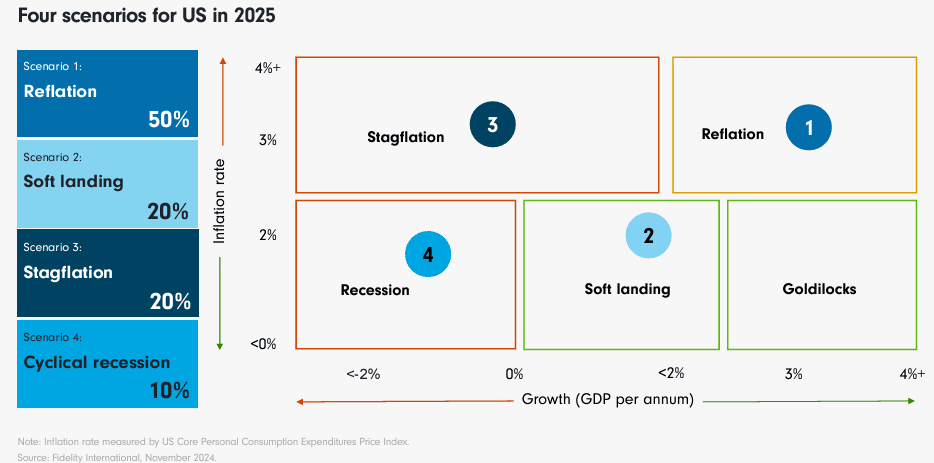

Fidelity International expresses concern about the lack of a clear path to slow the growth of U.S. public debt over the next four years.

In the asset manager's year-ahead investment strategy outlook, economists say expansive fiscal policy and significantly higher tariffs are likely to be the centrepieces of a second Trump presidency, expanding the deficit to an extraordinary 8% of GDP.

This should drive nominal GDP growth significantly above trend and aid headline numbers in 2025, reflating the U.S. economy.

"Against that backdrop, the changes the new administration has set out meaningfully increase the odds of outright rises in US inflation from the second quarter," says Salman Ahmed, Global Head of Macro and Strategic Asset Allocation at Fidelity.

However, the long-term sustainability of these debt levels is questionable, especially if tariff policy is more aggressive than Fidelity is assuming.

Fidelity believes that public finances are fast reaching their limits and that above-target inflation is likely to become the least costly option for an orderly resolution to the problem of debt sustainability.

The Republican sweep unlocks the potential for even larger deficits and reflationary economic policies domestically

Fidelity wanrs markets may have greeted the prospect of increased fiscal spending with euphoria, but it's a sign that all is not well with the underlying growth picture.

This growth picture is further threatened by increasing geopolitical tensions.

Given this macro setup, Fidelity sees good value in moving out of nominal U.S. government bonds into inflation-linked treasuries.

Here are Fidelity's key fixed-income investment strategies for 2025:

- Defensive US dollar investment grade: This strategy is recommended to shelter from recession risks.

- Global short duration income: This strategy is recommended to lock in decent all-in yields.

- Asian high yield: This strategy is recommended to capture attractive carry and spread compression.

Rationale for the Key Strategies:

US Recession Risks and Interest Rate Uncertainty

Fidelity believes a dominant theme for fixed-income markets in 2025 will be where US interest rates settle at the end of the current rate cycle.

Investor estimates for the terminal rate trough have been volatile. For example, when the Federal Reserve cut rates by 50 basis points in September 2024, the market's assessment of the terminal rate went up rather than down because it was thought that addressing growth risks sooner would mean less overall reduction.

Fidelity notes that investors looking for value in fixed income should be aware that the market struggles to price geopolitical risks that have the clear potential to hurt economic growth.

Strategists point out that if US growth deteriorates over the next 12 months, the Fed may have to cut more aggressively than expected, resulting in a lower terminal interest rate. Given current tight credit spreads, there is a risk-reward case for adding US duration with a bias towards holding higher quality credit.

Focus on Asia

Fidelity believes a big focus heading into 2025 is the timing and extent of China's stimulus measures and their potential to boost growth both domestically and across the region.

Strategists suggest that while waiting for Beijing’s next move, it’s worth considering that:

- China's property sector now makes up around 5% of the JP Morgan Asia Credit Non-Investment Grade index, down from over 30% at its peak, making for a stronger, more balanced index.

- The average rating of Asian high-yield bonds is now BB, and rating upgrades are likely to continue, particularly in frontier Asian economies and the BB category, where some rising stars are emerging.

- Asian high-yield spreads are attractive at over 500bps, above their 20-year average, leaving room for compression. With an average duration of just two years, Asian high yield bonds are also less sensitive to interest rate moves.

Fidelity concludes that these factors create a favorable environment for Asian high yield credit, especially if we see continued Fed easing as well as more monetary easing and stimulus from China.

Investment grade Asian bonds also look good as the supply of Asian US dollar investment grade bonds has shrunk significantly, while investor demand remains high.

Importance of Monetary Policy Outlooks

Fidelity expects that the next 12 months should see a jump in fiscal spending from the US and China. They note that while markets may have greeted this prospect with euphoria, it's a sign that all is not well with the underlying growth picture - one that is further threatened by increasing geopolitical tensions.

To address these concerns, Fidelity expects that the Fed will want to be the most proactive about bringing rates down to a neutral level.

However, structural economic weaknesses in the Eurozone make a case for being overweight duration there. Further Fed cuts would free central banks in China, Korea, and Indonesia, for example, to go further in cutting their interest rates and supporting Asian bonds. Fidelity concludes that, in practice, central banks will all have to run their own race, and that keeping pace with each one will be part of the challenge for fixed income investors in 2025.