Pound to Euro: Back to 1.20 on French Risk

- Written by: Gary Howes

© European Union. Source: EC - Audiovisual Service / Photo: Mauro Bottaro.

The Pound to Euro exchange rate could run higher if French risks break into the foreign exchange market.

French politics are back in the headlines as the government looks at risk as it attempts to pass a very unpopular budget.

Opposition parties have denounced the budget put forward by Prime Minister Michel Barnier, with Marine Le Pen's RN party potentially joining forces with the left-wing bloc in parliament to topple the government in a confidence vote.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Stocks in Paris are falling and government bond yields are surging as the market grows uneasy as the country's Parliament votes on the make-or-break budget.

For now, the financial market turmoil has not extended to foreign exchange markets, but it is a risk that is firmly on the radar.

"We think that the euro could be impacted by a bout of heightened political risk if the French government collapses and there is a sell-off in the French bond market," says Kathleen Brooks, an analyst at XTB.

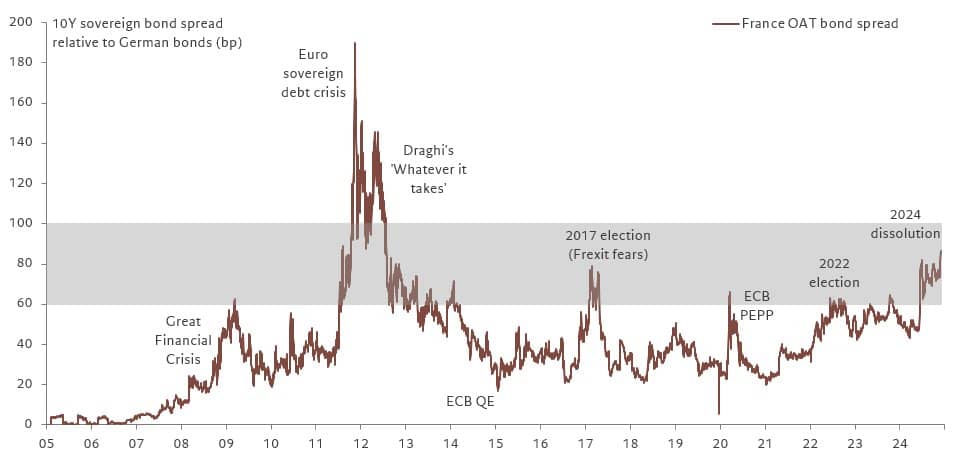

The chart below shows the cost of French debt (bond yields) versus the equivalent German yield. This is a much-watched measure of French-specific risks:

Image courtesy of Frederik Ducrozet at Pictet Wealth Management.

As can be seen, it has been rising of late, in tandem with concerns for the country's finances amidst the government's fragility.

Five-year borrowing costs climbed to 2.7% on Wednesday, more than the rate paid by the Greek government at 2.5%. French 10-year bond yields are also only slightly lower than Greece's.

Paris's borrowing costs were comfortably below Athens a year ago on both measures.

"The calm prevailing on the London exchange contrasts with the ongoing turmoil in France, where the CAC40 has hit a fresh four-month low while government borrowing costs soar," says Chris Beauchamp, Chief Market Analyst IG.

Barnier wants to push through €40bn worth of spending cuts and €20BN worth of tax rises to try and get the government's finances back on track.

His government doesn't appear to have the support to pass the budget and he is reportedly considering evoking article 49.3 of the constitution, which allows the government to force through legislation without a vote in parliament.

However, this could prompt the RN to join left-wing parties in toppling the government in a confidence vote.

Barnier's government has already survived a vote of no-confidence after RN refused to back the motion in October.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

The Euro has proven relatively immune to French developments thus far, largely because of the extraordinary dominance of the Dollar in global FX.

However, with the 'Trump trade' looking to have run its course for now there is the prospect that France's fragile political setup starts to reverberate.

The Pound to Euro exchange rate has largely been rangebound as the U.S. dominates, but if France comes to the fore a break higher could occur.

However, veteran FX trader Brent Donnelly, who runs Spectra Markets, says he is not "really sure how important the French story is for the price of EUR."

"When people got really excited about France widening in June 2024, that was the low in EURUSD. Widening spreads definitely are not bullish EUR in themselves, but short EUR on the back of France politics is unlikely to be a useful hypothesis," he notes.