Pound-Japanese Yen Breaks to 6-Month Highs as Abe Resignation Looms

- Abe resigns

- JPY volatile on news

- But Japanese policy unlikely to shift substantially

- GBP/JPY breaks higher

Image © Chairman of the Joint Chiefs of Staff.

- GBP/JPY spot rate at time of writing: 140.253

- Bank transfer rates (indicative guide): 136.297

- FX specialist rates (indicative guide): 138.961

- For more information on why these rates differ, please see here

Japan’s prime minister Shinzo Abe resigned on Friday due to his ill health, leading investors to question where the world's third largest economy was headed now its longest serving post-war leader would be replaced.

Abe apologised to the Japanese people in a press conference confirming his decision to resign due to a recurrence of a chronic inflammatory bowel condition.

"I apologise from the bottom of my heart that despite all of the support from the Japanese people, I am leaving the post with one full year left in my term and in the midst of various policies and coronavirus," he said.

Abe's resignation was leaked earlier in the day by Japan's public broadcaster NHK which caused volatility in the Japanese Yen, and we expect it might take some time for investors to fully digest the implications for Japan's economy, financial markets and the Yen.

Abe has visited a hospital twice over the past two weeks, fuelling speculation that his health has deteriorated.

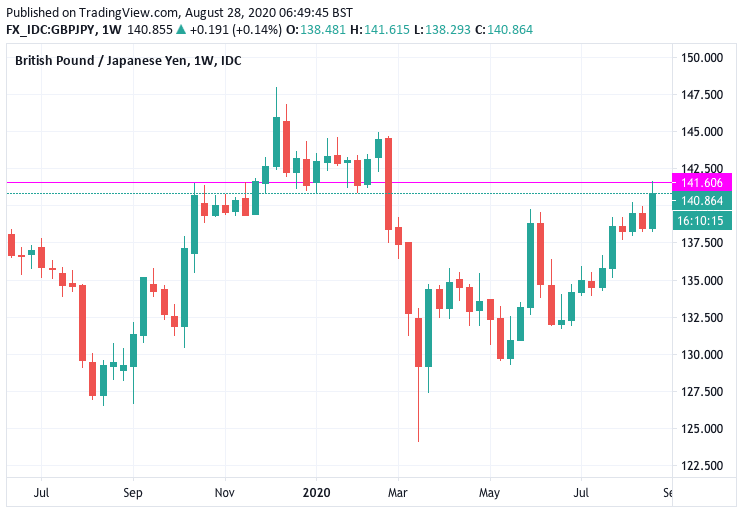

The Pound-to-Yen exchange rate rose to a six-month high at 141.606 in the wake of the news, while the U.S. Dollar-to-Yen exchange rate hit a ten-day high at 106.947 before paring those gains.

Above: Six-month highs for GBP/JPY

Abe began his second term in 2012 after a landslide election win in the Lower House, making him Japan's longest-serving post-war leader.

His tenure has left a notable stamp on the economy, dubbed 'abenomics', and investors are clamouring to understand whether his legacy will continue.

"PM Abe’s departure creates inevitable uncertainty on the outlook for ‘Abenomics’ but the essence of ‘Abenomics’ is the strong coordination between government and the BoJ and its aggressive monetary easing stance. That’s not going to change," says Derek Halpenny, Head of Research at MUFG.

Abe has a history of poor health and was forced to stand aside in 2007 owing to inflammatory bowel disease, after only serving a year in office.

💡 $JPY reaction to 2020 Abe resignation different to when Abe abruptly resigned in Sep 2007. Back then USD/JPY moved 3% higher in weeks following resignation given the political uncertainty. Key difference is Yen REER has been much weaker under Abe (~6% lower today vs. Sep 2007) pic.twitter.com/Vt4wTwyq5s

— Viraj Patel (@VPatelFX) August 28, 2020

"The market could exhibit knee-jerk equity weakness on the rising chance of an internal regime change as it is difficult to believe at this point the next PM will be able to maintain the same degree of political stability as PM Abe has. It is uncertain whether JPY will rise or sell off given this is about domestic risk, but the combination of increased political risk in Japan and the US could be initially negative for USD/JPY," says Izumi Devalier, Japan Economist at Bank of America Merrill Lynch.

Abe's term as president of the main ruling Liberal Democratic Party would have run out in September next year. The Party is now likely to hold a vote to elect its next president in a leadership race to be called shortly, paving the way for a new prime minister to replace of Mr Abe, who had been due to stay in power until September 2021.

Potential successors include a string of conservative LDP heavyweights, including former minister Shigeru Ishiba, chief cabinet secretary Yoshihide Suga and defence secretary Taro Kono.

Bank of America's Devalier says the prevailing strength in the global equity market means any risk-off market reaction to the Abe news will likely be knee-jerk in nature and be faded.

"Longer term, the next prime minister's leadership will be a key driver for the market as it will determine political stability and the administration's ability to deliver effective policy," says Devalier.

Bank of America's economists say there are two issues of concern for investors going forward, 1) uncertainty around Abe's successors' policy framework, and risk of reversal of "Abenomics" macro policies; and 2) decline in political stability and inability to advance policies due to political infighting and gridlock.

"No matter who ends up being PM Abe's successor, we think there is unlikely to be much of a difference in basic macro policy in the near term and that fears of a policy reversal are overdone," says Devalier.

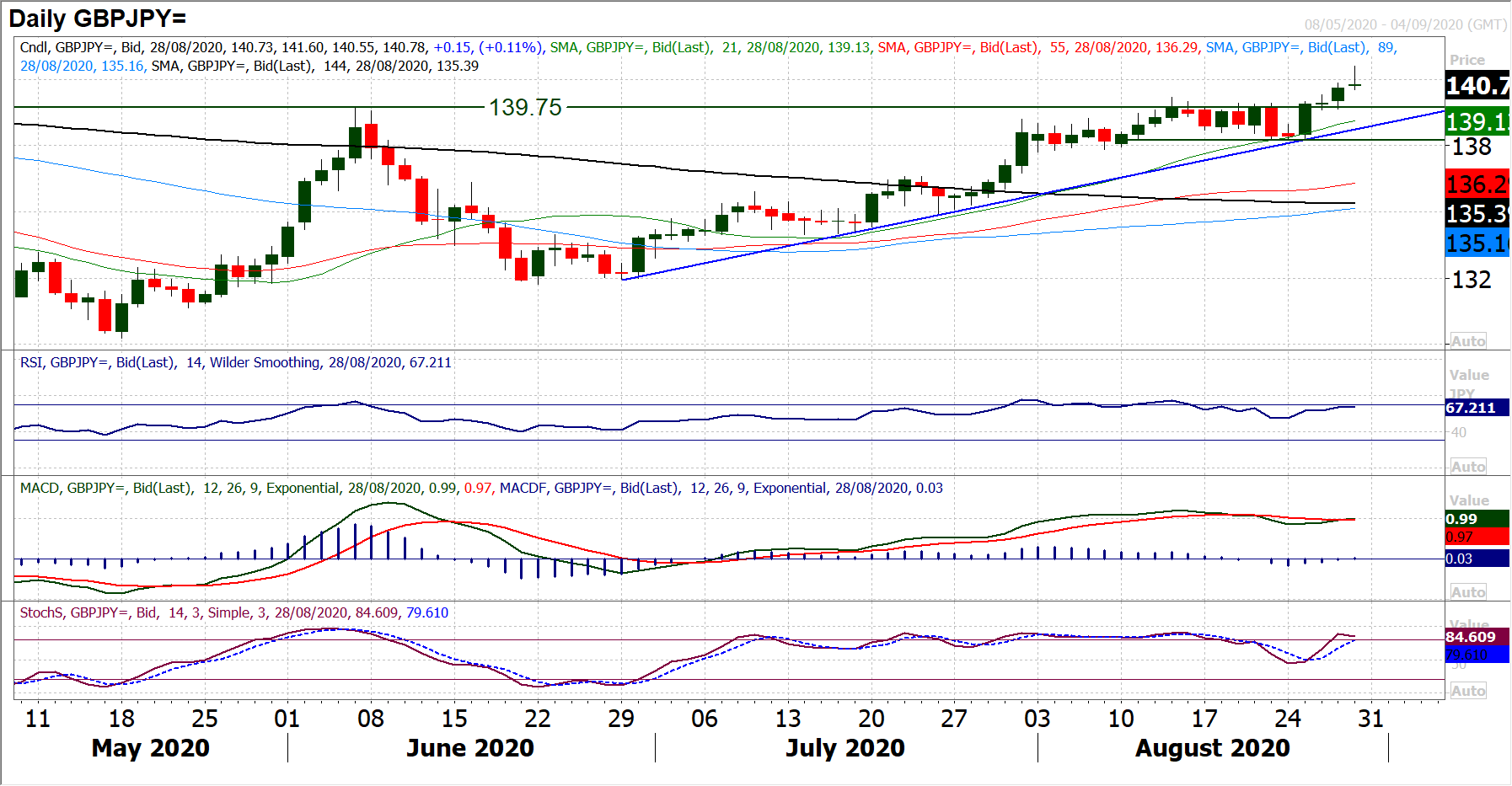

Looking at the Pound-to-Yen exchange rate in more detail, the recent moves are singificant from a technical perspective.

"Sterling/Yen has broken out decisively above resistance at 139.75. This barrier was the old June high which has been repeatedly acting as a ceiling over the past couple of weeks, until Wednesday’s closing breakout. However yesterday’s decisive bull candle has now cleared the resistance with a near six month high and is the next step forward in recovery. There has been a strong uptrend of the past two months with a succession of higher lows, the latest at 138.25 last week, but the market is now using the 139.75 breakout as the basis of support," says Richard Perry, an analyst with Hantec Markets.

"The uptrend comes in at 138.75 today, whilst the rising 21 day moving average (today around 139.10) has become a great basis of support now. Momentum indicators have turned bullish again, with upside potential too. We now look to use near term weakness as a chance to buy. With Prime Minister Abe’s resignation this morning, we could see a near term slip back but an initial buy zone is between 139.75/140.20 whilst anything towards the 21 day ma is also a buying opportunity. Below 137.75 would be a disappointment for the bulls now. Moving through 141.00 early today, the next real resistance is not until 144/145," adds Perry.